EUR/CAD was trading at 1.5785 on February 11th, when we published our article “EUR/CAD at the Edge of the Abyss?”. We were expecting a sell-off, which “should be powerful enough to take the exchange rate below 1.5100.” In other words, we were anticipating a decline of nearly 700 pips.

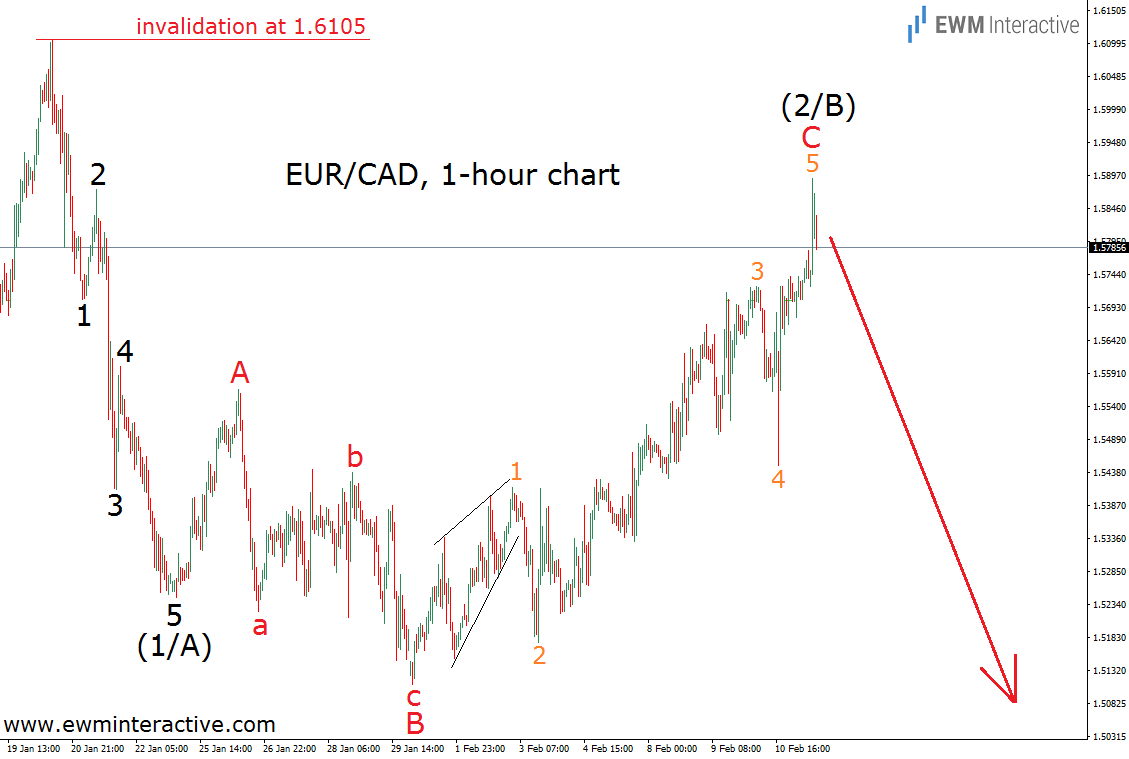

As always, the reason for this negative outlook was the Elliott Wave Principle and what it allowed us to see on the hourly chart of EUR/CAD. It is given below.

The theory says that after every impulse-correction cycle, the trend resumes in the direction of the five-wave sequence. In this case, we recognized an impulsive decline, followed by an expanding flat correction. So, as long as the invalidation level at 1.6105 was safe, targets below 1.5100 remained valid. The next chart demonstrates how EUR/CAD has been developing since that forecast.

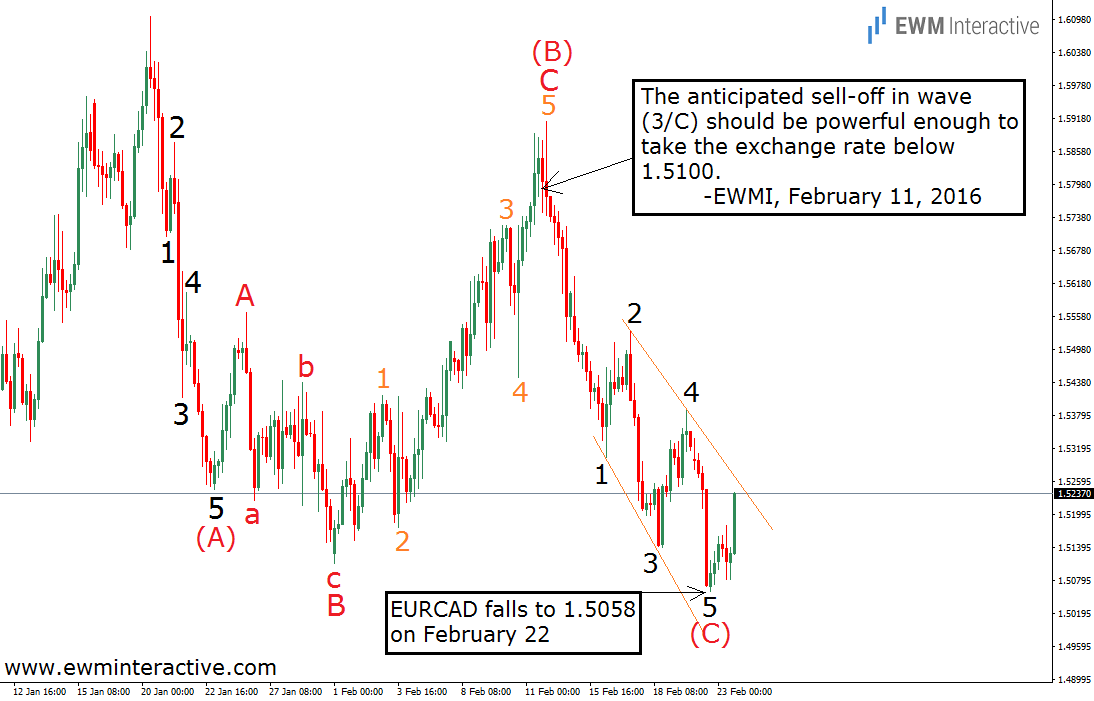

Wave 5 of C of (2/B) continued to the north for a while and climbed to 1.5913. This did not change the count in any way, because the invalidation level was much higher. Eventually, the bulls ran out of steam, which led to a sharp bearish reversal, just as the Wave Principle suggested. Only 11 days after the forecast, on February 22nd, EUR/CAD fell as low as 1.5058, thus exceeding the target at 1.5100.

From now, as long as the rate continues to make lower lows and lower highs, the downtrend is still in progress. Nevertheless, keep in mind the scenario shown above. It implies the idea of an (A)-(B)-(C) zig-zag correction from 1.6105 to 1.5058, where wave (C) is an expanding ending diagonal. In order for this count to become the primary one, the declining line, connecting the tops of waves 2 and 4 of (C) has to be broken. Until then, staying with the downtrend is the smarter decision.