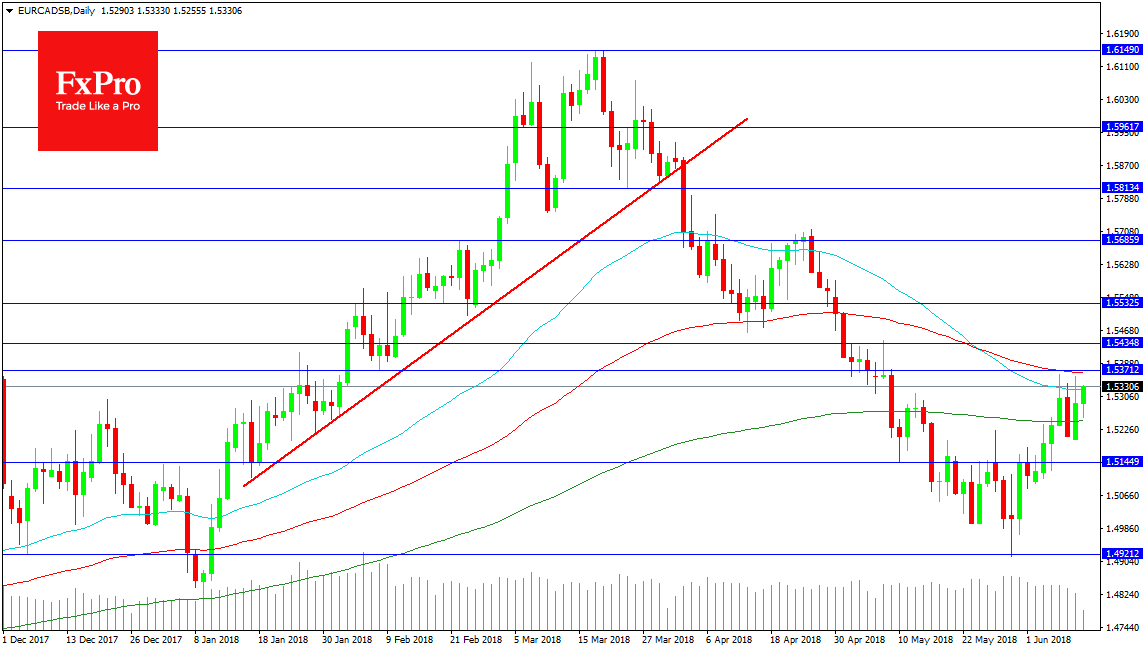

The EUR/CAD pair has rediscovered its DMAs over the last week and is now attempting to break above the 100 DMA at 1.53700. It is using the 200 DMA at 1.52474 as support in its attempt with yesterday’s low at 1.52031, a key level for risk to lean against. A failure of the move and a loss of these levels could push price down to 1.51449 and the 1.50000 level beyond. With the May low coming in at 1.49212 continued selling could result in a retest of 1.47365.

The 1.54348 point stands to offer a retest of the 100 DMA if the moving average is broken gifting traders an entry point on the breakout higher. With price consolidating and building energy it stands to reason that a breakout could push price higher to the 1.55325 level with 1.56859 presenting stronger resistance. A push above this line would lead to a move on 1.58134 which is an area of previous support from March. The 1.59617 level guards the way to 1.60000 and the high for the year at 1.61490.

For more in-depth analysis and market forecasts visit the FxPro Blog.