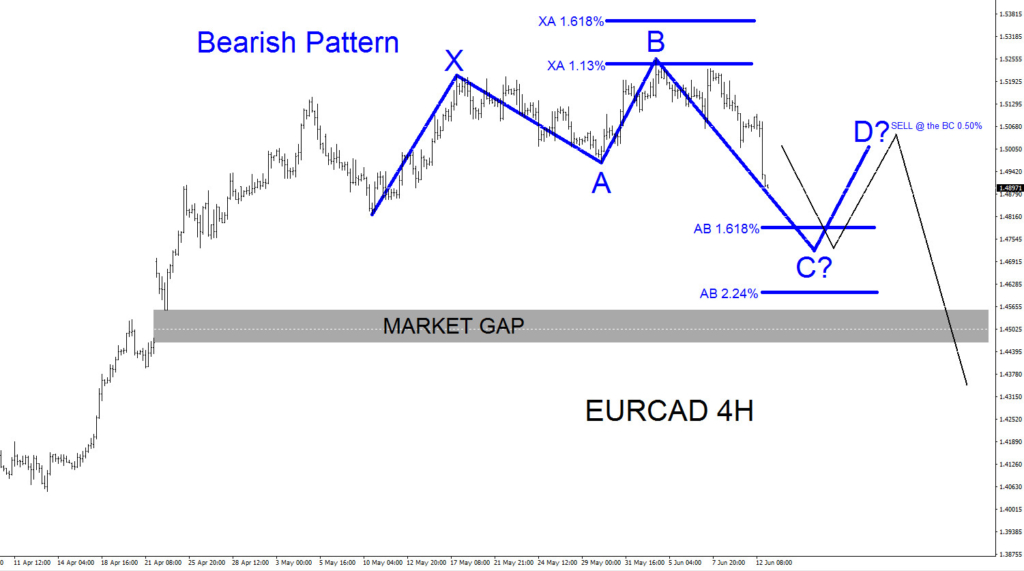

Today’s price action confirms that a possible top has been formed at the June 2/2017 high and EUR/CAD can be on the way lower to close a market gap that formed on April 23/2017. The turn lower will now give bears a chance to push the pair lower. Below we will show a possible scenario/bearish pattern where bears can enter the market and catch the move lower.

EUR/CAD 4 hour Possible Bearish Pattern: Traders need to wait for EUR/CAD to enter between the AB 1.618% – AB 2.24% Fib. levels where blue point C can possibly terminate and react with a bounce higher. If and when blue point C terminates in the suggested area traders will then wait for price to retrace/bounce higher back to the BC 0.50% Fib. retracement level where blue point D can terminate and trigger SELLS. If blue point C terminates in the suggested area and bounces higher to trigger SELLS stops should then be placed at the blue point B high.

If looking to sell EUR/CAD we prefer waiting for a retracement/bounce to trigger the blue point D sell at the BC 0.50%. Stops should be placed at 1.5255 (point blue B high) and should be sold at the BC 0.50% Fib. level minimum for a better risk/reward trade with targets below the April 23/2017 market gap.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade.

*** Always use proper risk/money management according to your account size ***