I’m spotting a breakout of a rising trendline on the weekly time frame on EUR/AUD.

Since February 2017, EUR/AUD has been in a healthy uptrend on the weekly time frame. As we can see from image 1, the inner trendline was already broken (purple color) but price made a new high, so that trend line break was not significant any more.

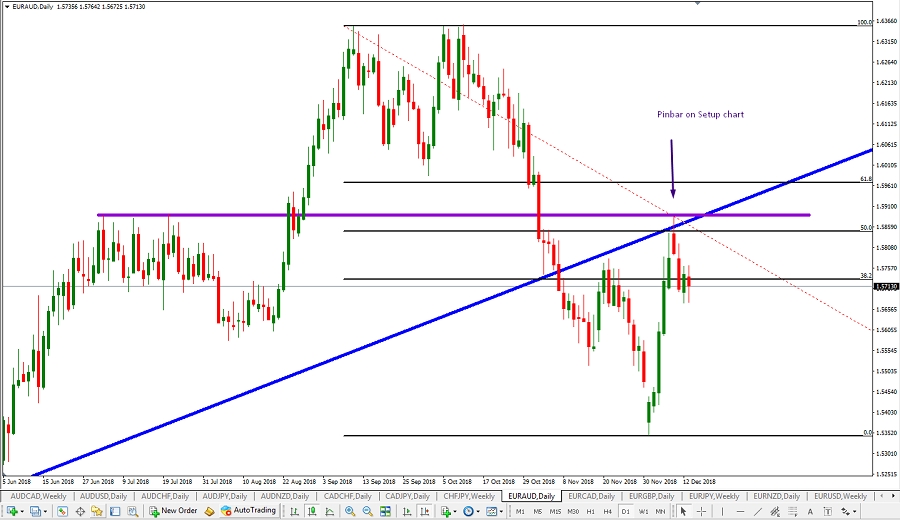

But recently price broke the outer trendline, in massive volume (multiple red candles) and instead of making a higher low, it came back down to the previous low, which is a very strong indicator that this trend is over. More over, the latest swing to the downside made a retracement to retest not only breakout levels, but also retesting the broken trend line, and that retracement came within 50.0% Fibonacci territory, which is another strong indication that the trend is over, and we are about to see a strong move down. Currently price has already reacted from the broken trendline (previous support now working as ressistance) with the latest weekly red candle. It seems the bears are taking over.

Courses Of Action

1. I personally took an agressive entry on this pair. I zoomed in to the Daily chart and spotted a pinbar, which as we know is a very strong reversal signal (see image 2). As that pinbar on the daily chart closed, i set up my Stop Sell order. Entry is 5 pips bellow the lowest point of the Pinbar, and Stop Loss 5 pips above the highest point of the pinbar.

- Entry: 1.57811

- Stop Loss: 1.58896

- Target (NYSE:TGT) 1: 50% of lot size at the close of the first candle

- Target 2: 50% of lot size at the close od the second candle.

I will move my Stop Loss to break even once price at least the distance from my entry to my Stop Loss which is 108 pips.

I am currently around 80 pips in profits.

2. For those of you who want to consider entering this long-term trade, there are multiple chances to enter here, but i am going to give you the conservative approach. Basically wait for this weekly candle to close tomorrow and set up a Sell Stop order 5 pips bellow the close of the candle. As far as the stop loss goes, there are 2 options. The first one which is very conservative and a wide stop loss is to set it up 5 pips above the highest point of the current weekly candle (1.58896). The more aggressive stop loss would be to measure the entire candle, and place the stop loss 5 pips above the 50% range of that candle. And set your target at the following consecutive candles.