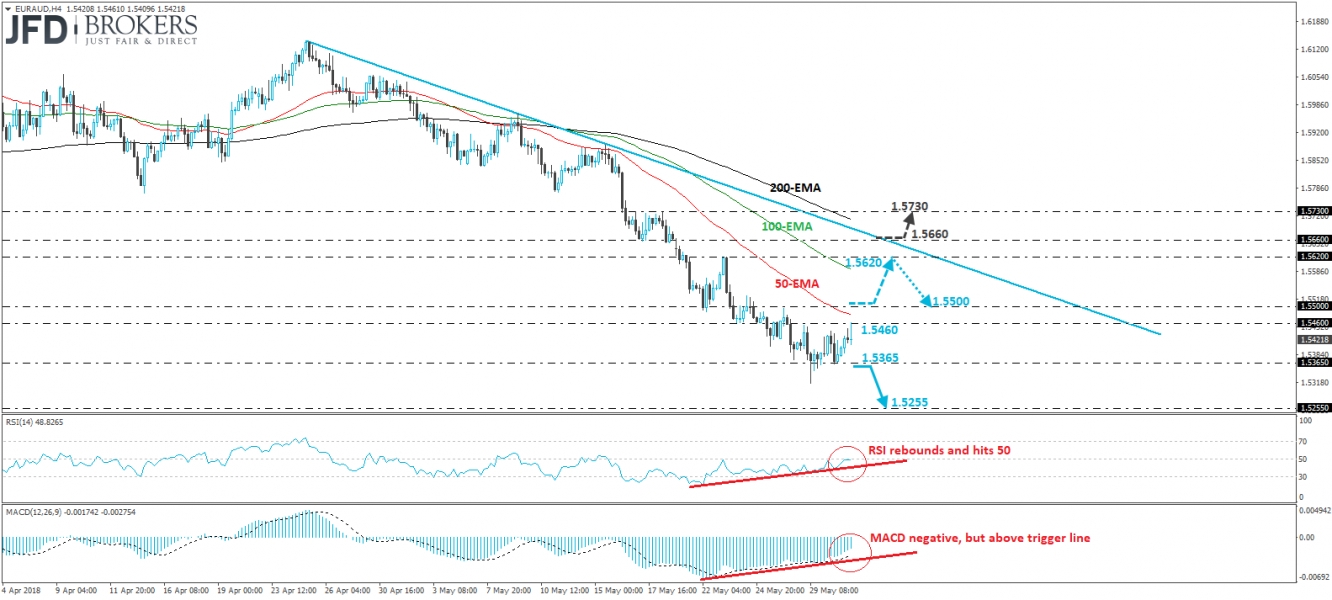

EUR/AUD moved higher yesterday after it hit support near the 1.5365 level. Nevertheless, the rebound was stopped by the 1.5460 resistance line, defined by Tuesday’s peak. The rate continues to trade below the downtrend line taken from the peak of the 25th of April, and also below all three of our moving averages, which point south. Thus, we hold the view that the short-term outlook is cautiously negative.

If the bears manage to take charge from current levels, then we may see them aiming for another test near the 1.5365 support level. A clear dip below that zone is possible to set the stage for more downside extensions, perhaps towards our next support of 1.5255, marked by the lows of the 18th and 29th of January.

Turning attention to our short-term oscillators though, we see that the RSI rebounded and hit its 50 line, while the MACD, although negative, lies above its trigger line and points north. What’s more, there is positive divergence between both these indicators and the price action, marked by their respective upside support lines. These momentum signs suggest that further recovery may be looming before the bears decide to shoot again.

A clear break above 1.5500 may confirm the case and could open the way for the 1.5620 resistance, marked by the peak of the 23rd of May, or the aforementioned short-term downtrend line. Having said that though, even in such a case, we would still see a negative short-term picture. The rate would still be trading below the downtrend line. We would like to see a clear break above 1.5660 before we start examining the case for a positive reversal. Such a break would bring the rate above the trend line and is possible to initially aim for the 1.5730 zone, defined by the highs of the 17th and 18th of May.