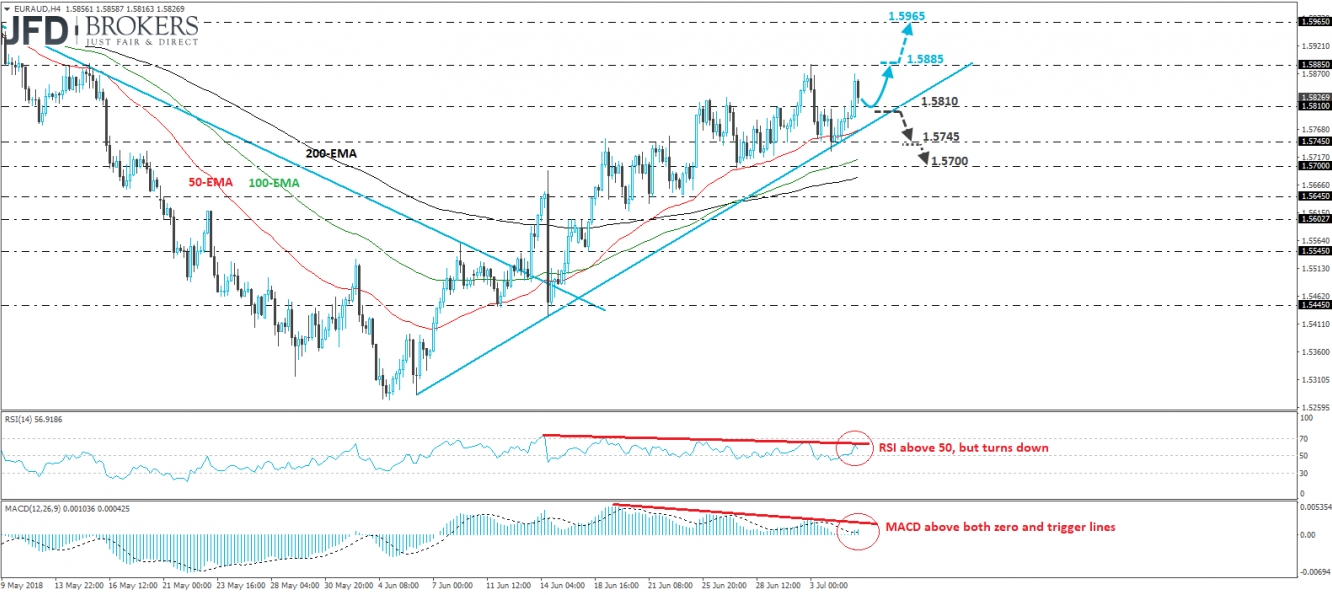

EUR/AUD traded higher during the early European morning Thursday, breaking above the resistance (now turned into support) territory of 1.5810. However, the spike was halted slightly below the 1.5885 obstacle and then, the rate retreated somewhat. The pair continues to trade above the uptrend line taken from the low of the 6th of June and thus, we will consider the short-term picture to still be positive.

If the bulls are strong enough to take the reins from near the 1.5810 level, or the near-term uptrend line, we would expect them to aim for another test near the 1.5885 key resistance zone. If that territory fails to prevent the rate from rising further, then we may experience extensions towards our next resistance area of 1.5965, defined by the peak of the 9th of May.

Taking a look at our short-term oscillators, we see that the RSI lies above 50, while the MACD stands above both its zero and trigger lines. Both indicators detect positive momentum. However, the RSI turned down after it hit its downside resistance line, which make us cautious that the current retreat may continue for a while more, at least until the aforementioned short-term uptrend line is tested.

Now, in case the bulls refuse to jump in from near the trend line and the line breaks, the rate could slide towards the 1.5745 barrier. That said, we would like to see a clear dip below that zone before we start examining the case of a trend reversal. Such a dip could confirm the completion of a failure swing top formation and could initially pave the way for our next support of 1.5700. Another dip below that zone could see scope for extensions towards the 1.5645 obstacle.