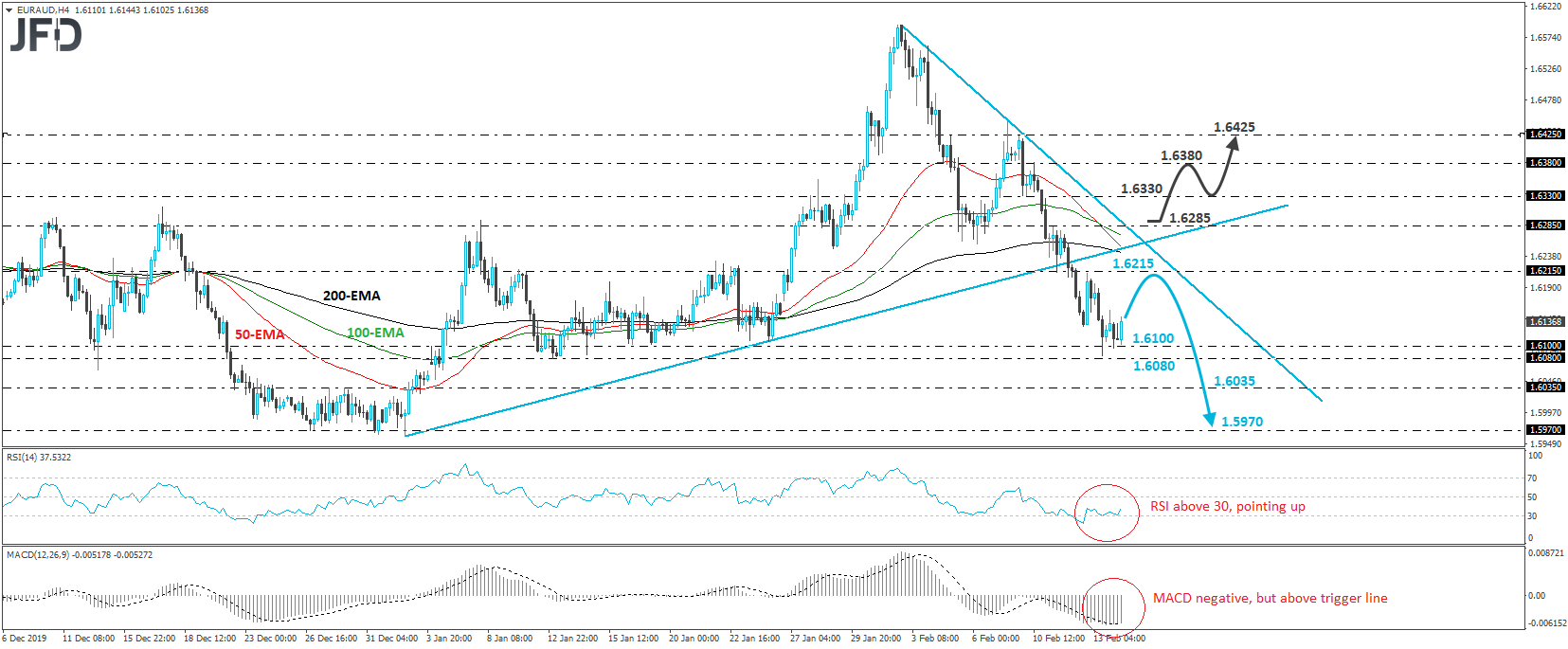

EUR/AUD traded in a consolidative manner today, staying above the key support zone between the 1.6080 and 1.6100 levels. Overall, the rate has been trading in a downtrend mode below a downside resistance line since Feb. 3, while on Wednesday, it fell below the upside support line drawn from the low of Jan. 2. These technical signals suggest that the short-term outlook is negative, but we would stay careful of a possible corrective rebound before the next leg south.

The bears may have decided to take a break now, something that might allow the rate to recover towards the 1.6215 zone or the aforementioned downside line. The bears may decide to recharge from near those levels, diving once again towards the 1.6080/16100 key support zone. That said, we would like to wait for a dip below 1.6080 before we get confident on more declines. Such a dip would confirm a forthcoming lower low on the 4-hour chart and may pave the way towards the 1.6035 zone, marked by the highs of December 27th and 30th. If the sellers are not willing to stop there either, we may then see them aiming for the 1.5970 hurdle, which provided strong support between December 26th and January 2nd.

Turning our gaze to our short-term oscillators, we see that the RSI turned up from near its 30 line, while the MACD, although negative, lies above its trigger line and points up as well. What’s more, there is positive divergence between the RSI and the price action. Both indicators suggest that the downtrend is losing downside speed and corroborate our view for a possible corrective bounce before the bears take the reins again.

In order to start examining whether the bulls have stolen the bears’ swords, we would like to see a strong move above the 1.6285 level. This would place the rate above both the pre-mentioned lines and could pave the way towards the 1.6330 area, marked by an intraday swing low formed on Monday. If that level is broken as well, then their next stop may be an intraday swing high of the same day, at around 1.6380. Slightly higher lies the peak of the day, which may provide decent resistance if the 1.6380 level fails to do so.