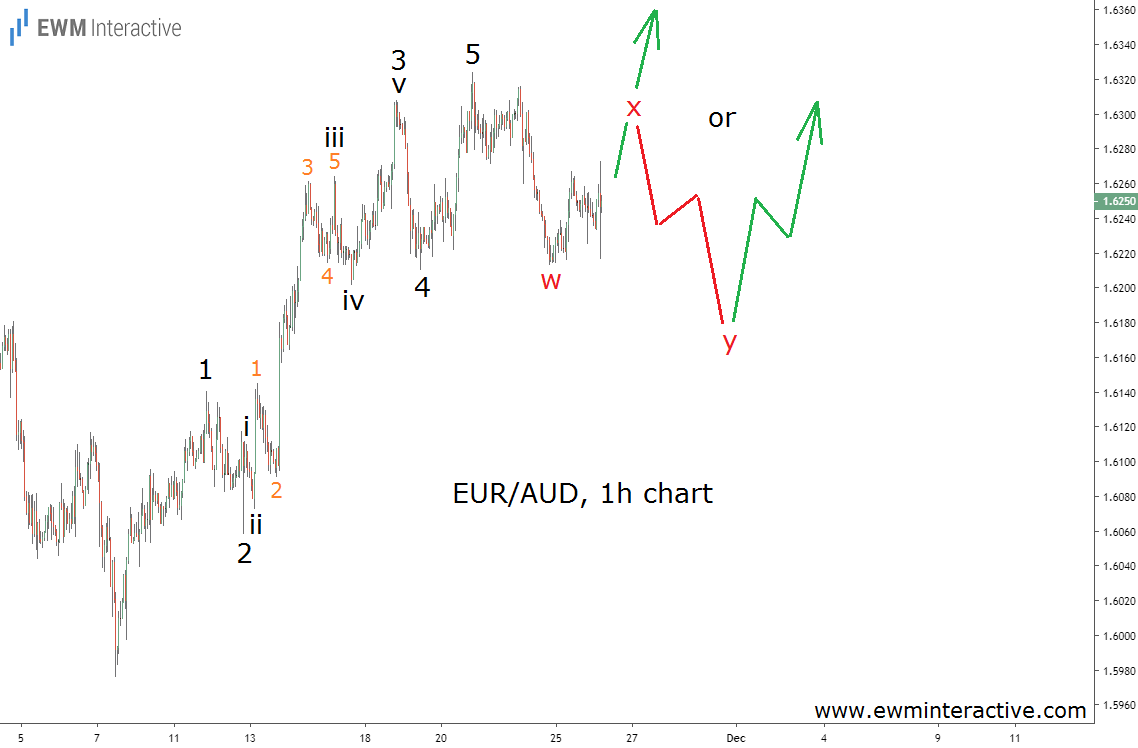

Twenty days ago, EUR/AUD managed to stop the bleeding and form a bottom at 1.5976. As of this writing, the pair trades around 1.6250 after reaching 1.6324 on November 20th. Is the uptrend still in progress or should we prepare for the bears’ return? A look at EUR/AUD‘s hourly chart through an Elliott Wave perspective might help us find answers.

The chart reveals that the post-November-7th recovery is shaped as a textbook five-wave impulse. The pattern is labeled 1-2-3-4-5 with an extended third wave. The sub-waves of both wave 3 and wave iii of 3 are also visible.

The theory states that a three-wave correction follows every impulse. In our opinion, that is what the dip from 1.6324 stands for. It is hard to tell if the corrective phase is over at 1.6213 or is going to evolve into a larger w-x-y retracement. In both cases, however, the 5-3 wave cycle points to the north. Betting against EUR/AUD bulls would be unwise under these circumstances. Once the larger uptrend resumes, targets above 1.6330 should be easy to conquer.