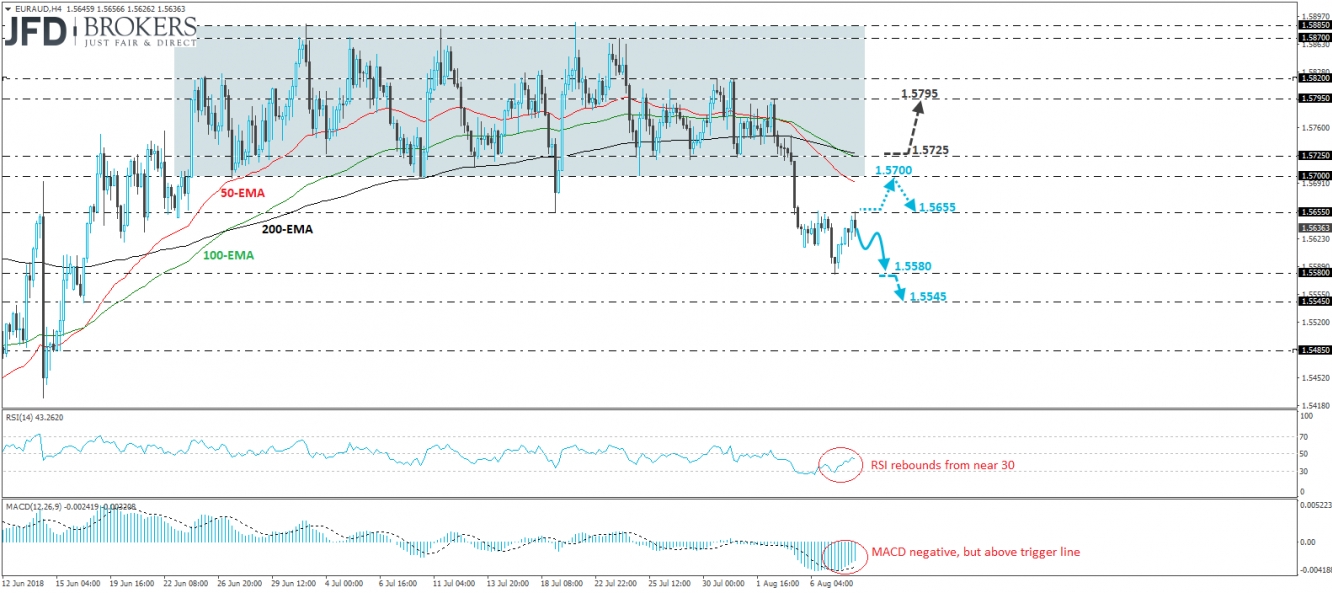

EUR/AUD traded higher after it hit support near 1.5580 on Tuesday. However, the recovery was halted near the 1.5655 resistance during the European morning Wednesday, and then the pair retreated somewhat. On the 3rd of August, the rate fell below 1.5700, the lower end of the sideways range that had been containing the price action since the 25th of June and thus, as long as the rate is trading below that bound, we would consider the near-term outlook to be negative.

If the bears are strong enough to jump back in at current levels, then we may see them aiming for another test near 1.5580. A break below that hurdle is possible to encourage more sellers to join in and perhaps set the stage for our next support of 1.5545, marked by the low of the 18th of June.

Looking at our short-term oscillators, we see that the RSI rebounded from near 30 and now lies near its 50 line, while the MACD, although negative, stands above its trigger line and points up. These momentum studies suggest that further recovery may be in the works before the next negative leg.

A decisive move above 1.5655 could confirm the notion and is possible to open the path for a test near the 1.5700 zone as a resistance this time. Nevertheless, the picture would still be somewhat negative in our view. We would still see a decent chance for the bears to pull the trigger from near 1.5700, the lower end of the aforementioned range. We prefer to wait for a clear break above 1.5725 before we abandon the downside case. Such a move could confirm the return of the pair within the range and could set the stage for upside extensions towards the 1.5795 obstacle, defined by the peak of the 2nd of August.