Key Highlights

· Euro remained under the bearish pressure against the Aussie dollar, and traded towards 1.5500.

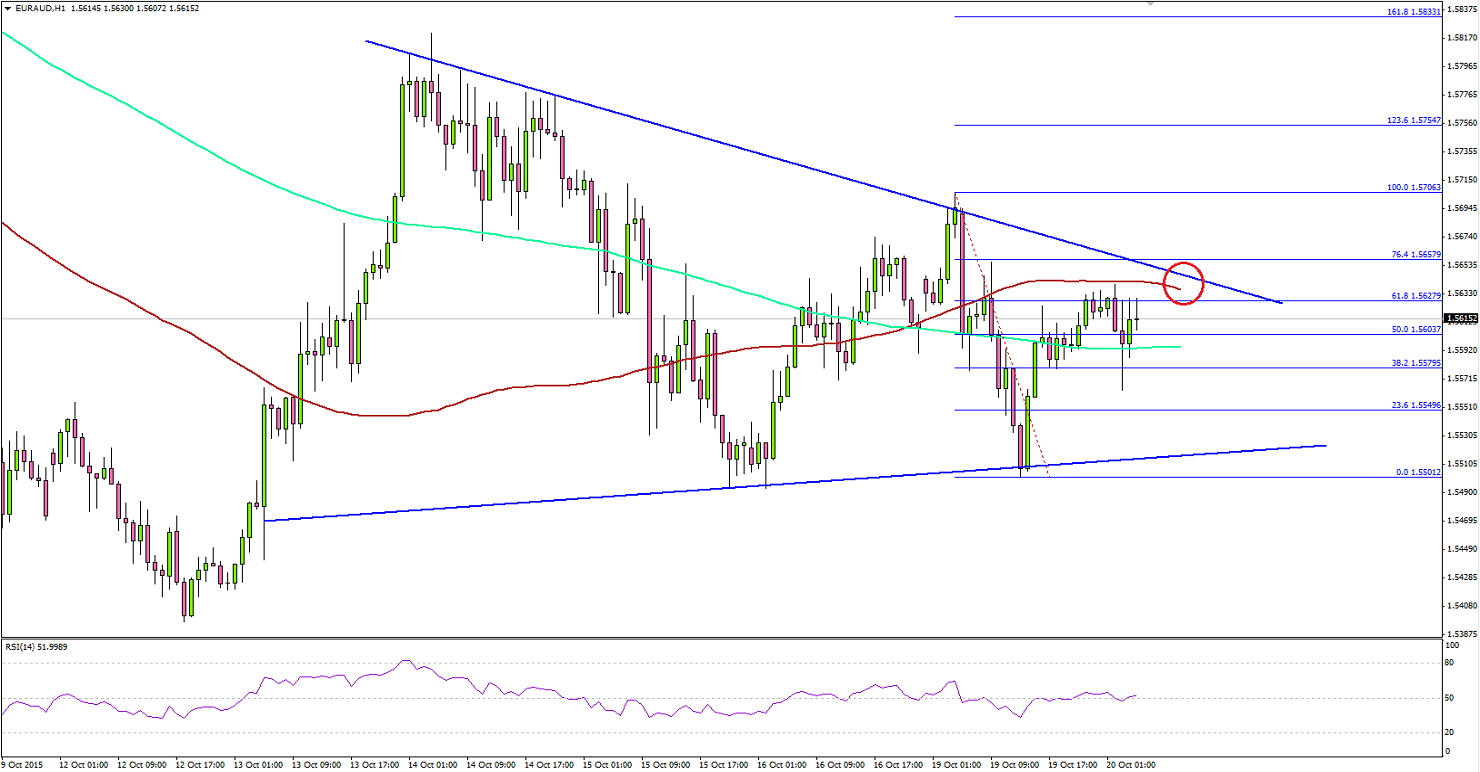

· There is a major breakout pattern forming on the hourly chart of the EUR/AUD pair, pointing towards a break.

· The minutes of the Reserve Bank of Australia meetings were released earlier during the Asian session, which failed to leave an impact on the Aussie dollar.

EUR/AUD Technical Analysis

The euro recovered to some extent after trading as low as 1.5501 against the Aussie dollar. There is a contracting triangle pattern formed on the hourly chart of the EUR/AUD pair that acted as a support and prevented downsides.

Currently, the pair is struggling to clear the 100 hourly simple moving average, which is acting as a hurdle for the pair. Moreover, the triangle upper trend line is also above the 100 MA. So, we can say that there is a major resistance formed near 1.5630-60.

There might be a break moving ahead, and it would be interesting to see which way the pair moves in the near term.

German PPI

Today in the Eurozone, the German Producer Price Index will be released by the Statistisches Bundesamt Deutschland. The forecast is of a 0.1% decline in September 2015. If there is a miss in the result, then there is a possibility of the euro moving lower.