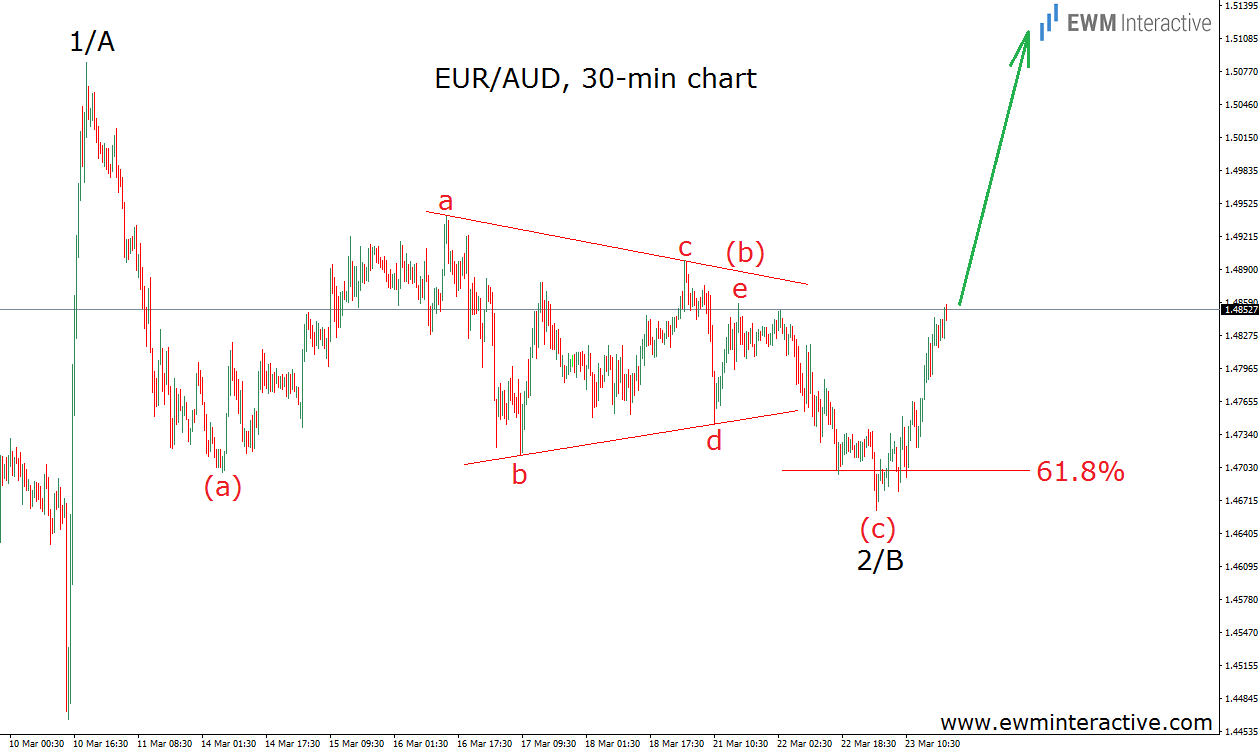

The EUR/AUD pair has been in a downtrend for a month since February 11th. Then, on March 10th, the bulls woke up with a bang and lifted the exchange rate from 1.4465 to 1.5085 in just five hours. Today, EUR/AUD fell to as low as 1.4662, before climbing above 1.4850 so far. Which of the two extremes, formed on March 10th, is more likely to be broken first – 1.4465 or 1.5085. The Elliott Wave Principle could help us find the answer. It is applied on the 30-minute chart of EUR/AUD, given below.

The chart above gives us a detailed picture of EUR/AUD’s development since March 10th. The speed and sharpness of the rally allows us to consider it as an impulse, especially when the following price action looks like an (a)-(b)-(c) zig-zag correction with a triangle in wave (b). Triangles precede the last wave of the larger sequence. Here, the larger sequence is the zig-zag pull-back, so its last wave is wave (c). According to this count, the whole 5-3 wave cycle, labeled as waves 1/A and 2/B, is over. According to the theory, the rate could be expected to move in the direction of wave 1/A. Another reason to believe that 1.5100 is far more likely to be in danger is the 61.8% Fibonacci level, which appears to have already stopped the bears’ ambitions near 1.4660 earlier today. If this is the correct count, the bulls could be expected to stay in the driving seat in EUR/AUD for a while.