With only one day left, the Euro seems poised to end November in positive territory against the U.S. dollar, following a sharp decline in October. Unfortunately for the bulls, the European currency is still losing to some of its other rivals this month. EUR/AUD, for example, is down by over 460 pips since the start of November.

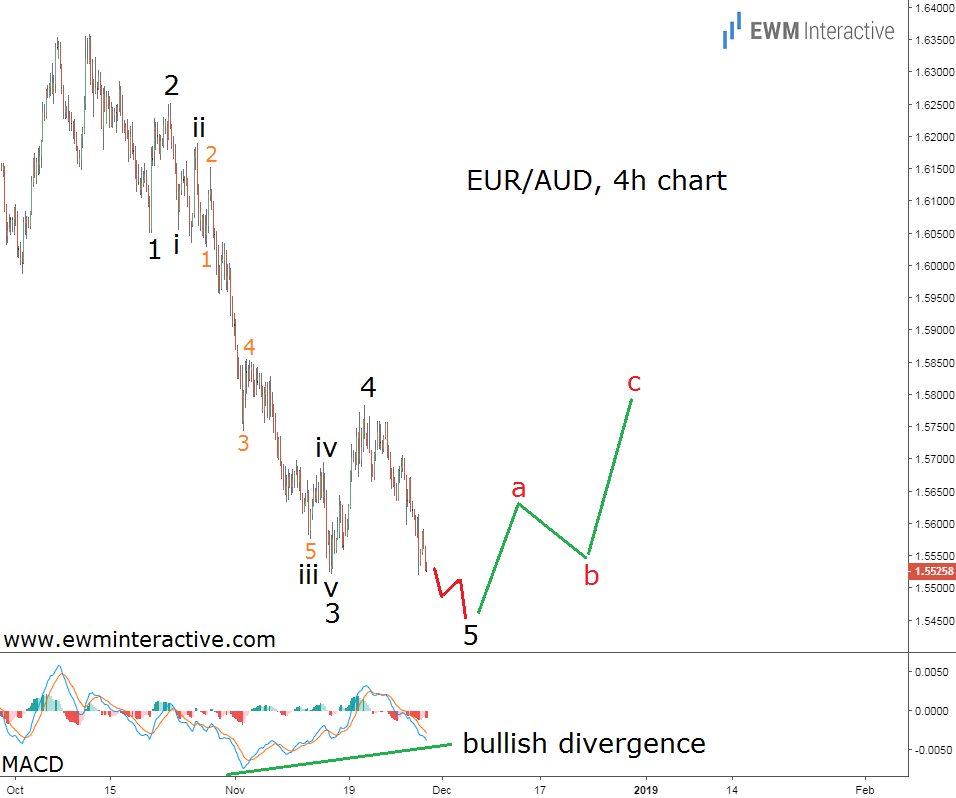

Is there end in sight for the bulls’ suffering? What are the odds of the Euro recovering against the Australian dollar? These are the questions whose answers we hope to find with the help of the Elliott Wave Principle and the 4-hour chart below.

The 4-hour chart of EUR/AUD reveals the structure of the entire plunge from the high at 1.6358 reached on October 11th. It also gives us a couple of reasons for optimism. First, the pair’s decline can easily be seen as a five-wave impulse. The pattern can be labeled 1-2-3-4-5. The sub-waves of wave 3 are also visible and wave 5 is still in progress.

According to the theory, a three-wave correction in the opposite direction occurs after every impulse. This means that once wave 5 makes a new low, a bullish reversal should be expected. If this count is correct, an unpleasant surprise awaits those traders, who join the bears near 1.5500.

The MACD indicator is the other thing which gives EUR/AUD bulls hope. It shows a bullish divergence between waves 3 and 5, indicating the selling pressure is easing.

To sum things up, this analysis suggests EUR/AUD is about to change direction soon. In our opinion, it is too late to sell. The anticipated recovery can lift the pair to the resistance of wave 4 near 1.5800. On the other hand, it is still to early to buy either, since nobody knows the exact price level of the bullish reversal. In such cases we believe staying aside until the reversal actually occurs is the best policy.