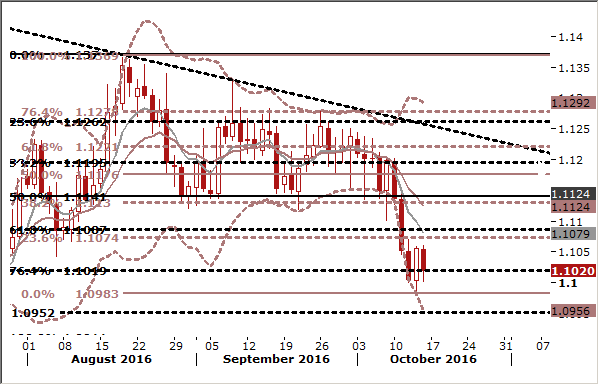

EUR/USD: Will Yellen Speech Be An Opportunity To Take Profit?

- The dollar rose today, as investors awaited U.S. retail sales data and remarks from Federal Reserve officials that could cement expectations of a U.S. interest rate hike this year.

- Retail sales data could offer some insight on the strength of consumption. Following the data, Fed Chair Janet Yellen will address a Boston Fed economics conference, at which Boston Fed governor Eric Rosengren will also speak.

- Minneapolis Fed President Neel Kashkari said on Thursday that sluggish growth in the U.S. economy will likely remain for the foreseeable future. Kashkari is not a voting member on the Fed's rate-setting committee until next year, but takes part in deliberations. He has yet to comment on when he would prefer to see a rate increase, but has said he is more worried about raising rates too quickly than too slowly.

- Philadelphia Fed President Patrick Harker said the Federal Reserve may want to hold off on monetary policy changes until after the U.S. presidential election on November 8. Fed officials normally take pains to distance themselves from electoral politics, and Harker's comments were an unusual admission that the Fed might need to craft policy based on who wins the White House. Harker will not vote at the Fed's November 1-2 policy meeting but will participate in its discussions. He will have a vote on rate policy at the Fed's 2017 meetings. Harker said he had been in favor of a rate increase at the Fed's September policy meeting and he insisted politics never play a role in the Fed's internal debate. He said the Fed should raise rates once by the end of this year..

- The minutes of the latest Fed meeting in September, released on Wednesday, prompted investors to raise their bets of a Fed rate increase at its December policy meeting. Markets are now pricing in around a 70% chance that the Fed will move.

- Markets are looking for a solid rebound in US consumer spending, with the headline retail sales print likely to pick up. Any upside in today’s release could sustain the dollar's upward momentum, but probably a downward USD reaction in case of weaker-than-expected data would be even stronger.

- Today’s speech of Fed Chair Janet Yellen would be a good opportunity to take profit on recent EUR/USD-selling positions. That is why a recovery in the evening is likely. We will be looking to get short on upticks for a target at 1.0960, slightly above July’s low.

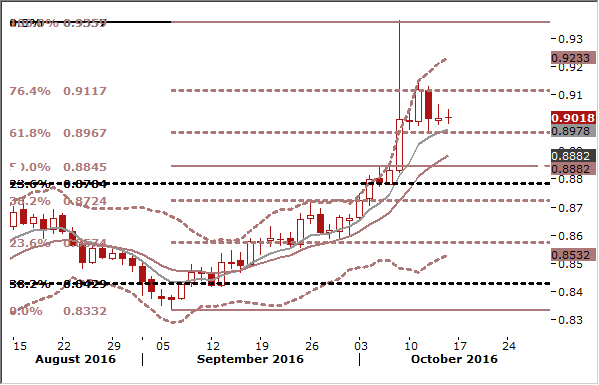

EUR/GBP: Corrective Move Is Likely In The Short Term

- The GBP traded just over a cent above this week's lows against the USD and steadied against the EUR on Friday.

- European Council President Donald Tusk, who will run the Brussels side of Britain's negotiations on leaving the EU, warned on Thursday that the bloc will not offer London any softer terms than a "hard Brexit". Worries about the economic fallout of Britain losing access to the single market under such a scenario are at the heart of the pound's decline in the past three weeks.

- The Bank of England has already cut interest rates and relaunched quantitative easing in a bid to offset any damage to growth over the next year. BoE governor Mark Carney and said today the BoE may tolerate some inflation overshoot to accommodate economic strength. The market is waiting for clues on whether another cut in interest rates is likely.

- The EUR/GBP continues to consolidate sharp gains from last week. Long red candlestick on Wednesday suggests there is a room for a corrective move on the EUR/GBP chart. In our opinion there is scope for EUR/GBP move to 14-day ema at 0.8883 or 0.8845 (50% fibo of September-October rise). Long-term EUR/GBP outlook remains bullish and we will be looking to get long on this pair at 0.8820.

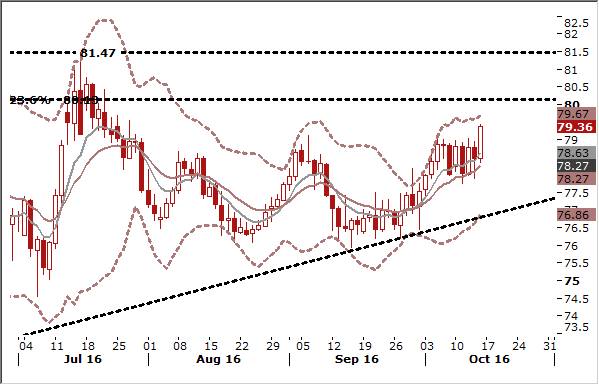

AUD/JPY: Stay Long For 81.00

- The AUD recovered from a near 1-month low on Friday on the back of buoyant commodity prices and a record government bond sale. The AUD is slightly up on the week, defying the strength in the greenback which rose on growing expectations of a rate rise in the United States by year-end.

- The Australian government this week issued its longest and largest syndicated deal ever, at AUD 7.6 billion with 65% of bonds going to foreigners.

- The Reserve Bank of Australia highlighted a revival in prices for resource exports when it left interest rates unchanged this month, after cuts in August and May. The futures market has recently also slashed the probability of another rate cut this year, which is pretty in line with our expectations.

- The RBA on Friday cautioned on high household debt levels and the risk that excessive borrowing to build and buy apartments could end in tears given looming supply.

- The AUD/JPY long opened at 78.00 is in good shape and we have raised stop-loss to the entry level. 7-day and 14-day exponential moving averages are positively aligned, which signals that bullish trend is likely to be continued. The nearest resistance level is just above 80.00 (23.6% fibo of 2014-2016 drop). We expect the AUD/JPY will break above this level and will be stopped near July high (81.47).