GROWTHACES.COM Forex Trading Strategies

EUR/CHF: buy at 1.0780, target 1.1170, stop-loss 1.0680, risk factor *

AUD/NZD: buy at 1.1005, target 1.1400, stop-loss 1.0860, risk factor **

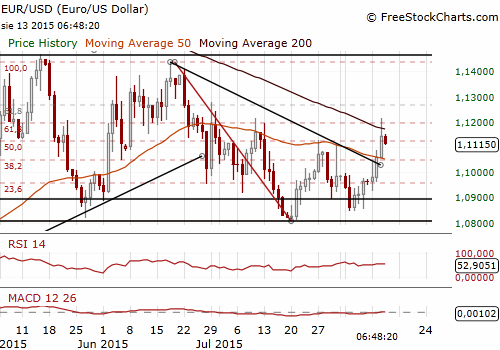

EUR/USD: Watch US Retail Sales Data Today

- China's central bank said that there was no basis for further depreciation in the yuan currency given strong economic fundamentals. The People's Bank of China shocked markets by pushing its official guidance rate down 2% on Tuesday. The bank said at the time that the move was a one-off depreciation. This move was interpreted by the markets as a triggering a wave of global “currency wars”. In our opinion such talking is clearly overdone. We do not think this move could influence the Fed decision in September.

- New York Fed President William Dudley said that an adjustment to China's currency is probably appropriate if that economy is weaker than Chinese authorities expected. He added: “Clearly what was happening is the Chinese yuan was appreciating along with the USD.”

- As we supposed the market picture has changed today. The USD rose from a one-month low against a basket of major currencies on Thursday as the yuan's fall slowed and investors are focused again on US macroeconomic releases. US retail sales data due at 12:30 GMT will be closely watched.

Significant technical analysis' levels:

Resistance: 1.1188 (high Aug 13), 1.1212 (high Aug 12), 1.1243 (high Jun 30)

Support: 1.1024 (low Aug 12), 1.0996 (10-dma), 1.0961 (low Aug 11)

Source: Growth Aces Forex Trading Strategies