GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.1140, target 1.1450, stop-loss 1.1045, risk factor *

GBP/USD: long at 1.5460, target 1.5800, stop-loss 1.5365, risk factor *

USD/CHF: short at 0.9375, target 0.9140, stop-loss 0.9460, risk factor **

EUR/GBP: long at 0.7190, target 0.7360, stop-loss 0.7130, risk factor *

EUR/CHF: long at 1.0410, target 1.0580, stop-loss 1.0365, risk factor **

CHF/JPY: long at 129.10, target 131.40, stop-loss 127.90, risk factor **

AUD/JPY: long at 95.60, target 98.80, stop-loss 94.60, risk factor **

Pending Orders

USD/CAD: sell at 1.2295, if filled – target 1.2020, stop-loss 1.2370, risk factor ***

AUD/USD: buy at 0.7845, if filled – target 0.8100, stop-loss 0.7780, risk factor ***

NZD/USD: buy at 0.7280, if filled – target 0.7500, stop-loss 0.7200, risk factor ***

EUR/JPY: buy at 133.80, if filled – target 136.50, stop-loss 133.00, risk factor *

EUR/CAD: buy at 1.3550, if filled – target 1.3800, stop-loss 1.3470, risk factor *

EUR/USD: Will FOMC Minutes Halt USD Rally?

(long at 1.1140)

- Chicago Fed President Charles Evans (voting this year) signalled that he saw early 2016 as a good time to act on rates. However, he said that substantially stronger wage growth would also be a strong indicator that could convince him of the need to raise rates earlier.

- The USD scaled a three-week high against the EUR today. The market is focused on Fed minutes due to be published today 18:00 GMT. Any encouragement for the view the bank would wait until next year with rises in interest rates might halt the USD progress.

- Headlines over Greece could be the reason for EUR weakening. The Greek government's parliamentary speaker said today Greece will not make a payment to the International Monetary Fund that falls due on June 5 if there is no deal with its creditors by then. Athens faces several payments totaling about EUR 1.5 billion to the IMF next month.

- We went long on the EUR/USD at 1.1140 and set the stop-loss below the strong support area near 1.1050. The rate tested this area today, but then recovered. Hawkish FOMC minutes today could be enough to break below the 1.1050, which should trigger stronger falls. However, recent weak macroeconomic data from the USA do not justify hawkish rhetoric.

Significant technical analysis' levels:

Resistance: 1.1150 (21-dma), 1.1166 (100-dma), 1.1326 (high May 19)

Support: 1.1051 (high on Mar 26), 1.0994 (50% of 1.0521-1.1468), 1.0960 (low Apr 29)

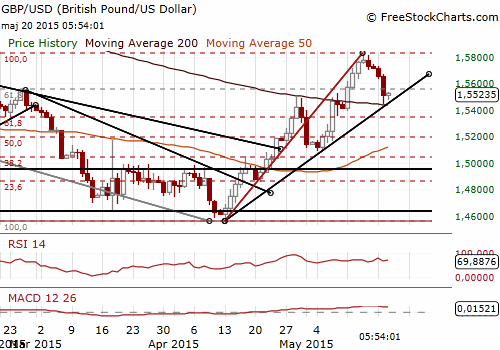

GBP/USD Little Changed After BOE Minutes

- The Bank of England released minutes of the Monetary Policy Committee's May meeting. The views of BoE policymakers appeared little changed in May when they voted unanimously to keep interest rates on hold. Two of its nine its members felt the decision was finely balanced between voting to keep rates on hold or to raise them, echoing previous meetings. Martin Weale and Ian McCafferty voted in favour of a rate increase in the last few months of 2014 but rejoined the no-hike majority in January as inflation tumbled. They are expected to be the first to start voting again for a rate hike.

- At their May meeting, policymakers reiterated their views on the outlook for inflation, saying that unless oil and commodity prices fell again, inflation rates close to zero were not likely to last long and would pick up notably towards the end of 2015. The main split on the committee remained on the risk of falling unemployment triggering faster wage growth that could stoke a faster pick-up in inflation than expected by the Bank.

- The Committee noted there appeared to be upside risk to British house prices after data from a surveyors organization showed a shortage of new homes coming on to the market.

- The GBP/USD volatility was relatively low today after three consecutive days of falls. We used yesterday’s dips to go long at 1.5460.

- Today’s FOMC minutes will be of key importance for the GBP/USD developments. However, the GBP traders should also watch closely Britain’s retail sales data due to be released tomorrow 8:30 GMT. The market expects slightly weaker retail sales growth vs. the previous month and our forecast for retail sales is close to the market consensus.

Significant technical analysis' levels:

Resistance: 1.5589 (10-dma), 1.5590 (200-dma), 1.5669 (high May 19)

Support: 1.5447 (low May 19), 1.5393 (low May 11), 1.5240 (low May 8)

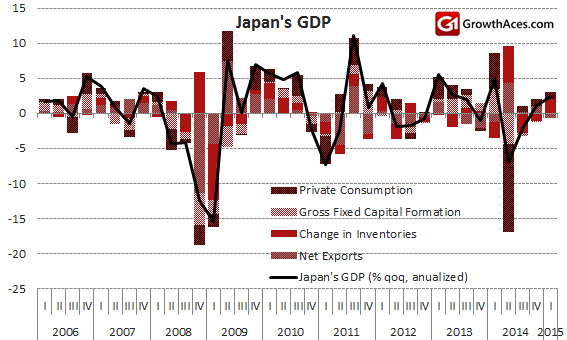

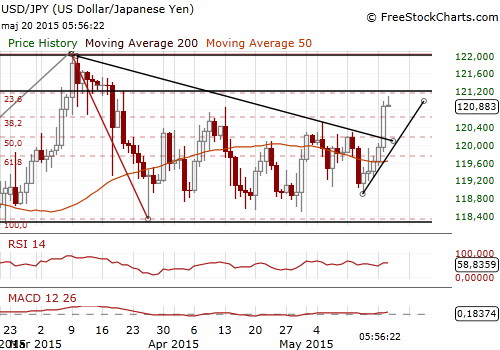

USD/JPY: Japan’s Economy On Recovery Path

(stay sideways)

- Japan's economy grew at a 2.4% annualised rate in the January-March period, beating a median market forecast for a 1.5% increase.

- Inventory was the biggest contributor to growth, adding 0.5 percentage point versus only 0.4 point gained by increases in domestic demand components like capital expenditure, consumption and housing investment.

- Private consumption rose 0.4% qoq. Capital spending also grew 0.4%, below an expected 0.8% gain but marking the first rise in four quarters. The pick-up in business investment is seen as crucial to sustained economic growth, so the latest numbers should come as some relief to policy-makers.

- The data will be closely scrutinised at the BOJ's two-day rate review that ends on Friday. The central bank is widely expected to maintain its massive stimulus programme and upbeat assessment of the economy.

- Japan's Economics Minister Akira Amari said that the economy is likely to continue recovering but policymakers must be mindful of risks such as a possible slowdown in overseas growth. Chief Cabinet Secretary Yoshihide Suga told a news conference he expects private spending and firms' capital expenditures to recover due to improving corporate earnings, lower oil prices and wage rises.

- The USD/JPY did not react to better-than-expected Japan’s GDP data, which is a bullish signal for this pair. The USD/JPY is close to the resistance at 121.16 (78.4% fibo of 122.04-118.33 slide). Technical analysis suggests that breaking above this level will open the way to 122.04 – the peak in March. The tankan and kijun lines are positively aligned, highlighting the upside potential. However, as Japan’s GDP data showed,the economy is on recovery path and possible further better macroeconomic data from Japan may be negative news for the USD/JPY bulls.

Significant technical analysis' levels:

Resistance: 121.16 (76.4% of 122.04-118.33), 121.20 (high Mar 20), 121.41 (high Mar 17)

Support: 120.58 (session low May 20), 119.83 (low May 19), 119.27 (low May 18)

Source: Growth Aces Forex Trading Strategies