GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.1245, target 1.1495, stop-loss moved to 1.1295, risk factor **

USD/JPY: short at 123.50, target 120.65, stop-loss moved to 123.20, risk factor *

USD/CAD: short at 1.2300, target 1.2100, stop-loss moved to 1.2200, risk factor **

EUR/GBP: long at 0.7150, target 0.7400, stop-loss 0.7080, risk factor ***

EUR/CHF: long at 1.0440, target 1.0680, stop-loss 1.0380, risk factor *

EUR/CAD: long at 1.3830, target 1.4100, stop-loss moved to 1.3830, risk factor **

Pending Orders

GBP/USD: buy at 1.5675, target 1.5990, stop-loss 1.5525, risk factor *

USD/CHF: sell at 0.9295, target 0.9095, stop-loss 0.9390, risk factor *

EUR/JPY: buy at 138.50, target 141.30, stop-loss 137.50, risk factor **

AUD/NZD: sell at 1.1300, target 1.1100, stop-loss 1.1400, risk factor ***

EUR/USD: We Should Wait Probably Till Sunday For Greece Deal

(long for 1.1495)

- US Federal Reserve kept interest rates unchanged, as widely expected. The Fed lowered its GDP growth forecasts for this year and interest rate forecasts at the end of 2016 and 2017. The Fed gave no timetable for a rate hike but said it expected the economy's gains to accelerate later this year. We still expect the Fed to raise rates in September. (See our yesterday’s Forex Trading Strategies Summary).

- All eyes now turn to Luxembourg where Eurozone finance ministers are meeting where Greece will top the agenda. In our opinion a deal is impossible today. Athens is refusing to put forward new proposals and Greek Finance Minister Yanis Varoufakis said he did not believe in agreement during the meeting in Luxembourg.

- German Chancellor Angela Merkel said that it is still possible for Greece to reach an agreement with its international creditors - the European Union, International Monetary Fund and European Central Bank. Merkel also said Germany's efforts are focused on keeping Greece in the Eurozone.

- If a deal is not reached today or tomorrow, Eurozone leaders will call an emergency summit probably on Sunday. This is the most probable date of reaching an agreement now.

- The EUR/USD broke above the resistance area of 1.3330/35 (highs on June 11 and June 16) after dovish FOMC projections yesterday, as we expected. Today another strong resistance level was broken – 1.1387, high on June 10. We stay long hoping that Greece will push the EUR/USD closer to 1.1500. However, we will be also moving up the stop-loss level to save profits.

Significant technical analysis' levels:

Resistance: 1.1450 (high May 18), 1.1468 (high May 15), 1.1486 (high Feb 6)

Support: 1.1277 (10-dma), 1.1206 (low Jun 17), 1.1189 (low Jun 15)

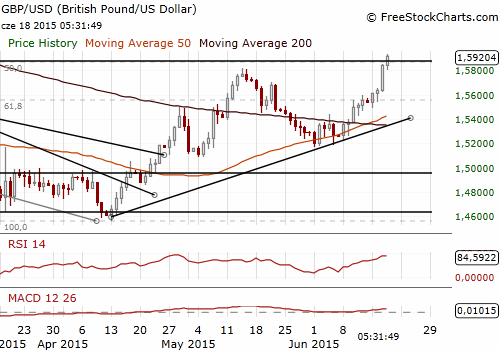

GBP/USD: Wages And Retail Sales Getting Higher, BOE Getting More Hawkish

(buy at 1.5675)

- British retail sales volumes rose 0.2% mom and 4.6% yoy in May. The market had expected retail sales to be flat in May after rising a downwardly revised 0.9% in April, when clothing sales were boosted by unusually warm weather. This time the Office for National Statistics said clothing sales were 1.6% down on April's level, the biggest fall since September 2014.

- Sales in the three months to May were up 4.5% compared with a year earlier, the slowest year-on-year growth in six months. However, we should adjust the data for lower consumer prices. After such an adjustment consumer spending could be on track for a very strong growth this year, as low inflation and rising wages give households more disposable income.

- Bank of England policymaker Kristin Forbes said: “The next move in interest rates is going to be up and it's coming at some point in the not-too-distant future.” Forbes also said growth in productivity would be key to how wage growth impacts inflation. Wednesday’s data showed British earnings rose at their fastest rate in nearly four years.

- The GBP/USD hit a seven-month high today, after better-than-expected UK retail sales data, which followed strong wage growth numbers and hawkish comments from Kristin Forbes. We took profit on our long position yesterday, but are looking to get long again on dips. The next target for the GBP/USD bulls will be 1.5990, just below the psychological resistance level at 1.6000.

Significant technical analysis' levels:

Resistance: 1.5940 (high Nov 12), 1.5945 (high Nov 11), 1.5960 (high Nov 6)

Support: 1.5808 (session low Jun 18), 1.5627 (low Jun 17), 1.5542 (low Jun 16)

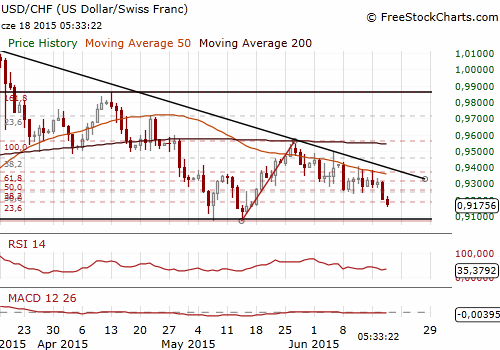

USD/CHF: SNB Repeats Its Mantra About Overvalued CHF, But It Does Not Work

(sell at 0.9295)

- In its quarterly policy meeting Switzerland's central bank kept its target range for the three-month Libor at -1.25 to -0.25%, as widely expected.

- The central bank repeated its mantra that the CHF was significantly overvalued and that it would remain active in foreign exchange markets as it deemed fit in order to influence monetary conditions. It voiced confidence that negative interest rates and penalties for holding cash in CHF would make the currency less appealing over time, leading to a weakening of the CHF.

- The SNB has made only minor adjustments to its inflation forecasts and sees inflation remaining in negative territory this year at -1.0% and next year at -0.4%, before edging up to just 0.3% in 2017. This forecast, which is dependent on a gradual depreciation of the CHF, is not a good justification for on-hold SNB policy.

- On the one hand the SNB suggests interventions, but on the other hand the bank made clear when it removed its explicit currency ceiling that it was no longer comfortable making massive interventions that were causing its balance sheet to increase.In our opinion another rate cut is necessary to help Swiss economy. However, such a move from the SNB is rather unlikely.

- That is why investors are keep on ignoring the SNB and the CHF continues to appreciate against the USD and remains strong against the EUR. At the same time Switzerland's government is trimming its economic forecasts for this year and next, saying a strong CHF is already hurting exports. The State Secretariat for Economics forecast GDP growth this year at 0.8% and 1.6% next, down from 0.9% this year and 1.8% in 2016 previously. Last week, Switzerland's KOF economic research institute predicted the Swiss economy to grow 0.4% in 2015 and 1.3% in 2016.

- We are the opinion the current CHF levels are detached from fundamentals and we should see CHF depreciation, at least against the EUR, in the medium term. We may still see some bearish pressure on the USD/CHF in the short-term, so getting short on upticks could be a good idea.

Significant technical analysis' levels:

Resistance: 0.9225 (hourly high Jun 18), 0.9234 (low Jun 10), 0.9291 (10-dma)

Support: 0.9100 (psychological level), 0.9079 (low May 14), 0.9072 (low May 7)

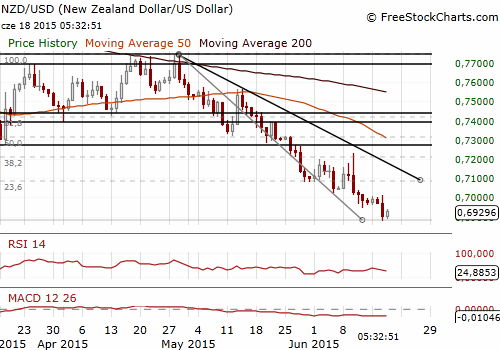

NZD/USD Hit By Weak GDP, Lost Ground Also Against Aussie

(stop-loss hit, we stay sideways)

- New Zealand's economy grew a seasonally adjusted 0.2% qoq in the first quarter, the lowest quarterly rate in two years, as drought hit farming and low prices hit oil production and exploration. The reading was strongly below the median forecast for 0.6% growth. The annual growth rate eased to 2.6% from the previous quarter's seven-year high of 3.5%.

- In the latest data, activity was supported by retail trade and accommodation, up 2.4% on strong tourist spending, while business services rose 2.1%. The primary sector of farming, forestry and mining, fell 2.9 percent overall, driven by a 7.8% decrease in oil and gas exploration and production, while agriculture production fell 1.4%.

- Weak data strengthened expectations for another rate cut from the Reserve Bank of New Zealand. Financial market pricing puts a 52% of a rate cut next month, with 39 basis points of cuts seen over the next 12 months.

- Our long NZD/USD position hit the stop-loss yesterday and we stay sideways now. The NZD/USD skidded to a five-year low after data showed economic growth was much weaker-than-expected despite dovish FOMC projections released yesterday. The strong support level is situated at 0.6864 (50% fibo of 0.4881-0.8846 rise).

- The kiwi also lost ground against the NZD. Further gains in the AUD/NZD, however, may be limited by a strong chart barrier near 1.1300, a level which capped the AUD late last year. That is why we expect a correction in this area and have placed a sell AUD/NZD order at 1.1300.

Significant technical analysis' levels:

Resistance: 0.7013 (high Jun 17), 0.7026 (high Jun 12), 0.7064 (10-dma)

Support: 0.6881 (session low Jun 18), 0.6864 (50% of 0.4881-0.8846), 0.6795 (low Jul 2010)

Source: Growth Aces Forex Trading Strategies