EUR/USD: Watch Draghi Today

- Chicago Fed President Charles Evans, one of the Federal Reserve's most vocal policy doves, said the U.S. central bank will raise its policy rate three more times by the end of next year as long as inflation expectations and the labor market continue to improve. His expectation is in line with the median forecast by the Fed's 17 policymakers at their most recent meeting, which took place last month. The forecast suggested short-term rates will be between 1% to 1.25% by the end of next year, up from a range of 0.25% to 0.5% currently.

- Evans, who rotates into a voting spot on the Fed's policy-setting committee next year, would not speculate on the exact timing of the Fed's next rate increase, and suggested he sees little difference between November, December and January.

- St. Louis Federal Reserve President James Bullard said on Monday that a single U.S. interest rate rise would be all that was necessary for the time being.

- The EUR has come under renewed pressure after the European Central Bank last week kept the door open to more stimulus in December and doused speculation that it would taper its asset buying programme.

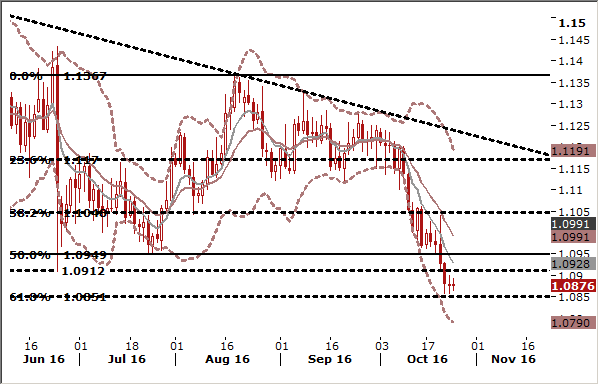

- EUR/USD bias remains on downside, the break of June 1.0912 low last week has weakened the structure. A series of long black candlestick in October weighs heavily on the outlook and the bear cycle is expected to continue down to 1.0822 (March 10 low). ECB Governor Mario Draghi’s speech is scheduled for today, 15:30 GMT. It would be reasonable to wait for his comments and see the market reaction to assess whether there is a chance for a corrective move.

USD/CAD: Poloz Tempers Rate Cut Expectations

- Bank of Canada Governor Stephen Poloz said a further easing from the Bank of Canada would bring the central bank closer to unconventional monetary policy and the decision on whether to cut rates again is not one to take lightly.

- Taking questions from lawmakers, Poloz also said that there were ingredients of a possible divergence between Canada and the United States, both economically and from a monetary policy standpoint. The head of the central bank also said that given the negative impact of the drop in oil on Canada, its economy could diverge from that of its neighbor to the south for three years or more. U.S. Federal Reserve is likely to raise rates before the end of the year, while the Bank of Canada is widely expected to stay on the sidelines until into 2018.

- Poloz's comments helped the Canadian dollar rally against the USD as it tempered market speculation about further rate cuts.

- The Bank of Canada renewed its inflation target at 2% and said it will change the way it measures inflation in order to better gauge long-term trends.

- The value of Canadian wholesale trade rose 0.8% in August, the fifth consecutive monthly gain. The increase exceeded the 0.6% mom advance predicted by the market.

- The loonie is supported also by oil prices. Oil edged up on Tuesday ahead of the release of U.S. crude inventory data, which in recent weeks has provided bullish surprises. The private American Petroleum Institute is due to publish its weekly crude stocks estimates on Tuesday at 20:30 GMT, followed by the official Energy Information Administration data due on Wednesday.

- Last month OPEC approved modest output cuts that are due to be set in stone in the coming weeks. The goal is to trim global production to a range of 32.50-33.0 million barrels per day. Russian Deputy Prime Minister Arkady Dvorkovich said a possible agreement among global leading oil producers on capping crude output would help to stabilise global oil prices. But Iraq, the second-largest producer in the Organization of the Petroleum Exporting Countries, said on Sunday it wanted to be exempt from output curbs as it needed more money to fight Islamic State militants.

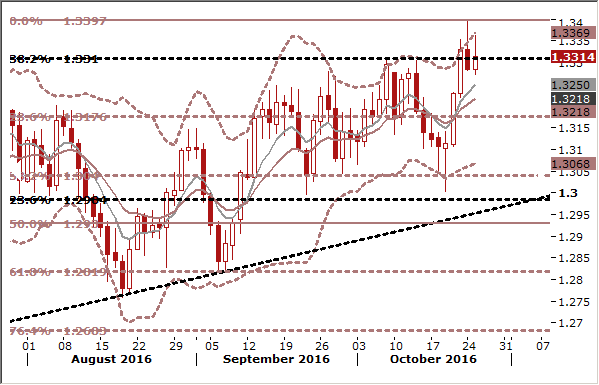

- In our opinion there is a high risk of USD/CAD corrective move in the coming days. We are also looking to sell the EUR/CAD. Our offer is at 1.4650.