The quiet start to the week ended dramatically on Wednesday, as the euro went on a roller-coaster ride, courtesy of Bernard Bernanke. The Federal Reserve Chairman was testifying in Washington, and his comments about the Fed’s quantitative easing program shook up the currency markets. In economic news, US Existing Home Sales fell below expectations, and European PMIs were a mixed bag. The US will release two key events later on Thursday – Unemployment Claims and New Home Sales.

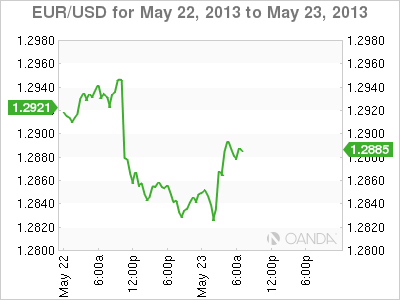

All eyes were on the US Federal Reserve yesterday, as Fed Chair Bernard Bernanke testified before the Joint Economic Committee of Congress. As well, the Fed released its minutes of the previous policy meeting. Bernanke first stated that tightening monetary policy could hurt the US recovery. The euro reacted positively, as it climbed sharply and climbed very close to the 1.30 line. However, this proved to be a very brief climb. Bernanke later said that a decision to scale back QE could be taken in the “next few meetings” if the US economy improved. This brought the euro back down in a hurry, and the pair closed a tumultuous day in the 1.2840 range.

Almost overshadowed by Bernanke’s remarks in Congress was the release of the minutes from the FOMC’s last policy meeting. The minutes indicate that the US recovery will have to gain more traction before the Fed winds down QE. Policy members were split, as some suggested scaling back QE in June (at the next policy meeting), while others wanted to increase QE, given the weak inflation readings we are seeing. It should be noted that the FOMC minutes relate to a meeting which took place at the beginning of May, in contrast to the fresh testimony of Bernanke on Wednesday.

If the Eurozone is to get back on its feet, Germany, the largest economy in the Eurozone and the “locomotive of Europe”, will have to lead the way. However, the German locomotive is having all sorts of trouble. Last week’s GDP and inflation numbers were weak, and Thursday’s German PMIs were mixed, as Manufacturing PMI beat the estimate, while Services PMI missed the forecast. Both releases were under the 50-point level, indicating contraction in both the manufacturing and service sectors. Weak numbers out of Germany and the Eurozone continue to weigh on the shaky euro, which has coughed up about three cents in May.

EUR/USD May 23 at 10:20 GMT

EUR/USD 1.2886 H: 1.2905 L: 1.2821 EUR/USD Technical" title="EUR/USD Technical" width="600" height="79">

EUR/USD Technical" title="EUR/USD Technical" width="600" height="79">

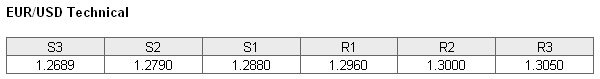

EUR/USD continues to show volatility, and the pair is edging higher, as it trades in the high-1.28 range. The pair is testing the 1.2880 line on the downside. This line could face more activity during the day. The next support level is at 1.2790. On the upside, the pair faces resistance at 1.2960. This line has strengthened following the sharp losses sustained by the pair on Wednesday. There is a stronger resistance at the round number of 1.3000.

- Current range: 1.2790 to 1.2880

- Below: 1.2880, 1.2790, 1.2689, 1.2589 and 1.2500

- Above: 1.2960, 1.3000, 1.3050, and 1.31

OANDA’s Open Positions Ratio

EUR/USD ratio is pointing to movement towards long positions in Thursday trading. This is reflected in the current movement of the pair, as the euro has posted modest gains against the dollar.

The pair’s volatility continues, triggered by Bernanke’s comments about QE on Wednesday. We could see continuing movement from the pair during the day, as the US releases key housing and employment numbers later.

EUR/USD Fundamentals

- 7:00 French Flash Manufacturing PMI. Estimate 44.8 points. Actual 45.5 points.

- 7:00 French Flash Services PMI. Estimate 44.7 points. Actual 44.3 points.

- 7:30 German Flash Manufacturing PMI. Estimate 48.6 points. Actual 49.0 points.

- 7:30 German Flash Services PMI. Estimate 50.2 points. Actual 49.8 points.

- 8:00 Eurozone Flash Manufacturing PMI. Estimate 47.1 points. Actual 47.8 points.

- 8:00 Eurozone Flash Services PMI. Estimate 47.4 points. Actual 47.5 points.

- 8:00 Italian Retail Sales. Estimate 0.3%. Actual -0.3%.

- 10:05 US FOMC Member James Bullard Speaks.

- 12:30 US Unemployment Claims. Estimate 347K.

- 13:00 US Flash Manufacturing PMI. Estimate 51.6 points.

- 13:00 US HPI. Estimate 0.9%.

- 14:00 Eurozone Consumer Confidence. Estimate -22 points.

- 14:00 US New Home Sales. Estimate 429K.

- 14:30 US Natural Gas Storage. Estimate 90B.

- 19:30 ECB President Mario Draghi Speaks.