GROWTHACES.COM Forex Trading Strategies

Taken Positions

USD/CAD: short at 1.2030, target 1.1840, stop-loss 1.2115, risk factor **

AUD/USD: long at 0.8025, target 0.8295, stop-loss 0.7940, risk factor *

NZD/USD: long at 0.7450, target 0.7650, stop-loss 0.7360, risk factor **

EUR/GBP: long at 0.7165, target 0.7450, stop-loss moved to 0.7210, risk factor **

Pending Orders

EUR/USD: buy at 1.1340, if filled - target 1.1530, stop-loss 1.1250, risk factor *

GBP/USD: buy at 1.5610, if filled – target 1.5880, stop-loss 1.5530, risk factor ***

USD/CHF: sell at 0.9290, if filled - target 0.9100, stop-loss 0.9370, risk factor **

EUR/JPY: buy at 135.20, if filled - target 137.50, stop-loss 134.20, risk factor *

EUR/CHF: buy at 1.0380, if filled – target 1.0580, stop-loss 1.0310, risk factor ***

EUR/CAD: buy at 1.3600, if filled - target 1.3840, stop-loss 1.3510, risk factor *

GBP/JPY: buy at 186.10, if filled – target 188.90, stop-loss 185.10, risk factor ***

CHF/JPY: buy at 128.80, if filled - target 131.20, stop-loss 127.80, risk factor *

AUD/JPY: buy at 95.60, if filled – target 98.80, stop-loss 94.60, risk factor **

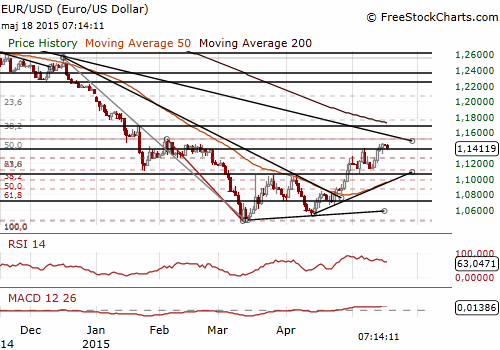

EUR/USD: USD Bulls In Retreat

(buy at 1.1340)

- Chicago Fed President Charles Evans (voting this year) said today the Federal Reserve could look at a rate hike in June if the economy is strong enough. However, he argued for rates to start rising in early 2016. The Fed's policymaking Federal Open Market Committee meets next on June 16-17. One of the most important events this week is the release of Fed minutes on Wednesday.

- The USD is recovering today from lows reached on Friday on another surprisingly bad round of US economic data. US industrial output slipped 0.3% in April after a similar decline in March. A 0.1% gain was expected. A plunge of 14.5% in oil and gas well drilling pushed mining production down 0.8% last month. It was the fourth straight monthly decline in mining output.

- The University of Michigan's preliminary May reading on the overall index on consumer sentiment was 88.6, down from the final April read of 95.9. The survey's subindex on business conditions fell to 99.8 from 107.0 in April, while a reading on consumer expectations declined to 81.5 from 88.8.

- The data from the Commodity Futures Trading Commission released on Friday showed the value of the USD net long position fell to USD 29.11 billion in the week ended May 12, from USD 32.25 billion the previous week. Net longs on the USD declined for a seventh straight week.

- The EUR/USD is off the highs from Friday but underlying momentum stays with the bulls. The 10-dma lends support ahead at 1.1302. We raised our buy order on the EUR/USD to 1.1340. If the order is filled the target will be 1.1530, just above the 50% fibo of the December-March slide at 1.1514.

Significant technical analysis' levels:

Resistance: 1.1468(high May 15), 1.1486 (high Feb 6), 1.1499 (high Feb 5)

Support: 1.1360 (hourly low May 15), 1.1324 (low May 15), 1.1302 (10-dma)

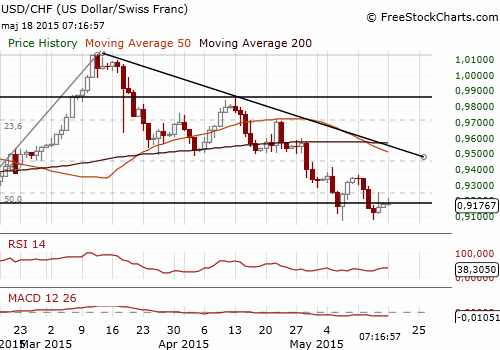

USD/CHF: SNB: The CHF Is Still Very Highly Valued

(sell at 0.9290)

- SNB board member Fritz Zurbruegg told the Berner Zeitung in an interview published on Monday: “The Swiss franc is still very highly valued. All our models show that.” He added: “But we are not only looking at the development of the euro-franc exchange rate, but rather we look at the exchange rate compared to several currencies.” Zurbruegg also said the SNB could increase its balance sheet, a signal the central bank may be prepared to intervene in the currency market to weaken the franc.

- In a separate interview to the Tribune de Genève, Zurbruegg said the SNB was satisfied with the impact of negative interest rates, a 0.75% charge on some CHF deposits introduced in an effort to deter speculative flows into the currency.

- The Federal Statistics Office said today Swiss retail sales were down 4.6% in March yoy in nominal terms, and were down 2.8% even when adjusted for inflation. The Office also revised February's figure downwards to a drop of 3.1% yoy, the most since September 2002. Other recent data have also pointed to a deflationary trend. Swiss producer and import prices fell 5.2% yoy in April.

- In our opinion the potential of further CHF appreciation against the EUR is diminishing. Swiss macroeconomic data look poor compared with recovering Eurozone economy and the threat of the SNB intervention is rising. That is why we think a drop in the EUR/CHF could be a good opportunity to go long on this pair. We have placed our EUR/CHF buy order at 1.0380. We set the target at 1.0580, which is slightly below the 61.8% fibo of the 1.0811-1.0235 slide.

- We took small profit on our previous short USD/CHF position (0.9240-0.9200). The USD/CHF did not reach the target, but we had locked in profit earlier. We keep our bearish outlook on the USD/CHF despite rising possibility of the CHF weakening against the EUR. We are looking to get short again at 0.9290. But this trade is a bit more risky now.

Significant technical analysis' levels:

Resistance: 0.9221 (10-dma), 0.9255 (high May 15), 0.9360 (high May 12)

Support: 0.9079 (low May 14), 0.9072 (low May 7), 0.9046 (low Jan 29)

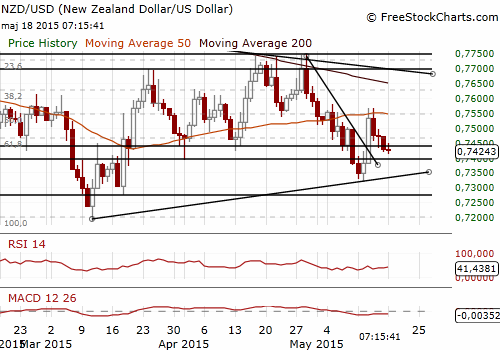

NZD/USD Falls On Rate Cut Speculation

(long at 0.7450)

- Following a recent central bank announcement on curbing housing loans to Auckland property investors, the government said income gained on residential properties sold within two years of purchase would be taxed at up to 33%.

- Ahead of its annual budget announcement on Thursday, the government also said it would require New Zealanders and non-residents buying and selling any property to register with the Internal Revenue Department, while non-residents would also be required to set up bank accounts in the country.

- The new rules, which exclude primary residences, will take effect on October 1, the same time that Reserve Bank of New Zealand rules for residential property investors in Auckland will begin. They will be required to deposit at least 30% on bank loans.

- The government has been under pressure to do more to quell the housing market in Auckland, where house prices hit a record high in April, having tripled in just over a decade as the city faces a chronic housing shortage as immigration increases.

- Investors are of the opinion that the move may pave the way for the RBNZ to cut interest rates later this year if they succeed in lowering record-high house prices. Markets imply a roughly 50% chance of a rate cut next month. We do not change our forecast that the RBNZ will not change interest rates. But the probability of such a move is rising, which is bad news for our long NZD/USD position.

Significant technical analysis' levels:

Resistance: 0.7458 (session high May 18), 0.7502 (high May 15), 0.7562 (high May 14)

Support: 0.7318 (low May 13), 0.7276 (low Mar 18), 0.7273 (low Mar 12)

Source: Growth Aces Forex Trading Strategies