GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.1100, target 1.1400, stop-loss moved to 1.1240, risk factor **

USD/JPY: short at 123.50, target 120.65, stop-loss 124.75, risk factor *

EUR/GBP: long at 0.7275, target 0.7450, stop-loss 0.7225, risk factor ***

EUR/CAD: long at 1.3880, target 1.4100, stop-loss 1.3780, risk factor **

AUD/JPY: long at 95.00, target 97.50, stop-loss 94.00, risk factor ***

Pending Orders:

EUR/CHF: buy at 1.0460, if filled - target 1.0680, stop-loss 1.0410, risk factor *

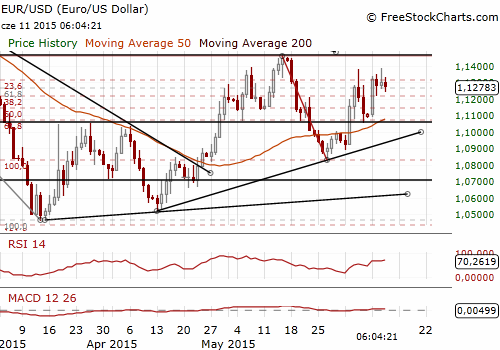

EUR/USD: US Retail Sales Data Will Set Direction

(long under threat ahead of US data)

- The chairman of Eurozone finance ministers said a cash-for-reform deal with Athens was still possible in time for their June 18 meeting, with just a few issues remaining to be solved, but Greek counter-proposals were not yet satisfactory. The leaders of Germany and France agreed with Greek Prime Minister Alexis Tsipras on Wednesday that negotiations between Greece and its creditors must be intensified to reach a deal. Without releasing fresh cash by the end of this month, Greece is heading for a default, with severe consequences for its economy and the risk of sliding out of the Eurozone.

- The World Bank lowered the growth outlook for the United States to 2.7% this year, from 3.2%% in January, and to 2.8% next year, from a previous forecast of 3%. Kaushik Basu, the World Bank's chief economist, said the Federal Reserve should hold off on a rate hike until next year to avoid worsening exchange rate volatility and crimping global growth.

- The EUR/USD is falling ahead of today’s US retail sales data (12:30 GMT). We expect a strong reading and there is a substantial risk that the EUR/USD will fall below the raised stop-loss of our long position. But we have already locked in profit on this position opened at 1.1100. We are waiting for US retail sales data now that will set the direction ahead of next week’s FOMC meeting.

Significant technical analysis' levels:

Resistance: 1.1387 (high Jun 10), 1.1450 (high May 18), 1.1468 (high May 15)

Support: 1.1214 (low Jun 9), 1.1190 (10-dma), 1.1083 (low Jun 8)

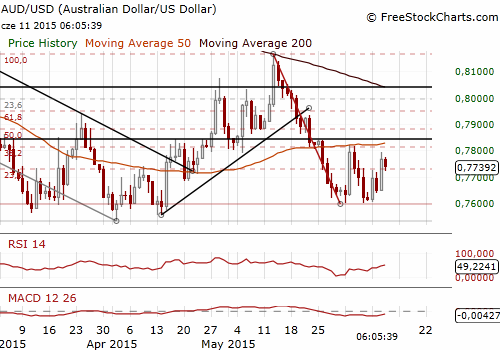

AUD/USD Jumped On Solid Employment Report

(stay sideways)

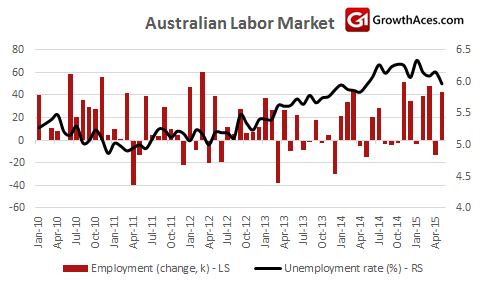

- The Australian Bureau of Statistics showed employment rose 42k in May, well ahead of market forecasts for an 11k gain and above our estimate for an 18k rise. The jobless rate dropped a tenth of a percentage point to a one-year low of 6.0%.

- Full-time employment rose by 14.7k and part-time employment increased by 27.3k in May 2015 (seasonally adjusted). Unemployment decreased by 22k. The seasonally adjusted labour force participation rate remained steady at 64.7% from a revised April 2015 estimate. Hours worked increased 0.1% to 1.631 billion hours, a record high and an increase of 2.0% yoy.

- In our opinion a strong employment report does not mean the RBA rhetoric will be more hawkish. Employment data are very volatile and have been revised greatly in the past. Moreover, consumer confidence reading released earlier this week has gone into reverse this month.

- The AUD/USD fell today to 0.7713 after the Reserve Bank of New Zealand cut interest rates, but our buy order at 0.7110 was not filled. The AUD recovered after stronger-than-expected employment report. The AUD/USD reached today’s high at 0.7793, but is depreciating now. That is why we withdrew our buy order. We keep our medium-term bullish AUD/USD outlook, but want to wait for today’s US retail sales figures to take a position.

Significant technical analysis' levels:

Resistance: 0.7793 (hourly high Jun 11), 0.7819 (high Jun 3), 0.7839 (high May 26)

Support: 0.7636 (low Jun 10), 0.7598 (low Jun 5), 0.7572 (low Apr 15)

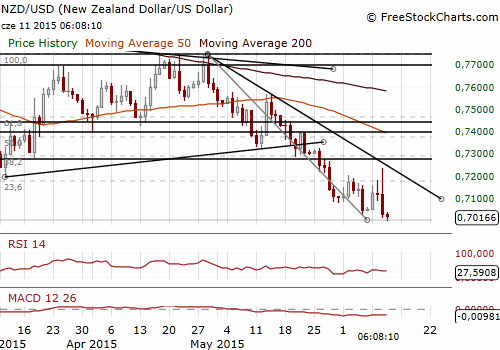

NZD/USD: Stronger-Than-Expected Reaction To Expected RBNZ Cut

(stop-loss hit, but medium-term outlook is slightly bullish)

- The Reserve Bank of New Zealand cut its official cash rate to 3.25% in its first easing since March 2011, in line with our expectations.

- RBNZ Governor Graeme Wheeler said in a statement: “A reduction in the cash rate is appropriate given low inflationary pressures and the expected weakening in demand, and to ensure that medium-term inflation converges towards the middle of the target range.” Wheeler said that the NZD remained overvalued despite a slide since March, adding that a further significant fall was needed to boost export proceeds.

- A weaker currency would boost prices for dairy products, the country's biggest export earner, lifting overall growth and improving the terms of trade. It would also boost incomes in the farming sector, which has been stung by an ongoing fall in global dairy prices.

- New Zealand’s CPI fell to a 15-year low of 0.1% in the first quarter. The RBNZ forecasts inflation will return to its 1% to 3% target range in the March 2016 quarter, rising to 2% in the second half of next year.

- The market expects the RBNZ to cut rates once more over the next three months before returning to the sidelines for a prolonged period. Market pricing based on overnight interest rate swaps is putting a 56% chance of a further 25 bps cut next month, and 33% of cuts over the next 12 months. In our opinion, there will be no more cuts.

- The market reaction to the rate cut was much stronger than we assumed. Our buy order at 0.7110 was filled after the RBNZ decision, but the long position reached a stop-loss soon. We expect acceleration of economic growth and inflation in New Zealand in the second half of the year that should restrain the central bank from further cuts. An expected rise in commodity prices and improving risk appetite should also support the NZD. We will be looking to get long again on the NZD/USD soon.

Significant technical analysis' levels:

Resistance: 0.7072 (low Jun 1), 0.7121 (10-dma), 0.7180 (session high Jun 11)

Support: 0.6998 (session low Jun 11), 0.6988 (low Sep 2010), 0.6947 (low Aug 2010)