Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

EUR/USD – Two Bar Trading Range

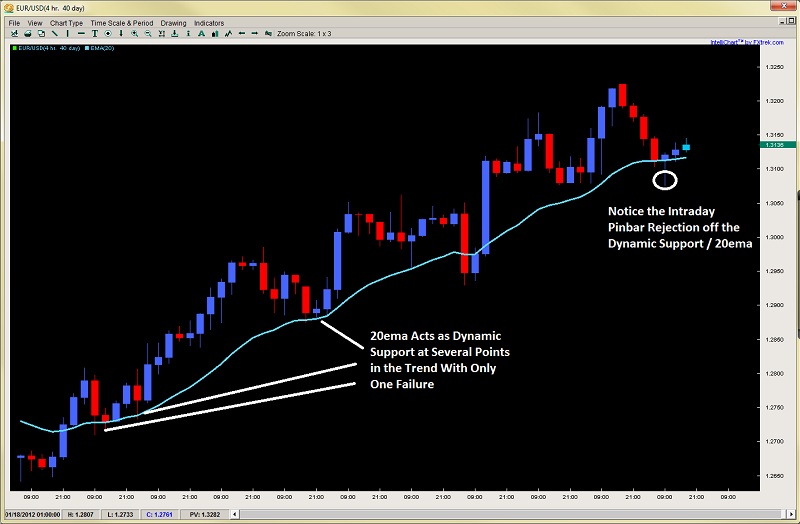

As we talked about last week for the Euro, the key resistance level was around the 1.3200 area. Price closed last week right on this key level which was a prior swing low for Nov. last year which you can see in the chart below.

EUR/USD" title="EUR/USD" width="622" height="590" />

EUR/USD" title="EUR/USD" width="622" height="590" />

For this week, it started the week off selling on the open suggesting there are willing sellers here as the market pretty much sold off from the open.

However, taking a closer look at the price action for today, we can see today’s candle sold off to yesterday’s low while only breaking it by one pip. It then rejected to close 60pips off the lows. This failure to break the lows of the prior candle by more than 1pip means its unlikely to have trapped any traders short on the break.

Thus in effect, it has created a two-bar trading range so while price stays in the middle, its unlikely day traders will take heavy sides buying or selling this pair. They will more than likely wait for the two-bar trading range to be broken before taking any new positions. However, there are still two intraday plays.

If you are a preferred seller and think the bears have control or will take control, then you have a clear line in the sand to sell either just above 1.3200 with stops above yesterday’s high, or a possible sell around 1.3181 with stops tightly above 1.3224 targeting 1.3084 just above yesterday’s low. If the price action is corrective and timid, then this may give sellers confidence to add onto their positions or take new ones. You can watch the 1hr and 4hr for clues on this.

If you are a preferred buyer, then you can play off the intraday dynamic support on the 20ema for the 4hr time frame which also produced a pinbar. Stops would ideally placed tightly below yesterdays low so this gives you plays on both sides.

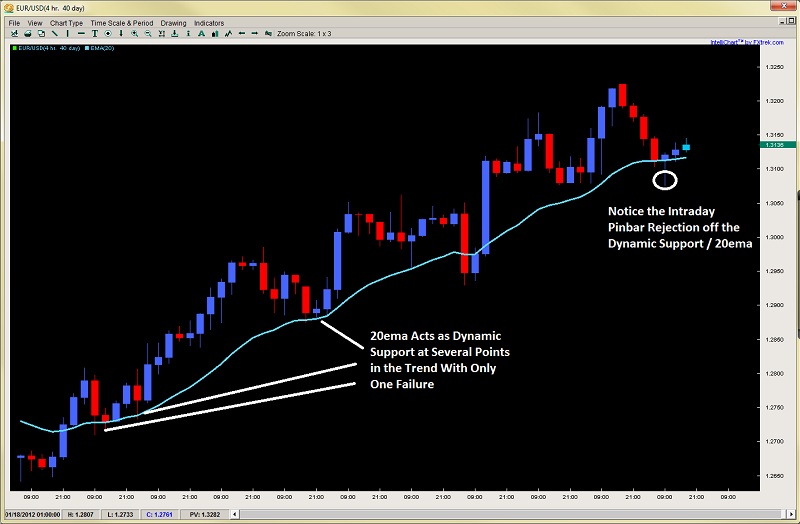

As we talked about last week for the Euro, the key resistance level was around the 1.3200 area. Price closed last week right on this key level which was a prior swing low for Nov. last year which you can see in the chart below.

EUR/USD" title="EUR/USD" width="622" height="590" />

EUR/USD" title="EUR/USD" width="622" height="590" />For this week, it started the week off selling on the open suggesting there are willing sellers here as the market pretty much sold off from the open.

However, taking a closer look at the price action for today, we can see today’s candle sold off to yesterday’s low while only breaking it by one pip. It then rejected to close 60pips off the lows. This failure to break the lows of the prior candle by more than 1pip means its unlikely to have trapped any traders short on the break.

Thus in effect, it has created a two-bar trading range so while price stays in the middle, its unlikely day traders will take heavy sides buying or selling this pair. They will more than likely wait for the two-bar trading range to be broken before taking any new positions. However, there are still two intraday plays.

If you are a preferred seller and think the bears have control or will take control, then you have a clear line in the sand to sell either just above 1.3200 with stops above yesterday’s high, or a possible sell around 1.3181 with stops tightly above 1.3224 targeting 1.3084 just above yesterday’s low. If the price action is corrective and timid, then this may give sellers confidence to add onto their positions or take new ones. You can watch the 1hr and 4hr for clues on this.

If you are a preferred buyer, then you can play off the intraday dynamic support on the 20ema for the 4hr time frame which also produced a pinbar. Stops would ideally placed tightly below yesterdays low so this gives you plays on both sides.