Market ranges occur when a currency pair lacks a specific directional trend. This can often happen as the market awaits specific direction from a news event like todays FOMC release. Instead of being deterred by sideways pricing, short term Forex traders can take advantage of them by identifying the range define and preparing to trade the news using entry orders. Today we will review a trading plan for taking advantage of these scenarios.

The first step for trading a breakout of the range is to identify current levels of support and resistance. These levels should be easy to identify as price will trade flat in a range. Resistance will be found overhead by connecting a series of near identical highs, while support is below can be found by matching current lows in price action. Looking at the EURUSD chart below, current resistance can be found near 1.3415. Support is currently holding up price near 1.3385, creating a tight 30 pip trading range on the pair. These points will be the basis for our strategy, and should be clearly marked on our chart before progressing. EUR/USD: 30 Minute" width="625" height="332">

EUR/USD: 30 Minute" width="625" height="332">

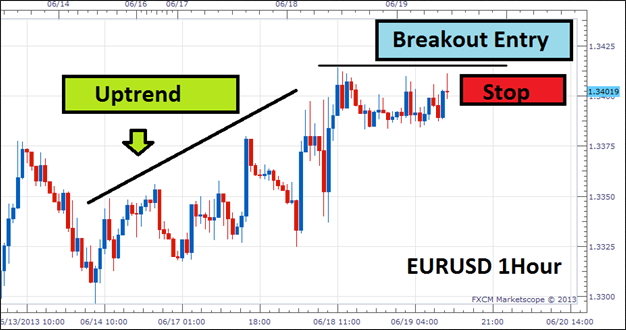

Next, once support and resistance have been updated and a trading range identified, we can begin to prepare our trading strategy. Even though price is moving sideways at present, traders may look to take a directional bias when trading a breakout of the range. Currently price action has been headed towards higher highs, creating an uptrend on the EUR/USD. Knowing this, short term trend traders can look for entries to buy on higher highs.

In order to create a higher high, price will have to move through the resistance levels that we described above. If prices trade above the previous high at 1.3415, breakout traders will look to buy the EURUSD. This method can be used by placing an entry order above this value, or traders may even consider to manually entering into the market once the breakout has been confirmed with a candle closing above current resistance. EUR/USD: 1 Hour" width="626" height="330">

EUR/USD: 1 Hour" width="626" height="330">

When trading breakouts, it is always important to consider risk. In the event of a false breakout, traders can set stops underneath levels of current resistance. I recommend placing stops at half the value of the initial range. This way if you use a full extension of the range as a profit target, you will naturally develop a 1:2 Risk/Reward ratio.

--- By Walker England, Trading Instructor

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/USD: Trade With Breakout Entries

Published 06/19/2013, 02:19 PM

Updated 07/09/2023, 06:31 AM

EUR/USD: Trade With Breakout Entries

Article Summary: Short term trading ranges can provide excellent opportunities for Forex scalpers. Learn to trade breakouts with the trend prior to today’s FOMC news event.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.