ASIA ROUNDUP:

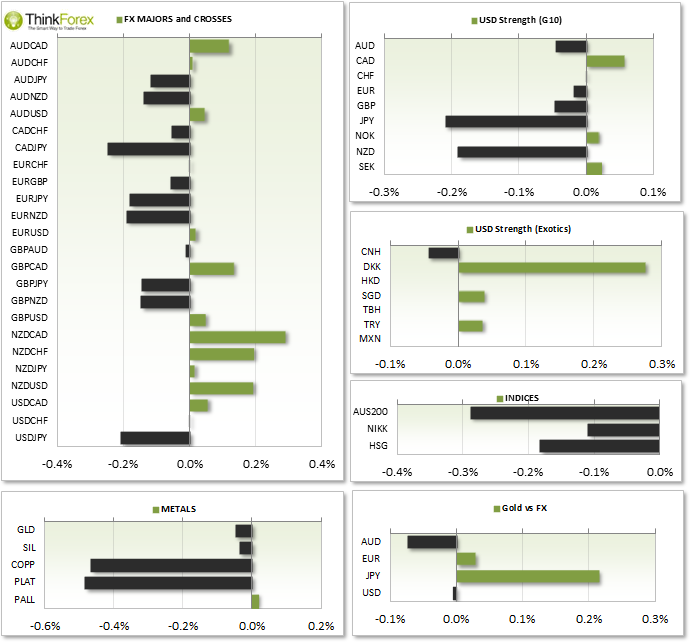

- NZD Economists expect NZD economy to grow by 4% due to the building boom being much stronger than first thought.

- AUD posted a surprise trade deficit when the market was geared up for a surplus. AUD lost ground against JPY and AUD but broke to new multi-week highs against CAD

- CNY Services PMI by HSBC fell for a 2nd consecutive month coming in at 50.7 and a 4-month low.

ECB Interest Rate decision tonight is the dominating theme. The crowd are mixed as to how they ECB will respond with many calling for aggressive action which will bring the Euro down, with many others expecting a limp response from ECB which will result in aggressive short-covering from Euro Bears (EUR/USD bullish).

US Initial Jobless claims will be used in conjunction with yesterday's ADP Non-farm payroll figures to try and estimate tomorrow's Nonfarms Payroll release.

BoE Interest Rate decision is widely expected to remain fixed, however any dovish tones from Carney in the following statement should be GBPUSD bearish.

Pairs to monitor: EUR/USD, EUR/GBP, USD/AUD, EUR/CAD, GBP/CAD, XAU/EUR

EUR/USD: Time to break out of the 65-pip range

I will not draw predictive lines for intraday on EUR/USD today - my view has been made pretty clear on the plethora of posts these past few days; I expect the market to be disappointed with ECB action and short-cover, to see the EUR/USD turn bullish above 1.3580 support. If they do come up with the good, this support level should break to target 1.350

However if you are to trade this release be prepared for any of the following

- Low liquidity leading up to the event

- Gaps, whipsaws and indecision (if data is mixed)

- A fast and furious directional move (if data is loud and clear)

Therefore as traders it is your duty to figure out how to trade such a release.

If you like to enter before the release to anticipate the direction of the breakout, then it would be advisable to be sensible with your stop loss and leave plenty of 'breathing room' and hope for a longer-term move to evolve. If the trade turns out to be a non-directional move you can manually close the trade with minimum damage (assuming you can calculate your risk properly).

Trying to straddle such a release with a 10-pip stop could result in tear if both orders get stopped out. (This is where you place a buy and sell order either side of price to cancel the order which doesn't trigger).

Another approach is to wait for the release to come out and see if the technical and fundamentals align. Once liquidity has returned and an established trend is underway, look to trend trade intraday timeframes using the above S/R levels as potential targets and / or reversal points.

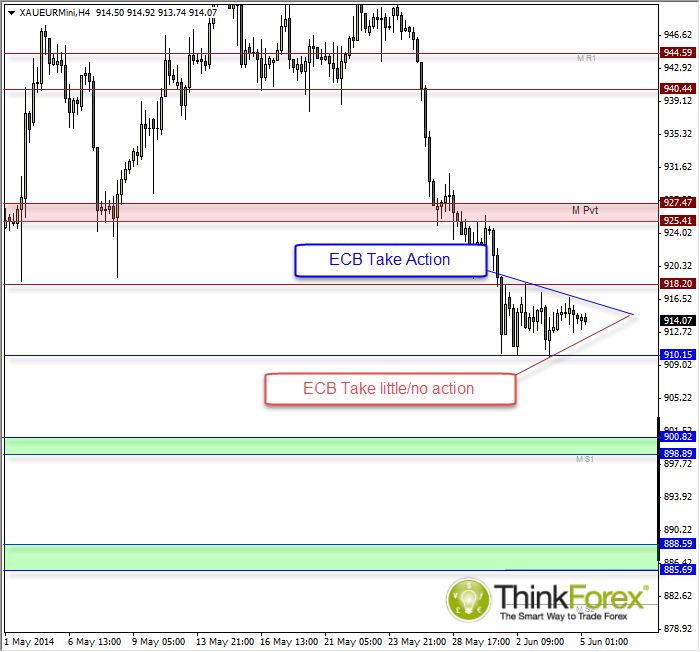

XAU/EUR: Trades within a pennant and breakout is pending

With the euro dominating the news and Gold being a safe haven, The Gold/Euro would be a logical place to look for a trade. In terms of timing the trade then the same notes above apply.