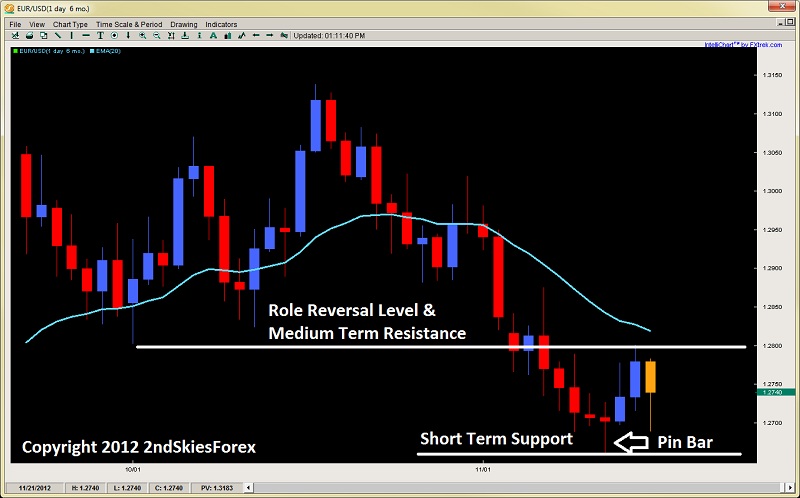

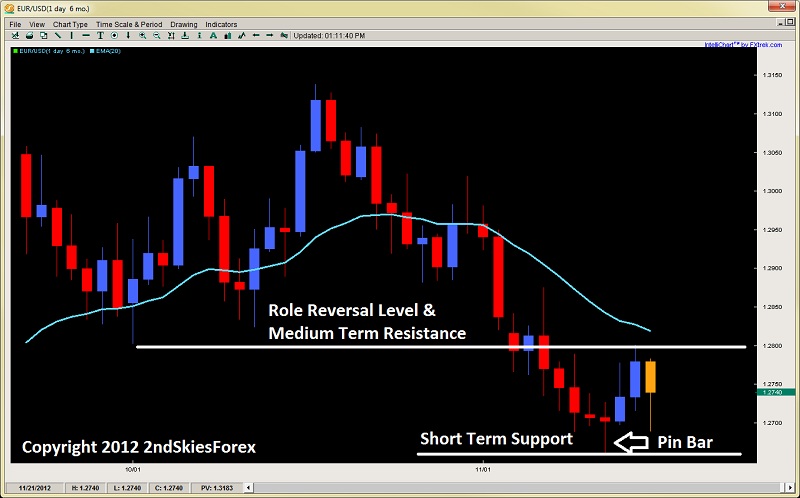

EUR/USD

Attempting to bottom and make some headway to the upside, the EUR/USD failed to clear the 1.2800 role reversal level which was the October swing lows. For now, the pair is stuck between 1.2800 weekly highs and 1.2659 lows which was the pin bar rejection on Tuesday. So bears can look to sell any weak rallies up to 1.2800 while bulls can look for intraday price action triggers near 1.2659.

EUR/USD" title="EUR/USD" width="800" height="599">

EUR/USD" title="EUR/USD" width="800" height="599">

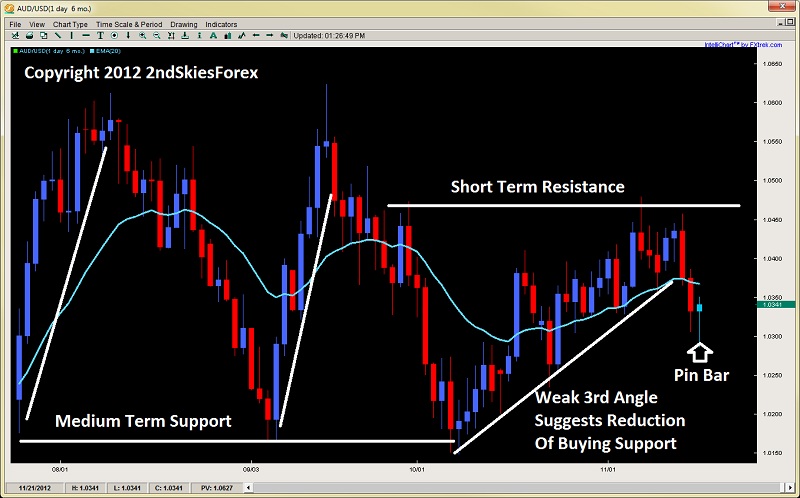

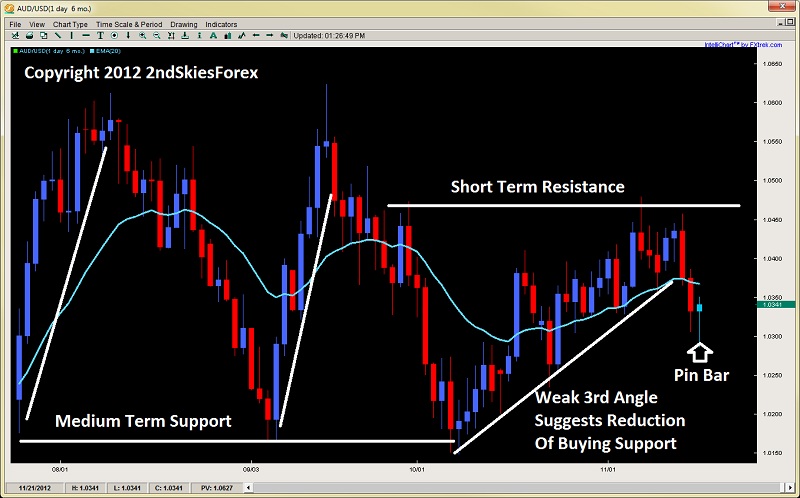

AUD/USD

Although the pair has been holding the 1.0150 are since late July this year, the aussie is starting to look like it’s breaking down as the price action angles are weakening on the daily charts. This was the same pattern that occurred on the EUR/USD before the big sell-off in April, with each successive angle getting weaker.

The pair did form a pin bar on Friday which may lend it some short-term support, but if the pair breaks the medium-term support 1.0150, we could see some strong unwinding down to the big figure at parity. Bears can watch for sell signals at 1.0450 while bulls can watch 1.0290 for intraday support.

AUD/USD" title="AUD/USD" width="800" height="599">

AUD/USD" title="AUD/USD" width="800" height="599">

Crude Oil

Trying to form a base since the 23rd of October, the commodity has been holding the $84 and $85 handles well in the last 10 days forming several intraday engulfing bars and pin bars off the key levels. The $87 – $84 range has held since the 7th of November, but some small buying pressure is building. If the commodity can take out $87 and close above it, then $89 is the next challenge so watch for some breakout pullbacks setups here. Bears meanwhile can look to sell on weakness leading into $89.

Original post

Attempting to bottom and make some headway to the upside, the EUR/USD failed to clear the 1.2800 role reversal level which was the October swing lows. For now, the pair is stuck between 1.2800 weekly highs and 1.2659 lows which was the pin bar rejection on Tuesday. So bears can look to sell any weak rallies up to 1.2800 while bulls can look for intraday price action triggers near 1.2659.

EUR/USD" title="EUR/USD" width="800" height="599">

EUR/USD" title="EUR/USD" width="800" height="599">AUD/USD

Although the pair has been holding the 1.0150 are since late July this year, the aussie is starting to look like it’s breaking down as the price action angles are weakening on the daily charts. This was the same pattern that occurred on the EUR/USD before the big sell-off in April, with each successive angle getting weaker.

The pair did form a pin bar on Friday which may lend it some short-term support, but if the pair breaks the medium-term support 1.0150, we could see some strong unwinding down to the big figure at parity. Bears can watch for sell signals at 1.0450 while bulls can watch 1.0290 for intraday support.

AUD/USD" title="AUD/USD" width="800" height="599">

AUD/USD" title="AUD/USD" width="800" height="599">Crude Oil

Trying to form a base since the 23rd of October, the commodity has been holding the $84 and $85 handles well in the last 10 days forming several intraday engulfing bars and pin bars off the key levels. The $87 – $84 range has held since the 7th of November, but some small buying pressure is building. If the commodity can take out $87 and close above it, then $89 is the next challenge so watch for some breakout pullbacks setups here. Bears meanwhile can look to sell on weakness leading into $89.

Original post