EUR/USD remains steady in Tuesday trading. The pair has gained close to one cent so far this week, and was trading in the high-1.31 range in the European session. In economic news, Spanish employment numbers were excellent, as Unemployment Claims recorded a sharp drop. In the US key releases continue to disappoint, as ISM Manufacturing PMI came in below the estimate. Today’s major release is US Trade Balance, and the markets are expecting a slightly higher deficit than last month.

The markets were treated to some good news to start the week, as Eurozone Manufacturing PMIs all moved higher. Italian Manufacturing PMI hit a four-month high, climbing to 47.3 points. Eurozone Final Manufacturing PMI improved to 48.3 points, its highest level since March 2012. Spanish Manufacturing PMI kept pace with a sharp rise, jumping from 44.7 points to 48.1 points. Despite the good news, traders should keep in mind that all three PMIs remain below the 50-point level, indicative of continuing contraction in these manufacturing sectors. The upward movement is certainly a welcome development, but if the European manufacturing industry is to recover, PMIs will need to continue to improve and cross above the 50 level.

Spanish employment numbers sizzled on Tuesday, as Unemployment Change dropped by 98.3 thousand. This was the indicator’s best performance ever in the month of May. The estimate stood at -50.2 thousand. The solid numbers are welcome news for beleaguered Prime Minister Mariano Rajoy, whose government remains deeply unpopular due to a strict austerity program. However, it should be noted that May is often a good month for Spanish employment numbers, and the Unemployment Rate hit a record high in Q1, climbing to 27.1%. So the employment picture remains grim, despite the solid Unemployment Change release.

Spanish numbers have been a pleasant surprise in the young month of June. Manufacturing PMI climbed from 44.7 points to 48.1 points, the index’s best showing in two years. This was followed by Unemployment Change, which posted a sharp drop of 98 thousand. Is the Eurozone’s fourth largest economy on the road to recovery, after all the bumps we’ve seen? Spanish Services PMI will be released on Wednesday, and the markets will be hoping for more good news from this key release.

Quantitative easing has become a hot topic, as the markets ponder whether the US Federal Reserve will scale back the current round of QE. Fed policymakers, including Fed Chair Bernanke, have hinted that QE could be wound up in the next few months. However, with the US continuing to alternate between good and bad economic releases, the Fed is unlikely to act before it is convinced that the US economy is improving. Much of the volatility we are seeing from EUR/USD can be attributed to market uncertainty about what action the Fed will take, and further hints from the Fed about scaling back QE will continue to impact on the currency markets.

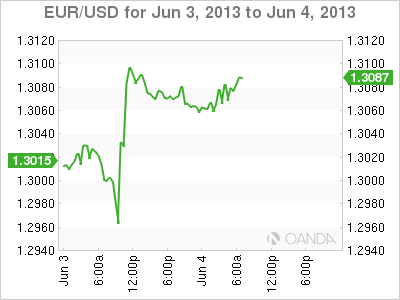

EUR/USD June 4 at 10:20 GMT

EUR/USD 1.3074 H: 1.3089 L: 1.3051 EUR/USD Technical" title="EUR/USD Technical" width="601" height="77">

EUR/USD Technical" title="EUR/USD Technical" width="601" height="77">

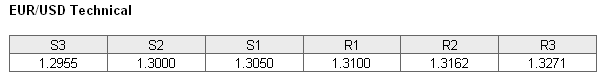

EUR/USD is steady after Monday’s sharp gains. On the downside, 1.3050 is providing support. This is a weak line, and could be tested if the dollar shows any upward movement. The next line of support is at the round number of 1.30. On the upside, the pair is putting pressure on the 1.31 line, and this could continue during the day. There is stronger resistance at 1.3162.

- Current range: 1.3050 to 1.3100

- Below: 1.3050, 1.3000, 1.2955, 1.2843 and 1.2753

- Above: 1.3100, 1.3162, 1.3271 and 1.3353

EUR/USD ratio has shifted directions in Tuesday trading, as we are seeing movement towards short positions. Currently, we are not seeing much movement from the pair, which has settled down after strong gains to open the week.

The euro started the week with a bang, and finds itself within striking distance of the 1.31 level. Will the upward momentum continue? Today’s major release is US Trade Balance, and we could see some movement from the pair if the reading is not in line with market expectations.