EUR/USD has started the week quietly, in sharp contrast to the volatility we saw last week. In Tuesday’s European session, the pair is trading in the low-1.31 range. Taking a look at economic news, there is only one Eurozone release today. Italian Retail Sales declined 0.1% posting its fourth consecutive drop. The markets are keeping a close eye on the US, which releases three key events later today - Core Durable Goods Orders, CB Consumer Confidence and New Home Sales.

The US dollar surged against the major currencies last week, as Federal Reserve chair Bernard Bernanke signaled that QE would likely be scaled down in 2013, and could be terminated in 2014, if growth and employment numbers continue to improve. The Fed said that it expects the economy to grow and unemployment to fall, which will allow for the scaling back of QE. This current round of QE has been in place since December 2012. Bernanke’s comments bolstered the dollar against the major currencies, as winding up QE is dollar-positive.

German numbers continue to raise concerns in the markets. Long considered the locomotive of Europe, the largest economy in the Eurozone continues to churn out weak data. Last week, German Manufacturing PMI remained under the 50-point level, indicating contraction in the manufacturing sector. German PPI also disappointed, posting a decline of -0.3%. On Monday, German Ifo Business Climate, a key indicator, came in at 105.9 points, just short of the estimate of 106.0. These numbers point to weakness in the German economy, and if Germany does not lead the way to recovery, the Eurozone will have a very tough time pulling out of the current recession.

Greece has not been in the news recently, as the bailout program has been progressing according to schedule. However, the dark clouds of political instability have returned as the smallest party in the governing coalition, the Democratic Left party, quit the government on Friday. The reason was the government’s decision to close the state broadcaster as part of its plan to eliminate 15,000 public sector jobs by 2014, as mandated by the bailout agreement. The loss of the Democratic Left leaves the coalition with a razor-thin majority of just three seats. The timing of this crisis is particularly unfortunate, as Greece is due to receive another installment of bailout funds in July. The troika (European Commission, ECB and IMF) are playing down the crisis, saying that the bailout will proceed on schedule. If this proves not to be the case, we could see the euro run into some turbulence. EUR/USD" width="400" height="300">

EUR/USD" width="400" height="300">

EUR/USD June 25 at 9:15 GMT

EUR/USD 1.3122 H: 1.3151 L: 1.3110

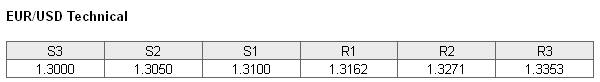

EUR/USD continues to trade in the low-1.31 range, as the proximate support and resistance lines remain in place (S1 and R1 above). The pair is receiving support at the round number of 1.3100. This is a weak line, and could face more pressure if the euro loses more ground. This is followed by a support level at 1.3050. On the upside, 1.3162 continues to provide resistance. This is followed by resistance at 1.3271.

- Current range: 1.3100 to 1.3162

- Below: 1.3100, 1.3050, 1.3000 and 1.2944

- Above: 1.3162, 1.3271, 1.3353, 1.3477 and 1.3586

The EUR/USD ratio started out the week with some strong movement, but is unchanged in the Tuesday session. This is consistent with what we are seeing from the pair, which is trading quietly. A majority of positions in the ratio continue to be short, indicating a strong bias towards the US dollar posting gains at the expense of the euro.

The euro has settled down, but remains under pressure from the dollar. We could see some volatility from EUR/USD as the US releases three key events later on Tuesday.

EUR/USD Fundamentals

- 8:00 Italian Retail Sales. Estimate 0.0%. Actual -0.1%.

- 12:30 US Core Durable Goods Orders. Estimate 0.0%.

- 12:30 US Durable Goods Orders. Estimate 3.0%.

- 13:00 US S&P/CS Composite-20 HPI. Estimate 10.6%.

- 13:00 US HPI. Estimate 1.2%.

- 14:00 US CB Consumer Confidence. Estimate 75.2 points.

- 14:00 US New Home Sales. Estimate 462K.

- 14:00 US Richmond Manufacturing Index. Estimate 0 points.

- 21:00 US Treasury Secretary Jack Lew Speaks.