GROWTHACES.COM Forex Trading Strategies

Taken Positions

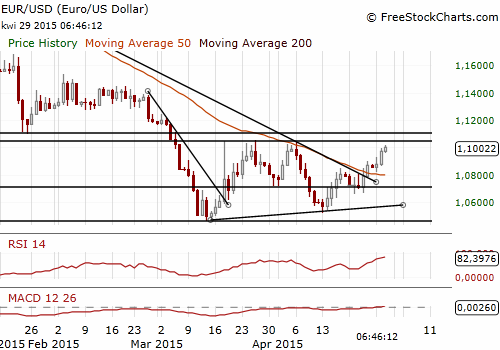

EUR/USD: long at 1.0740, target 1.1120, stop-loss moved to 1.0920, risk factor *

USD/JPY: short at 119.35, target 117.20, stop-loss 120.20, risk factor **

USD/CHF: short at 0.9600, target 0.9450, stop-loss 0.9670, risk factor ***

NZD/USD: long at 0.7630, target 0.7800, stop-loss moved to 0.7630, risk factor **

EUR/GBP: long at 0.7170, target 0.7350, stop-loss 0.7110, risk factor ***

EUR/JPY: long at 129.00,target 132.30, stop-loss moved to 130.50 risk factor *

CHF/JPY: long at 124.70, target 126.85, stop-loss 124.00, risk factor ***

Pending Orders

GBP/USD: buy at 1.5220, if filled - target 1.5540, stop-loss 1.5110, risk factor *

AUD/USD: buy at 0.7900, if filled – target 0.8230, stop-loss 0.7790, risk factor **

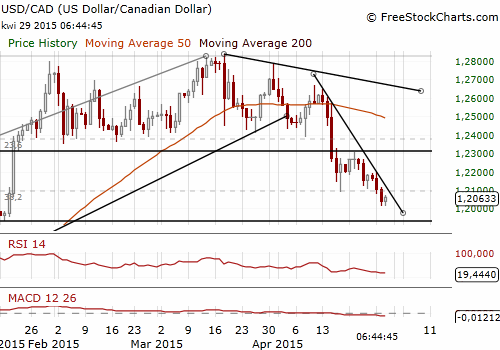

USD/CAD: sell at 1.2160, if filled - target 1.1950, stop-loss 1.2260, risk factor **

GBP/JPY: buy at 181.10, if filled - target 184.60, stop-loss 179.90, risk factor *

EUR/CAD: buy at 1.3150, if filled – target 1.3350, stop-loss 1.3050, risk factor ***

AUD/NZD: buy at 1.0280, if filled – target 1.0500, stop-loss 1.0190, risk factor ***

AUD/JPY: buy at 93.80, if filled - target 97.00, stop-loss 92.60, risk factor **

EUR/USD: Stay Long Waiting For Weak US GDP Data And Dovish FOMC

(target raised to 1.1120 in anticipation of dovish FOMC)

- Greek government officials said that Athens is expected to present draft reform legislation to lenders today. The bill is not expected to offer major new concessions beyond those already discussed with lenders. But it includes details on measures to tackle corruption and evasion, and the publication of a concrete bill is meant to underline the government's intent. It will include tax and public administration reforms, a tax on television broadcasting rights and TV advertisements. The talks have been held up on disagreement about major issues like pension and labour reform as well as a proposed value-added tax hike on Greek tourist islands. The draft bill is expected to be debated at a cabinet meeting in Athens on Thursday.

- European Union Economics Commissioner Pierre Moscovici said that talks between Greece and its lenders to reach a debt deal were not going fast enough, but that a reshuffle in Athens' negotiating team was a good sign.

- The European Central Bank raised the cap on emergency liquidity assistance that Greek banks can draw from the country's central bank by EUR 1.4 billion, taking the ELA ceiling to EUR 76.9 billion. The ECB has raised the cap in increments, keeping pressure on Athens to strike a deal with its creditors over economic reforms required to unlock remaining bailout aid.

- The Conference Board said its index of U.S. consumer confidence fell to 95.2 from an upwardly revised 101.4 in March (from 101.3 originally reported). The markets was looking for a much better reading of 102.5.

- Looking ahead, U.S. first-quarter GDP data is due at 12:30 GMT, followed by the Fed statement at 18:00 GMT.

- The market expects growth of 1.0% qoq annualized vs. 2.2% in the fourth quarter 2014. In our opinion the growth might be even slightly weaker (0.8%), as we expect that there was no growth in investment spending and net exports subtracted about 0.3 percentage point from GDP growth.

- The Fed says its decision on when to raise rates will be data-dependent and made on a meeting-by-meeting basis, a stance that it may reaffirm today. However, the statement is likely to be dovish - the majority of U.S. data since the previous FOMC meeting in March have surprised on the downside and a June rate hike is off the table. Moreover, futures traders put the odds of a September hike at only 25%.

- We have raised the target of our long EUR/USD position to 1.1120. In our opinion this level is likely in case of weak U.S. GDP reading and dovish FOMC statement. However, it is good to use trailing stop-loss just to lock profits.

Significant technical analysis' levels:

Resistance: 1.1036 (high Apr 6), 1.1052 (high Apr 6), 1.1062 (high Mar 18)

Support: 1.0927 (5-dma), 1.0860 (low Apr 28), 1.0820 (low Apr 27)

USD/CAD: BOC Comments Pretty In Line With Our Scenario

(profit taken, sell again at 1.2160)

- In an appearance before the House of Commons finance committee Bank of Canada Governor Stephen Poloz said he had characterized the first quarter as “atrocious” to assure the market that the Bank of Canada was taking this into account and would not therefore necessarily have to cut rates. He said: “We wanted markets to understand that we already believed that the quarter was going to look quite poor so, in that context, the markets would therefore not be doubling up on their bets that the Bank of Canada would need to do further actions.”

- Poloz said optimistic signals on exports, consumption and business investment lends confidence that the January cut, which it deemed “insurance” against the oil shock, would be sufficient. BOC governor also said the negative effects from the oil price shock would last longer than three or four months, but would begin to be “overwhelmed” after the first quarter by renewed exports and other positives. He added: “We are confident, the fundamentals are very strong, I would say stronger then what we are putting into our forecasts.”

- Poloz said that the estimate of inflation was complicated: “Prices are moving because of oil prices, and because of the exchange rate depreciation. Those are temporary things that we look through. We believe that underlying, taking out all the temporary effects, inflation is running at around 1.6 or 1.7%.”

- The CAD rallied against the USD yesterday, hitting its strongest level since before the Bank of Canada shocked markets in January with an unexpected rate cut. BOC governor’s comments were pretty in line with our scenario of no additional cuts and the markets are stepping back from expectations for further monetary easing in Canada.

- Poloz’s speech supported our short USD/CAD position. Although the rate did not reach the target of 1.2000 and hit the lowered stop-loss at 1.2050 today, we took profit on our short position opened at 1.2280. We are looking to get short again at 1.2160.

- Canadian February GDP data is due on Thursday.

Significant technical analysis' levels:

Resistance:1.2045 (session high Apr 29), 1.2116 (high Apr 28), 1.2205 (high Apr 27)

Support: 1.2014 (session low Apr 29), 1.2000 (psychological level), 1.1989 (38.2% of 1.0620-1.2835)

Source: Growth Aces Forex Trading Strategies