EUR/USD

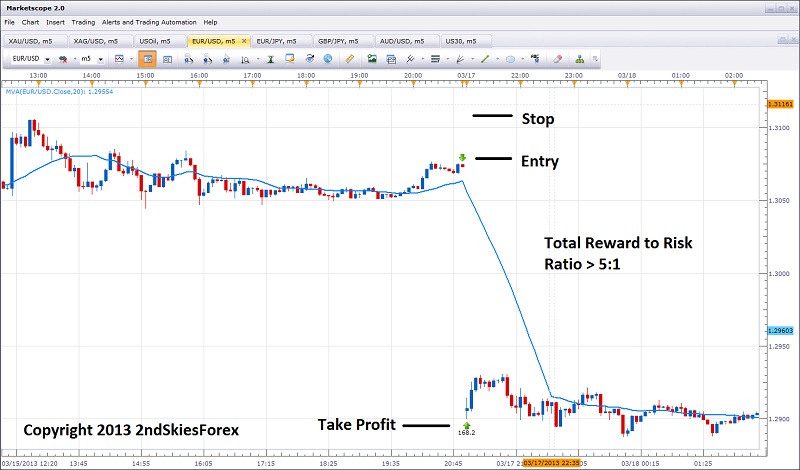

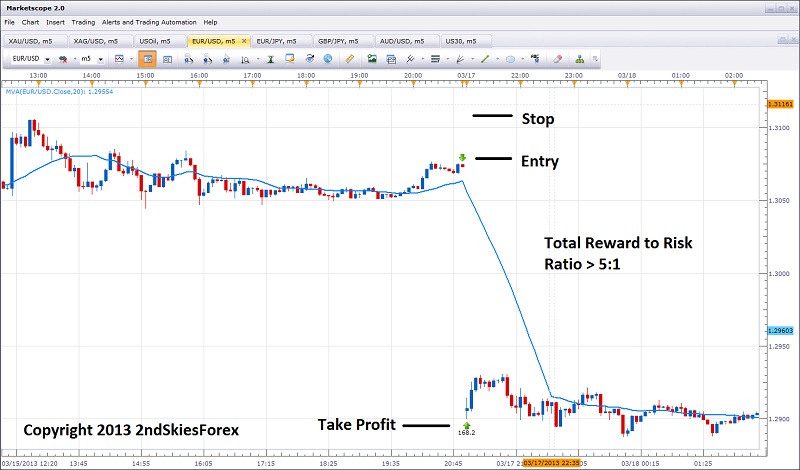

Last Thursday in my daily market commentary, I discussed how the EURUSD was in a downward sloping channel, which was offering a great selling opportunity at the channel top around 1.3100 for an eventual retest of 1.2900. Price hit 1.3107, sold off, and then on market open gap’d down exactly to 1.2900. This was heavily discussed on my blog, facebook page, and in my traders forum where ‘saavy’ price action traders made some huge pips so hopefully you did as well.

Now that the Cyprus Hill tax has been suggested (although we are not sure whether it will fully manifest with the parties agreeing not to vote the wealth transfer deposit haircut into effect), the bottom line is this severely hurts EZ confidence, for if one country can try it, why not another (i.e. Italy, Spain, Portugal)?

Thus, I’ll look to sell the Euro on any rallies into 1.3100 and 1.3050 targeting 1.2900 and perhaps even lower towards 1.2700 (Nov. 2012 low).

NOTE: I traded this EURUSD setup personally with the actual trade below snagging over 168 pips and over a 5:1 reward to risk ratio.

Live Price Action Trade EURUSD

EUR/USD" title="Live-Price-Action-Trade-EUR/USD" width="518" height="476">

EUR/USD" title="Live-Price-Action-Trade-EUR/USD" width="518" height="476">

EURUSD 4hr Chart Channel & Levels

EUR/USD 4hr Chart Channel & Levels" title="EUR/USD 4hr Chart Channel & Levels" width="518" height="476">

EUR/USD 4hr Chart Channel & Levels" title="EUR/USD 4hr Chart Channel & Levels" width="518" height="476">

USD/JPY

On Mar. 11th I talked about looking to get long on any pullbacks into the 94.50/60 area. Today the USDJPY provided that opportunity by dipping down to the dynamic support and 20ema, then bounced forming a daily pin bar closing above the key support area. Those not already long off the level, can watch for price action signals off the 94.50 level targeting 96 and 96.50 to rejoin the trend.

USD/JPY" title="USD/JPY" width="518" height="476">

USD/JPY" title="USD/JPY" width="518" height="476">

GBP/USD

After dropping over 1400+ pips, the GBPUSD formed a small pin bar at the bottom and has bounced about 200 pips off the low. This ran right into a with trend pin bar that dinked off the daily 20ema. Today’s price action resulted in an inside bar, so we have our short term range setup.

Bears wanting to get short via the pin bar can do so just below the daily 20ema targeting 1.5000 and 1.4900. Bulls on the other hand can either wait for a pullback into those levels forming a HL (higher low) and targeting 1.5100 and an eventual break of the pin bar high (1.5175) for a potential deeper reversal up towards 1.5200 and 1.5400.

GBP/USD" title="GBP/USD" width="518" height="476">

GBP/USD" title="GBP/USD" width="518" height="476">

Original post

Last Thursday in my daily market commentary, I discussed how the EURUSD was in a downward sloping channel, which was offering a great selling opportunity at the channel top around 1.3100 for an eventual retest of 1.2900. Price hit 1.3107, sold off, and then on market open gap’d down exactly to 1.2900. This was heavily discussed on my blog, facebook page, and in my traders forum where ‘saavy’ price action traders made some huge pips so hopefully you did as well.

Now that the Cyprus Hill tax has been suggested (although we are not sure whether it will fully manifest with the parties agreeing not to vote the wealth transfer deposit haircut into effect), the bottom line is this severely hurts EZ confidence, for if one country can try it, why not another (i.e. Italy, Spain, Portugal)?

Thus, I’ll look to sell the Euro on any rallies into 1.3100 and 1.3050 targeting 1.2900 and perhaps even lower towards 1.2700 (Nov. 2012 low).

NOTE: I traded this EURUSD setup personally with the actual trade below snagging over 168 pips and over a 5:1 reward to risk ratio.

Live Price Action Trade EURUSD

EUR/USD" title="Live-Price-Action-Trade-EUR/USD" width="518" height="476">

EUR/USD" title="Live-Price-Action-Trade-EUR/USD" width="518" height="476">EURUSD 4hr Chart Channel & Levels

EUR/USD 4hr Chart Channel & Levels" title="EUR/USD 4hr Chart Channel & Levels" width="518" height="476">

EUR/USD 4hr Chart Channel & Levels" title="EUR/USD 4hr Chart Channel & Levels" width="518" height="476">USD/JPY

On Mar. 11th I talked about looking to get long on any pullbacks into the 94.50/60 area. Today the USDJPY provided that opportunity by dipping down to the dynamic support and 20ema, then bounced forming a daily pin bar closing above the key support area. Those not already long off the level, can watch for price action signals off the 94.50 level targeting 96 and 96.50 to rejoin the trend.

USD/JPY" title="USD/JPY" width="518" height="476">

USD/JPY" title="USD/JPY" width="518" height="476">GBP/USD

After dropping over 1400+ pips, the GBPUSD formed a small pin bar at the bottom and has bounced about 200 pips off the low. This ran right into a with trend pin bar that dinked off the daily 20ema. Today’s price action resulted in an inside bar, so we have our short term range setup.

Bears wanting to get short via the pin bar can do so just below the daily 20ema targeting 1.5000 and 1.4900. Bulls on the other hand can either wait for a pullback into those levels forming a HL (higher low) and targeting 1.5100 and an eventual break of the pin bar high (1.5175) for a potential deeper reversal up towards 1.5200 and 1.5400.

GBP/USD" title="GBP/USD" width="518" height="476">

GBP/USD" title="GBP/USD" width="518" height="476">Original post