GROWTHACES.COM Forex Trading Strategies

Pending Orders

EUR/USD: sell at 1.0650, if filled – target 1.0460, stop-loss 1.0745, risk factor **

GBP/USD: sell at 1.4740, if filled - target 1.4500, stop-loss 1.4860, risk factor *

USD/CHF: buy at 0.9775, if filled – target 0.9885, stop-loss 0.9725, risk factor **

USD/JPY: buy at 120.05, if filled – target 121.65, stop-loss 119.45, risk factor **

EUR/JPY: sell at 128.25, if filled - target 126.60, stop-loss 129.00, risk factor ***

EUR/CAD: sell at 1.3440, if filled – target 1.3235, stop-loss 1.3540, risk factor **

CHF/JPY: sell at 123.20, if filled – target 120.50, stop-loss 124.40, risk factor ***

AUD/NZD: buy at 1.0135, if filled – target 1.0290, stop-loss 1.0090, risk factor **

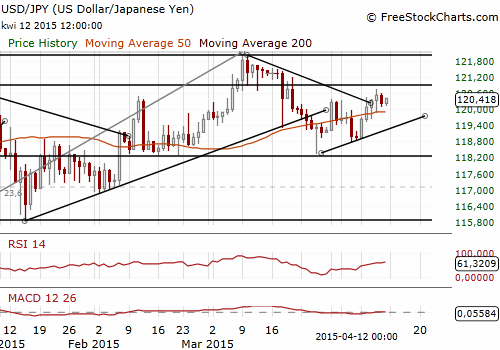

USD/JPY: BOJ Keeps Upbeat View On Economy

(buy at 120.05)

- Bank of Japan Governor Haruhiko Kuroda voiced confidence over the country's economic recovery and stressed the central bank will maintain its massive stimulus programme for as long as needed to hit its 2% inflation target.

- The Bank of Japan released minutes of its March meeting. The BOJ kept monetary policy steady at the March meeting but offered a slightly more downbeat view on prices, saying inflation will hover around zero for the time being. Many members of the Bank of Japan's policy board shared the view that the output gap and inflation expectations show that Japan's price trend will continue to improve. They agreed there is a high chance of meeting the central bank's 2% inflation target in the period around the fiscal year that started in April.

- At a subsequent meeting that ended on April 8, the BOJ again left monetary policy intact, and board member Takahide Kiuchi unsuccessfully proposed the BOJ reduce its asset purchases.

- The Bank of Japan raised its assessment for three of Japan's nine regions in its quarterly report, the most in more than a year, and maintained its rosy view for the remaining areas, signalling that the benefits of its stimulus programme was broadening. In the opinion of the BOJ a weak yen boosted exports and lured more overseas tourists. Some BOJ branch managers saw increasing signs that the weak yen and rising labour costs in China are prompting big manufacturers and parts suppliers to shift production home.

- Japan's core machinery orders fell 0.4% mom in February vs. the median estimate of a 2.8% decline. It followed a 1.7% fall in January.

- Japanese wholesale prices rose 0.7% yoy in March vs. 0.4% yoy in February. Domestic final goods prices fell 1.3% yoy.

- We have raised our USD/JPY buy order to 120.05, as we see strong support near 120.00.

Significant technical analysis' levels:

Resistance: 121.20 (high Mar 20), 121.41 (high Mar 18), 121.52 (high Mar 17)

Support: 120.11 (session low, Apr 13), 119.87 (low Apr 9), 119.65 (low Apr 8)

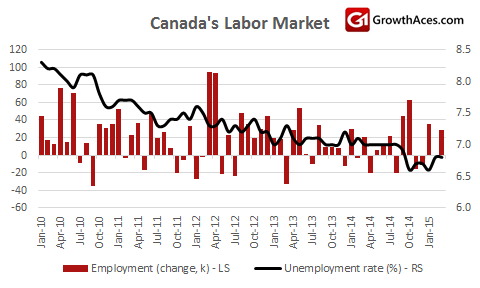

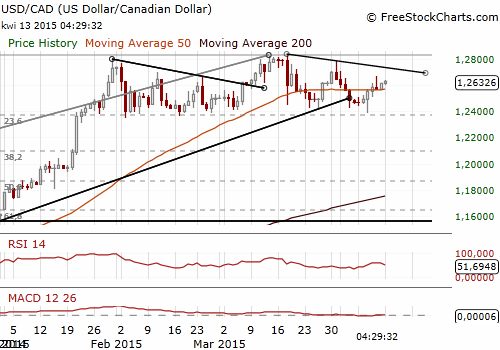

USD/CAD: Canadian Employment Figures Not As Good As It Seems

(stay sideways)

- The Canadian economy unexpectedly added 28.7k jobs in March. The figures topped expectations for the employment level to be unchanged last month. The unemployment rate was steady at 6.8%.

- But the composition of jobs was not as robust as the increase in the overall figure suggested. The gain came from 56.8k new part-time positions, the most since July, as employers cut 28.2k full-time jobs. The natural resources sector, which includes oil and gas extraction, added 6.3k positions after losing 26.0k jobs over the past two months.

- The Bank of Canada meeting is scheduled for Wednesday. It is widely expected that the bank will keep interest rates unchanged and Friday’s jobs report did not change these expectations. The reaction of the USD/CAD to the BoC decision should be rather limited.

- We stay sideways on the USD/CAD, but selling EUR/CAD may a profitable strategy. We are looking to get EUR/CAD short at 1.3440.

Significant technical analysis' levels:

Resistance: 1.2667 (high Apr 10), 1.2709 (high Apr 1), 1.2783 (high Mar 31)

Support: 1.2559 (session low Apr 13), 1.2508 (low Apr 9), 1.2388 (low Apr 8)

AUD/USD Hammered By Poor China Data

(stay sideways)

- China's export sales contracted 15% yoy in March vs. expectations for a 12% rise. We should notice, however, that in February Chinese exports rose 48.3% yoy, so a strong fall in March may be a one-off statistical effect. In a sign that domestic demand was tepid, Chinese imports shrank 12.7% yoy in March.

- The surprise drop revived worries about China’s slowing economy encouraged investors to sell the AUD. Also undermining sentiment was a downgrade in the World Bank's 2015 growth forecasts for developing East Asia and China.

- Friday’s data from the Commodity Futures Trading Commission showed net Aussie shorts stood at more than 40k contracts, from around 24k the week before. We should expect that the combination of Chinese data and predictions for slower growth only reinforced expectations the RBA will ease again in May.

- In our opinion the RBA may surprise markets again and keep rates on hold at its nearest meeting – a lot depends on inflation data that will be released next week. We expect Australian employment figures on Thursday to be slightly better than market consensus, which should support the AUD. The AUD may be not strong enough to rise against the USD, but we are looking to get AUD/NZD long.

Significant technical analysis' levels:

Resistance: 0.7678 (session high Apr 13), 0.7720 (high Apr 10), 0.7738 (high Apr 9)

Support: 0.7571 (low Apr 3), 0.7534 (low Apr 2), 0.7500 (psychological level)

Source: Growth Aces Forex Trading Strategies