Today, the euro-dollar exchange rate, better known to forex traders as EUR/USD, is trading pretty much where it traded in early July. Despite some large ups and downs, the net progress of this currency pair has been zero. But that may be about to change.

Here at Elliott Wave International, we've been using wave analysis to forecast forex markets since the early 1990s. What these two decades of producing intensive, 24-hour-a-day updates have proven to us is this:

Elliott wave patterns in forex market charts can and do warn you of trend changes days or hours before you will hear a fundamental analysis explanation of the same move.

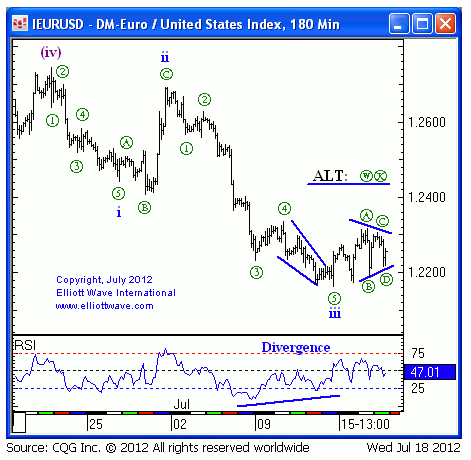

Looking at the charts of EUR/USD today, here's what jumps off the page. Labeled below on the chart, you can see that from the late June high of near $1.27, EUR/USD has fallen in what Elliotticians call an impulse wave pattern.

An impulse is a 5-wave, non-overlapping move. You can see below that so far, EUR/USD has likely finished only 3 waves of the impulse (labeled with the blue Roman i, ii, and iii). The sideways choppy move we've seen since the early July fits well as a wave iv.

Fourth waves often take the shape of an Elliott wave pattern called "triangle," a sideways move labeled ABCDE. Indeed, below you can see a developing triangle between the converging trend lines, labeled ABCD (circled), with wave E underway. EUR/USD" title="EUR/USD" width="471" height="460">

EUR/USD" title="EUR/USD" width="471" height="460">

Once wave E finishes, so will the larger-degree wave iv. And what comes after wave 4 of an Elliott wave impulse? Why, wave 5 of course!

Which means that the EUR is likely staring at a new low for the year.

Now, the new low has to wait until after wave iv is finished. Also, keep in mind that Elliott wave patterns are fluid, "living" things, so this wave iv could extend -- perhaps taking the form of yet another Elliott wave pattern called a "flat" correction. But that would only delay the resumption of the bear trend. In other words, the EUR may run, but it cannot hide.

by Jim Martens

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/USD: Prepare For Some Fireworks?

Published 07/19/2012, 02:32 AM

Updated 03/09/2019, 08:30 AM

EUR/USD: Prepare For Some Fireworks?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.