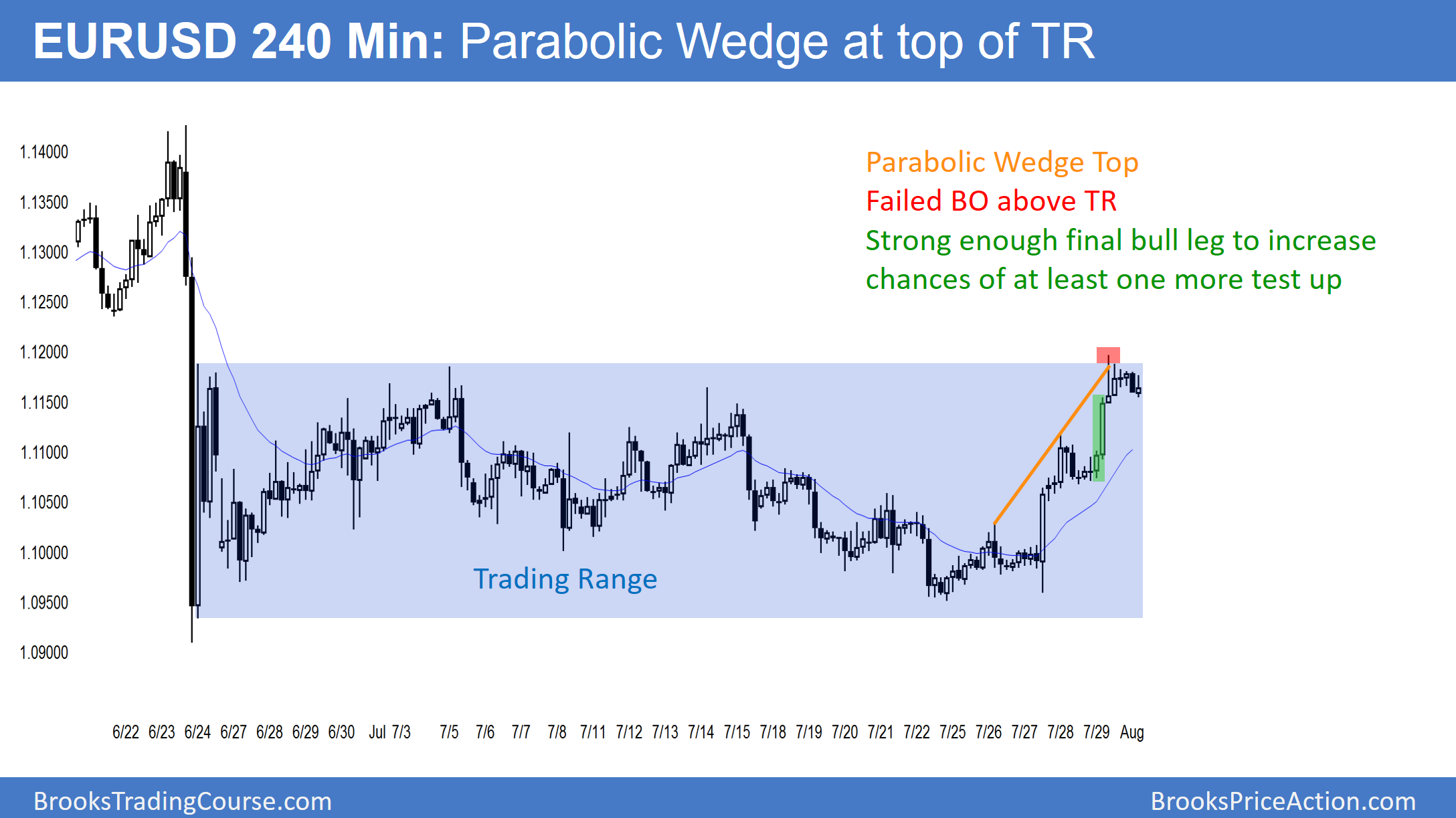

The 240-minute EUR/USD has a Parabolic Wedge Top. This could be a buy vacuum test of the top of the trading range. The final leg up was strong enough to give the bulls a 50% chance of a successful breakout. There is also a 50% chance of a pullback down into the middle of the range. If that happens, it usually initially begins with a 10-bar Endless Pullback before the bulls give up. Once they give up, they create a breakout. This often leads to a measured move down into the middle of the range.

The daily EUR/USD chart reversed up strongly again on Friday. Yet, it only poked a little above the month long trading range. The bulls want strong follow-through buying today. If they get it, the next target is the June 24 sell climax high.

The bears want this rally to stall here at the top of the trading range. They then want a reversal down. They therefore see this as a double top bear flag.

Since the daily chart is now in the middle of its 2016 trading range, the odds are that it will enter a small trading range for a few days. This is because traders are quick to take profits after brief moves when the market is in a trading ranges. Reversals come quickly. As a result, traders are unwilling to hold onto their positions for swing trades.

European Forex session

After Friday’s strong rally to the top of the month-long trading range on the daily chart, the EUR/USD Forex chart stayed in a 30 pip range overnight. The rally on the 240-minute chart from the July 24 low has 3 pushes up and is in a Parabolic Wedge bull channel. This increases the chances for a sharp pullback. However, the leg up on Friday was strong enough so that there will probably be at least one more push up before a pullback. Because the EUR/USD is at the top of its month-long trading range, if there is one more push up, it might be small.

There is still the possibility of a strong breakout above the range, but when the bulls stop buying aggressively at resistance, as they have since Friday, the odds drop to about 50%.