The EUR/USD is showing little movement in Wednesday trading, as the pair continues to trade in the high 1.34-range in the European session. On Monday, German Ifo Consumer Climate climbed slightly and matched the forecast. In the US, CB Consumer Confidence fell in August. We could see some movement from the EUR/USD on Tuesday, with the release of two key US releases later in the day - Core Durable Goods Orders and New Home Sales. The markets are expecting both releases to point upwards, which could bring some relief to the dollar, which remains under pressure since the Federal Reserve decision not to scale down QE.

German Ifo Business Climate has looked very strong in recent releases, pointing to stronger confidence in the German economy, the largest in the eurozone. However, the key indicator appears to be a victim of its own success, as it fell short of high market expectations. In August, the indicator improved slightly to 107.7 points, its highest level since March 2012. However, the markets had expected a higher figure of 108.4 points. Business Climate has now improved over five consecutive months, pointing to stronger confidence in the German economy. This bodes well for both the eurozone and the euro.

On the weekend, German Chancellor Angela Merkel was re-elected to a third straight term in convincing style. Merkel’s conservative bloc won about 41.5% of the vote, but the bloc did not win a super majority, which would have enabled it to form the government on its own. This means that Merkel will have to reach out to one of the opposition parties to form a coalition, which could lead to some political uncertainty. The most likely scenario is a coalition with the center-left SPD, but that party’s head, Ralf Stenger, is in no rush and can afford to wait to wait for a generous offer from Merkel. Merkel’s big win is good news for the euro, but the ensuing political uncertainty is not.

Eurozone, German and French PMIs were released on Monday, and the results were a mix. Interestingly, there was a solid consistency among the releases, as all of the Manufacturing PMIs lost ground, while the Services PMIs improved. On a positive note, all of the PMIs posted readings above the 50-point level, with the exception of French Flash Manufacturing PMI. This means that with the exception of the French manufacturing industry, the PMIs continue to point to expansion in the services and manufacturing sectors.

The markets have settled down after the US Federal Reserve stunned the markets in deciding not to taper QE at its policy meeting last week. Most analysts had expected the Fed to announce a scaling down of the present bond-buying program of $85 billion/mth by $10-15 billion. However, the Fed was of the opinion that US economic data, particularly employment numbers, did not justify scaling down QE at this time. After the FOMC Statement, Federal Reserve Bank of St. Louis President James Bullard shed some light on the dramatic move (or lack of) by the Federal Reserve. Bullard said the vote was close, but weaker US numbers led to a decision not to taper. He added that the Fed may go ahead with “small” reductions to QE at its next policy meeting in October.

EUR/USD" border="0" height="300" width="400">

EUR/USD" border="0" height="300" width="400">

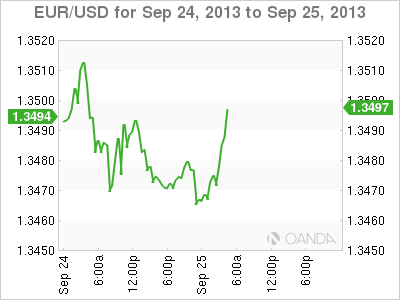

EUR/USD September 25 at 8:40 GMT

EUR/USD 1.3492 H: 1.3493 L: 1.3462

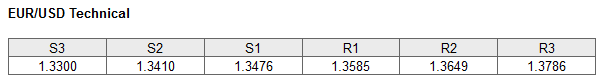

- EUR/USD continues to trade in the high-1.34 range in Wednesday trading. The pair has edged higher in the European session and is testing the 1.35 line.

- The pair continues to face strong resistance at 1.3585. The next line of resistance is at 1.3649. This line has remained intact since February.

- On the downside, the pair is testing support at 1.3476. This is followed by a support level at 1.3410.

- Current range: 1.3476 to 1.3585

Further levels in both directions:

- Below: 1.3476, 1.3410, 1.3300, 1.3162 and 1.3100

- Above: 1.3585, 1.3649, 1.3786, 1.3893 and 1.4000

OANDA’s Open Positions Ratio

The EUR/USD continues to point to movement towards long positions in Wednesday trading, continuing a trend we have seen all week. This is reflected in the current movement of the pair, as the euro has posted modest gains against the US dollar. The ratio continues to have a solid majority of short positions, indicative of a strong trader bias towards the US dollar reversing direction and moving to higher ground.

The EUR/USD has moved slightly higher and is testing the 1.35 line. With the US releasing key housing and manufacturing numbers later today, we could see further activity from the pair during the day.

EUR/USD Fundamentals

- 6:00 GfK German Consumer Climate. Estimate 7.1 points. Actual 7.1 points.

- 12:30 US Core Durable Goods Orders. Estimate 1.1%.

- 12:30 US Durable Goods Orders. Estimate 0.0%.

- 14:00 US New Home Sales. Estimate 422K.

- 14:30 US Crude Oil Inventories. Estimate -1.0M.