EUR/USD continues to drop in the Wednesday session. In the European session, the pair is trading in the low-1.30 range, the lowest levels we’ve seen in about three weeks. In the Eurozone, the day started on a positive note, as German Consumer Climate climbed to a multi-year high. Earlier in the day, ECB President Mario Draghi addressed the National Assembly in Paris. In the US today’s highlight is Final GDP. The markets are expecting a strong improvement from the previous reading, with an estimate of a 2.4% gain.

The US dollar surged against the major currencies last week, and the greenback continues to rally, benefitting from excellent US numbers on Tuesday. Core Durable Goods, CB Consumer Confidence and New Home Sales were all above their estimates. Manufacturing data, often a sore spot, also looked good as the Richmond Manufacturing Index had its best performance since last November. The strong numbers are particularly encouraging as they come from a wide range of economic sectors. If Thursday’s Unemployment Claims follow suit with positive data, we could see the US posts more gains against the retreating euro.

Recent German numbers have not impressed, raising concern in the markets. Long considered the locomotive of Europe, the largest economy in the Eurozone continues to churn out weak data. Last week, German Manufacturing PMI remained under the 50-point level, indicating contraction in the manufacturing sector. German PPI also disappointed, posting a decline of -0.3%. On Monday, German Ifo Business Climate, a key indicator, came in at 105.9 points, just short of the estimate of 106.0. These numbers point to weakness in the German economy, and if Germany does not lead the way to recovery, the Eurozone will have a very tough time pulling out of the current recession. There was good news on Wednesday as German Consumer Climate beat the estimate, but the markets will want to see a steady output of positive numbers from Germany before there can be serious talk of a Eurozone recovery.

The US dollar surged last week after Federal Reserve Chair Bernard Bernanke said that the Fed was planning to scale down QE. However, US (and global) stock markets fell sharply on the news, and the Fed finds itself trying to contain the damage and calm the nervous markets. Dallas Fed President Richard Fisher declared that “tapering” should not be confused with “tightening” and said that the Fed was not exiting from its accommodative policy action just yet. Minneapolis Fed President Naraya Kocherlakota reiterated that the Fed was continuing with an expansionary monetary policy event if QE was terminated, and said that it was a misperception to assume that the Federal Reserve had turned more hawkish. One can be excused for dismissing these statements as little more than linguistic acrobatics, and it is questionable if the markets will be reassured by these statements from the Fed, which were clearly aimed at damage control and reassuring nervous investors.

Greece has not been in the news recently, as the bailout program has been progressing according to schedule. However, the dark clouds of political instability have returned, as the smallest party in the governing coalition, the Democratic Left, quit the government on Friday. The reason was the government’s decision to close the state broadcaster as part of its plan to eliminate 15,000 public sector jobs by 2014, as mandated by the bailout agreement. The loss of the Democratic Left leaves the coalition with a razor-thin majority in parliament of just three seats. The timing of this crisis is particularly unfortunate, as Greece is due to receive another installment of bailout funds in July. The troika (European Commission, ECB and IMF) are playing down the crisis, saying that the bailout will proceed on schedule. If this optimism proves to be unfounded, we could see the euro run into some turbulence. EUR/USD" width="400" height="300">

EUR/USD" width="400" height="300">

EUR/USD June 26 at 10:30 GMT

EUR/USD 1.3018 H: 1.3088 L: 1.3017

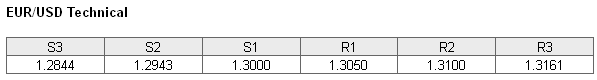

EUR/USD continues to lose ground, and is trading in the low-1.30 range. The pair is facing resistance at 1.3050. This weak line has seen activity today, and this could continue. Next, there is resistance the round number of 1.3100. This line has strengthened as the pair trades at lower levels. On the downside, 1.3000 continues to provide support, but we could see this significant line face pressure if the euro continues to slide. This is followed by a stronger support level at 1.2943.

- Current range: 1.3000 to 1.3050

- Below: 1.3000 and 1.2943, 1.2844 and 1.2696

- Above: 1.3050, 1.3100, 1.3162, 1.3271, 1.3353, 1.3477 and 1.3586

The EUR/USD ratio has resumed strong movement after a pause on Tuesday. Currently, the ratio is showing movement towards long positions. This is consistent with what we are seeing from the pair, as the dollar continues to post gains against the euro. A majority of positions in the ratio continue to be short, indicating a strong bias towards EUR/USD continuing its downward trend.

The euro continues to struggle, as it moves closer t the 1.30 level. We could see some volatility from EUR/USD if today’s GDP release out of the US does not meet market expectations.

EUR/USD Fundamentals

- 6:00 GfK German Consumer Climate. Estimate 6.6 points. Actual 6.8 points.

- 7:48 ECB President Mario Draghi Speaks.

- All Day – ECOFIN Meetings.

- 12:30 US Final GDP. Estimate 2.4%.

- 12:30 US Final GDP Price Index. Estimate 1.1%.

- 14:30 US Crude Oil Inventories. Estimate -1.9M.