It's a quiet start to the week for EUR/USD, as it trades in the mid-1.36 range in Monday’s European session. On Friday, Non-Farm Payrolls slumped to an eighteen-month low, but the Unemployment Rate improved sharply. In economic news, there are just two releases on the schedule. In the Eurozone, Italian Industrial Production dropped to 0.3%, missing the estimate. The sole US release is the Federal Budget Balance.

US employment numbers started 2014 on a positive note, but Friday’s Non-Farm Payrolls was dismal, posting its lowest gain since May 2012. The key employment indicator dropped to just 74 thousand, down from 203 thousand a month earlier. This was nowhere near the estimate of 196 thousand. Although the unemployment rate dropped to 6.7%, this was due to a drop in the participation rate, which fell to 62.8%, its lowest since 1978. This figure points to a worrying trend of a jobless US recovery.

The first ECB rate announcement of 2014 was a non-event, as the central bank held the benchmark rate at a record low of 0.25%, as expected. Mario Draghi's follow-up press conference did not make waves and move the currency markets, as has often been the case in the past. Draghi said that monetary policy will remain accommodative for as long as is needed to help the Eurozone economy recover, and that interest rates will likely remain at present or lower levels for the foreseeable future. If growth and inflation indicators continue to look weak, the ECB may have to take action at its next meeting in February. The euro shrugged off the ECB announcement and remained close to the 1.36 line.

Friday's disappointing Non-Farm Payrolls report may create some concern in the markets, but is unlikely to change the Federal Reserve's path of tapering QE, which it started just this month. In December, outgoing Fed chair Bernard Bernanke strong hinted that the Fed planned to wind up QE by the end of 2014, reducing the asset-purchase program by increments of $10 billion at each meeting. The Fed next meets for a policy meeting on January 28, and the question is will the Fed reduce QE by another $10 billion, down to $65 billion each month. Most analysts feel that one bad employment report will not affect the taper schedule and we will see a reduction in QE at the next meeting.

Portugal will exit its bailout program in May, which saw the country receive a rescue package from the EU and the IMF which amounted to EUR 78 billion. Portuguese Treasury Minister Castelo Branco is hopeful that the country will be able to sell bonds through auctions before May. Until now, Portugal has been relying on banks to sell bonds. The end of the bailout should allow Portugal full access to debt markets. Ireland, which exited a bailout program in December, became the first Eurozone member to do so since the debt crisis which rocked the bloc in 2009. EUR/USD" border="0" height="300" width="400">

EUR/USD" border="0" height="300" width="400">

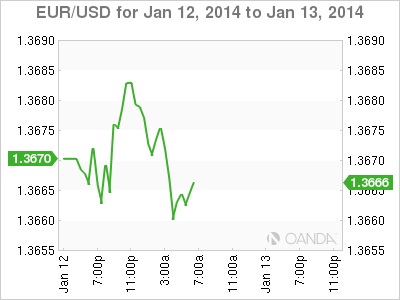

EUR/USD January 13 at 11:20 GMT

EUR/USD 1.3663 H: 1.3685 L: 1.3657 EUR/USD Technical" title="EUR/USD Technical" height="81" width="451">

EUR/USD Technical" title="EUR/USD Technical" height="81" width="451">

- EUR/USD is showing little movement in Monday trading. The pair touched a high of 1.3684 late in the Asian session.

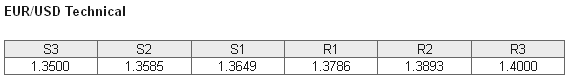

- 1.3649 has switched to a support role after gains by the euro on Friday. It is a weak line which could see some action during the day. This is followed by a stronger support line at 1.3585.

- The pair faces strong resistance at 1.3786. This is followed by resistance at 1.3893.

- Current range: 1.3649 to 1.3893

Further levels in both directions:

- Below: 1.3649, 1.3585, 1.3500, 1.3410 and 1.336

- Above: 1.3786, 1.3893, 1.4000 and 1.4140

OANDA's Open Positions Ratio

EUR/USD ratio is unchanged in Monday trading, continuing the trend we saw late last week. This is consistent with what we are seeing from the pair, which is showing little movement. The ratio is made up largely of short positions, indicative of a trader bias towards the dollar continuing to move to higher ground.

The euro is steady in Monday trading, with the pair trading quietly in the mid-1.36 range. With no major US releases on the schedule, it could be an uneventful North American session.

EUR/USD Fundamentals

- 9:00 Italian Industrial Production. Exp. 0.6%. Actual 0.3%.

- 19:00 US Federal Budget Balance. Exp. 44.3B.

*Key releases are highlighted in bold

*All release times are GMT

Original post