EUR/USD is showing little change, as the pair trades in the high-1.28 range in Friday’s European session. The euro failed to make up ground on Thursday, despite some disappointing US numbers, notably Unemployment Claims. Taking a look at Friday, there are no releases out of the Eurozone. It is a quiet day in the US as well, with just three releases. Today’s highlight is UoM Consumer Sentiment.

The markets got a good look at string of US releases on Thursday, but for the most part, the news was negative. Core CPI posted a weak gain of 0.1%, missing the forecast of a 0.2% gain. Unemployment Claims had looked impressive in recent readings, but the key indicator slumped, as new claims jumped to 360 thousand, blowing past the estimate of 332 thousand. The Philly Fed Manufacturing Index dropped into negative territory, posting a reading of -5.2 points. The markets had expected a gain of 2.5 points. Housing Starts fell sharply, from 1.04 million to 0.85 million. This was well below the estimate of 0.98 million. There was some positive news, as Building Permits, which rose to 1.02 million, beating the estimate of 0.94 million. The disappointing numbers will again bring into question the health of the US economy, which has not been able to churn out continuous positive releases.

There has been a lot of volatility from EUR/USD recently, and one of the reasons has been statements from the ECB regarding negative deposit rates. Essentially, this means that depositors would be charged a fee for cash deposits held in European banks. ECB head Mario Draghi broached the idea earlier this month, and the euro dropped almost immediately. The reason? Negative deposit rates would lead to the flow of funds out of the Eurozone, as deposit holders seek better returns on their money. Earlier in the week, ECB member Ignazio Visco said that the ECB was open to the idea of negative deposits. Proponents of the idea argue that it would increase lending to businesses and help boost economic activity in the sluggish Eurozone. The ECB would be the first major central bank to adopt negative deposit rates, and if the ECB does take steps to adopt this measure, we can expect the euro to react.

The dollar has enjoyed some broad strength against the major currencies of late, in part due to speculation that the Federal Reserve might terminate its current round of quantitative easing, thanks to an improving employment picture in the US. On Thursday, John Williams, president of the Federal Reserve Bank of San Francisco, said that the Fed could begin reducing its quantitative easing program this summer and wind up bond buying late in 2013. As QE is dollar-negative, any further statements from the Fed about QE will likely have an impact on the movement of EUR/USD.

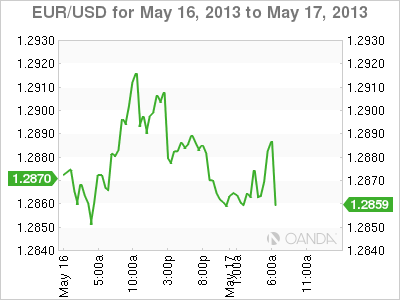

EUR/USD May 17 at 10:00 GMT

EUR/USD 1.280 H: 1.2888 L: 1.2851 EUR/USD Technical" title="EUR/USD Technical" width="601" height="82">

EUR/USD Technical" title="EUR/USD Technical" width="601" height="82">

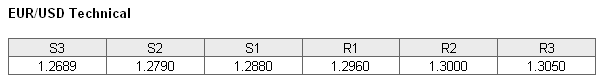

EUR/USD continues to trade in the high-1.28 range. The pair is testing support at 1.2880. This line could break if the euro loses any ground. There is a stronger support level at 1.2790. On the upside, the pair faces weak resistance at 12960. This is followed by resistance at the round number of 1.3000.

- Current range: 1.2880 to 1.2960

- Below: 1.2880, 1.2790, 1.2689, 1.2589 and 1.2500

- Above: 1.2960, 1.3000, 1.3050, and 1.31

EUR/USD ratio is pointing to movement towards long positions. We are currently seeing the pair move upwards, but this is a modest move. If the euro does show some strength and the pair moves upwards, we can expect the current movement in the ratio to continue.

EUR/USD is steady, and remains under the 1.29 line. The pair shrugged off a host of US releases on Thursday, so we could see some drifting for the duration of the day. However, there is a major consumer confidence release out of the US later, which should be treated as a market-mover.

EUR/USD Fundamentals

- 13:55 US Preliminary UoM Consumer Sentiment. Estimate 77.9 points.

- 13:55 US Preliminary UoM Inflation Expectations.

- 14:00 US CB Leading Index. Estimate 0.3%.