EUR/USD continues to trade quietly in the final year of 2014. Today, In Tuesday’s European session, the pair is trading in the mid-1.21 range. The euro is struggling, having lost about 350 points in the past two weeks. On the release front, Spanish CPI posted a sharp decline of 1.1%, while Eurozone Private Loans came in at -0.9%, matching the forecast. In the US, today’s highlight is CB Consumer Confidence. The markets are expecting a strong reading for December, with the estimate standing at 94.6 points.

Greece was in the spotlight on Monday, but this time it was a political crisis rather than trouble with the country’s bailout plan. Greece lawmakers failed to elect a new president for a third time, leaving Prime Minister no choice but to dissolve parliament. A general election has now been scheduled for January 25. The country’s controversial bailout agreement promises to be a major election issue. The bailout agreement ends in February, and Greece owes EUR 260 billion to the troika (EU, ECB and the IMF). Negotiations between Greece and the troika are on hold until after the election. The bailout agreement forced Greece to implement stiff austerity measures have proven deeply unpopular, and the Syriza Party, which leads in the polls, wants to cancel the bailout agreement and write off much of the country’s debt. Such a move could send shock waves across European markets, as other bailout countries such as Ireland would be tempted to follow Greece’s precedent and opt out of their financial obligations to the troika. The latest Greek saga will be closely watched by the markets as we move closer to Greek election day.

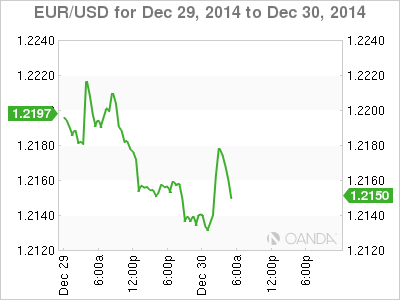

EUR/USD for Tuesday, December 30, 2014

EUR/USD December 30 at 10:40 GMT

EUR/USD 1.2150 H: 1.2188 L: 1.2124

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1926 | 1.2042 | 1.2143 | 1.2286 | 1.2407 | 1.2518 |

- EUR/USD edged lower in the Asian session, testing support at 1.2143. The pair has reversed directions in the European session and posted gains.

- 1.2143 is a weak support level. 1.2042 is next.

- 1.2286 remains a strong resistance line.

- Current range: 1.2143 to 1.2286

Further levels in both directions:

- Below: 1.2143, 1.2042, 119.26 and 118.02

- Above: 1.2286, 1.2407, 1.2518, 1.2688 and 1.2806

OANDA’s Open Positions Ratio

EUR/USD ratio is pointing to gains in short positions on Tuesday. This is not is consistent with the pair’s movement, as the euro has posted small gains. The ratio has a majority of long positions, indicative of trader bias towards the euro moving to higher ground.

EUR/USD Fundamentals

- 8:00 Spanish Flash CPI. Estimate -0.7%. Actual -1.1%.

- 9:00 Eurozone M3 Money Supply. Estimate 2.6%. Actual 3.1%.

- 9:00 Eurozone Private Loans. Estimate -0.9%. Actual -0.9%.

- 9:00 Italy 10-Year bond Auction.

- 14:00 US S&P/CS Composite-20 HPI. Estimate 4.4%.

- 15:00 US CB Consumer Confidence. Estimate 94.6 points.

*Key releases are highlighted in bold

*All release times are GMT

Disclaimer: This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.