GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.1325, target 1.1550, stop-loss 1.1205, risk factor *

GBP/USD: long at 1.5860, target 1.6040, stop-loss 1.5770, risk factor *

USD/CHF: short at 0.9210, target 0.9095, stop-loss 0.9275, risk factor *

USD/CAD: short at 1.2270, target 1.2100, stop-loss 1.2370, risk factor **

EUR/GBP: long at 0.7150, target 0.7400, stop-loss 0.7080, risk factor ***

EUR/CHF: long at 1.0440, target 1.0680, stop-loss 1.0380, risk factor *

EUR/JPY: long at 139.50, target 142.00, stop-loss 137.80, risk factor *

EUR/CAD: long at 1.3895, target1.4150, stop-loss 1.3770, risk factor **

GBP/JPY: long at 195.25, target 197.30, stop-loss 194.00, risk factor *

CHF/JPY: long at 133.65, target 136.00, stop-loss 132.10, risk factor **

Pending Orders

AUD/NZD: sell at 1.1300, target 1.1100, stop-loss 1.1400, risk factor ***

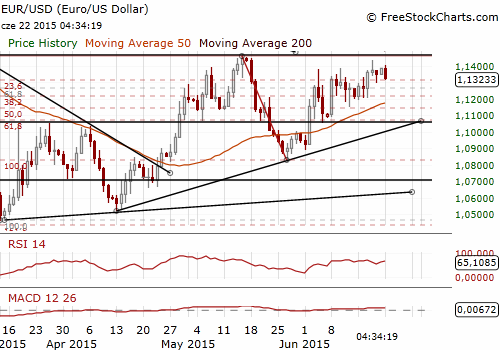

EUR/USD: It Is A Final Countdown

(long at 1.1325)

- Greek Prime Minister Alexis Tsipras made a new offer on a reforms package to foreign creditors on Sunday.

- Greek officials have said Athens may be willing to consider raising value-added-taxes or other levies to appease the lenders, who want concrete assurances that demanding budget targets will be met.

- Tsipras will meet European Commission President Juncker, ECB President Mario Draghi, IMF head Christine Lagarde and Eurozone finance ministers chairman Jeroen Dijsselbloem at 9:00 GMT. Eurozone finance ministers are due to meet 90 minutes later and a summit of Eurozone prime ministers and presidents is scheduled at 17:00 GMT.

- San Francisco Fed President John Williams (voting) said the central bank should probably raise interest rates twice this year, to between 0.5% and 0.75%, as long as economic data comes in as expected. Rate increases of a quarter percentage point each would be reasonable, he said, with little point in making rate increases any smaller. Williams predicted that GDP will grow at about a 2.75% annual pace for the next several quarters before slowing to a more sustainable pace next year. Unemployment, he said, will likely fall to 5.2% by year's end, and stronger wage growth is already evident.

- Cleveland Fed President Loretta Mester (voting) said the US economy has now grown strong enough to absorb an interest rate hike of 0.25 percentage point. She cited recent labor market improvement, wage gains, stability in the dollar and oil prices, and expectations that inflation will start to rise as reasons for confidence.

- Hawkish Fed comments are overshadowed by expectations for Greece deal today. In our opinion, there is high likelihood that the agreement will be reached. That is why we have got long at current market level of 1.1325.

Significant technical analysis' levels:

Resistance: 1.1404 (session high Jun 22), 1.1410 (high Jun 19), 1.1440 (high Jun 18)

Support: 1.1300 (10-dma), 1.1292 (low Jun 19), 1.1206 (low Jun 17)

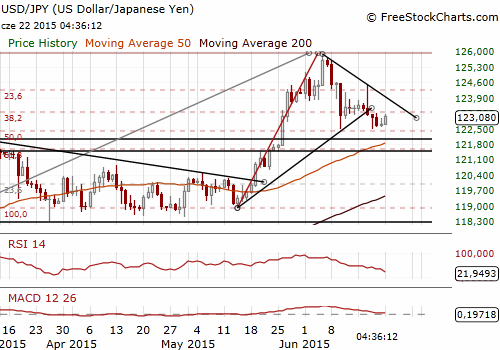

USD/JPY: Unclear Reaction To Greece Deal

(stay sideways)

- Bank of Japan Governor Haruhiko Kuroda said the central bank has ample means to achieve its goal of accelerating inflation to 2% and keeping it there in a stable manner. Kuroda said raising the 0.1% interest the BOJ pays on excess reserves parked with the central bank could be one option if the BOJ were to exit its massive stimulus programme. But he stressed that it was premature to debate a specific exit strategy now because how best to end the stimulus programme depends on economic and financial developments at the time.

- The market still expects the BOJ to ease policy further in October. In our opinion, expectations for further easing will diminish during summer months, as we expect an improvement in Japans’ macroeconomic figures. Traders are waiting now for BOJ minutes (23:50 GMT on Tuesday) and CPI data (23:30 GMT on Thusday).

- A Greek deal may trigger JPY-selling, as the JPY is considered as safe-haven currency. But in our opinion, a fall in the USD/JPY is also possible due to trading on crosses. That is why no position is justified from the risk/reward perspective.

Significant technical analysis' levels:

Resistance: 123.21 (high Jun 19), 123.61 (high Jun 18), 124.43 (high Jun 17)

Support: 122.56 (session low Jun 22), 122.48 (low Jun 18), 122.46 (low Jun 10)

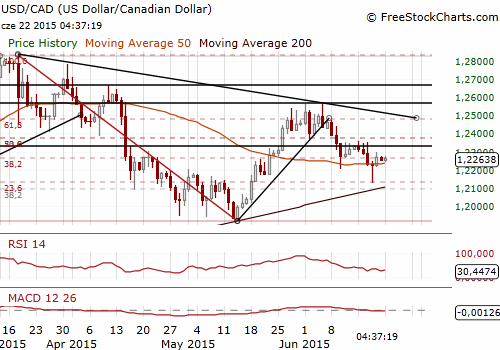

USD/CAD: Weak Canadian Retail Sales Overshadowed Slight Uptick In Inflation

(short at 1.2270)

- Canada's annual inflation rate in May edged up to 0.9% from 0.8% in April, but was still below the lower end of the Bank of Canada's 1% to 3% target range. The median forecast was at 0.8%. The annual inflation rate increased on the back of food prices, which were 3.8% higher than in May 2014. The energy index fell 11.8% yoy in May, following a 13.5% yoy drop in April. The core inflation rate, which strips out volatile items and is closely watched by the Bank of Canada, dipped to 2.2% in May from 2.3% in April. A reading of 2.1% was expected.

- Retail sales fell unexpectedly by 0.1% mom in April on lower spending at food and electronics stores. The market forecast a 0.7% increase. However, Statistics Canada revised March's mom gain to 0.9% from the previous 0.7% increase.

- The CAD weakened against the USD on Friday, hurt by data that showed an unexpected fall in retail sales. The disappointing retail sales figures overshadowed slight uptick in Canada's annual inflation rate for May.

- Retail sales data together with some of the other data that we have seen this month (manufacturing sales, goods trade data) show that growth outlook for the beginning of the second quarter is not too optimistic. However, improving economic figures from the USA and rising oil prices should support the economic outlook for Canada and strengthen the loonie in the medium term. We have gone USD/CAD short at 1.2270.

Significant technical analysis' levels:

Resistance: 1.2294 (high Jun 19), 1.2333 (high Jun 17), 1.2345 (high Jun 16)

Support: 1.2127 (low Jun 18), 1.2072 (76.4% fibo of 1.1920-1.2563), 1.1982 (low May 15)

Source: Growth Aces Forex Trading Strategies