Today is pivotal for the USD – either it pivots on the Fed meeting or we could see another dose of selling. By comparison, the actual QE2 announcement was certainly pivotal in the short-term for all markets. This time around, the situation for the EUR/USD is not as clear as it is for the USD in a more isolated sense, particularly vs. riskier currencies. That’s because we’re in the middle (?) of a massive short euro positioning unwind. In fact, the positioning picture suggests the biggest volatility risks may be in the commodity currencies versus the euro at the moment as much or more than in the USD.

Executive summary

On the EU side of the equation: at the time of the QE2 announcement, the EU systemic risk trade was re-accelerating after first big attempts by EU to put a lid on it in the early summer. EUR/USD had bottomed at 1.18 in May and was all the way up to 1.40 when QE2 was confirmed (after trading at 1.26 in late August, when Jackson Hole hints were made).

The setup is much more euro positive now from an EU tail risk perspective than it was then (though questions in the longer run pipeline certainly abound and could crop up at any time). Positioning-wise for the euro, the setup is vastly more euro positive this time around as there are still large stale euro shorts out there.

For the USD more broadly, the positioning picture is far more USD positive than it was then (outside of EUR/USD), mostly versus the commodity currencies. So overall positioning is clear cut for the euro, a bit mixed for the USD depending on the currency. This means that the likes of EUR/AUD and EUR/CAD are at the biggest risk of a positioning squeeze if the euro strength continues, even more so than EUR/USD.

Meanwhile, back then, the USD was extremely weak from the time of Jackson Hole hint on August 27 to the actual QE2 announcement on November 3, but strengthened for a few weeks after that November announcement, particularly as the EU systemic risk came back into focus.

What might happen after tomorrow

For the USD, the key here is whether risk continues the leg up on the back of whatever the Fed has to offer or if the market has more thoroughly front-run the risk implications of the coming QE3. For the euro, the strength may be somewhat independent of what the USD is doing due to a possible continued unwind of EU tail risk trades. So two possible scenarios are: strong euro, weak USD if risk appetite continues higher and strong euro, even stronger USD if risk appetite fades.

Maximum FOMC dovishness: As not everyone is expecting QE3 to go full throttle today, but possibly only hinted at, we may get another small burst of USD weakening after this meeting if the Fed delivers something up front today, but risk appetite is so stretched that we relatively quickly transition to consolidation. EUR/USD could stretch all the way to 1.33-1.34 in a continued blowout euro covering scenario if this proves the case.

Less FOMC dovishness: If the markets/risk appetite are disappointed, the biggest moves will likely be in the commodity currencies, possibly versus the euro, and the likes of a EUR/CAD and EUR/AUD could see another massive squeeze higher. In this scenario, the EUR/USD rally would peter out far more quickly, perhaps nearer 1.30. Commodity currency downside could be most precipitous in this scenario.

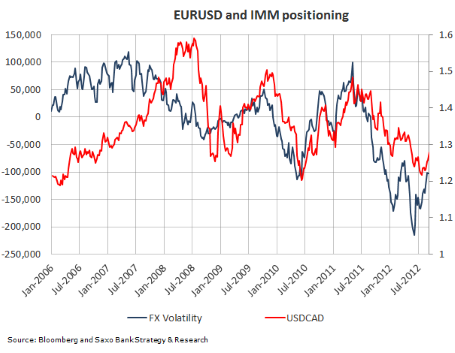

Chart: EUR/USD vs. net IMM futures positioning.

We can imagine that the last 300+ pips of EUR/USD appreciation since the last IMM snapshot has seen a considerable further reduction of shorts, but the overall net positioning is still very large by pre-2012 standards. So from a positioning perspective, this thing could continue to blow higher – well above 1.300 and possibly to the 1.33 to 1.34 range if we have a risk positive outcome, with more sideways to eventually downside and a slower position reduction if market risk appetite quickly sours. EUR/USD_1" title="EUR/USD_1" width="455" height="353">

EUR/USD_1" title="EUR/USD_1" width="455" height="353">

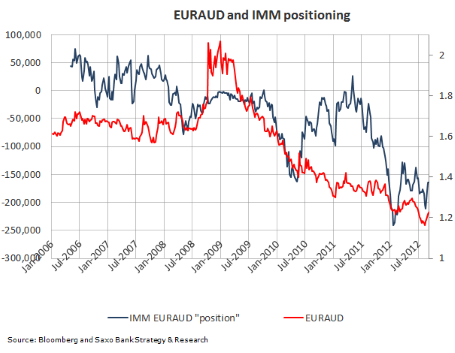

Chart: EUR/AUD vs. synthetic IMM positioning

Note the new EUR/AUD “positioning” (net EUR/USD position less AUD/USD net position) price lows of late came with less positioning conviction – interesting divergence and interesting from a “pain trade” or “squeeze” perspective.

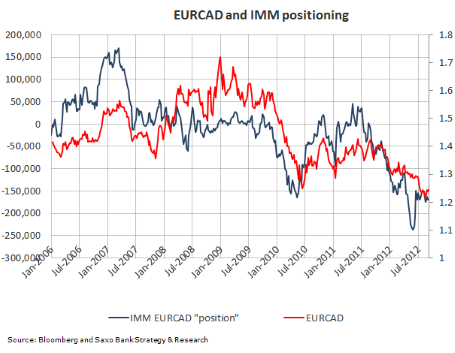

Chart: EUR/CAD vs. synthetic IMM positioning

Very similar to the setup for EUR/AUD, except that CAD has been even stronger of late and the USD/CAD positioning in the IMM is extreme, as I pointed out recently. EUR/CAD" title="EUR/CAD" width="455" height="353">

EUR/CAD" title="EUR/CAD" width="455" height="353">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/USD: Is Current Pre-QE3 Setup The Same As For QE2?

Published 09/13/2012, 03:19 AM

Updated 03/19/2019, 04:00 AM

EUR/USD: Is Current Pre-QE3 Setup The Same As For QE2?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.