GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.0935, target 1.1140, stop-loss moved to 1.0935, risk factor **

USD/JPY: short at 124.15, target 122.20, stop-loss 125.10, risk factor **

USD/CAD: short at 1.2490, target 1.2250, stop-loss 1.2590, risk factor **

AUD/USD: long at 0.7655, target 0.7900, stop-loss 0.7555, risk factor **

NZD/USD: long at 0.7160, target 0.7350, stop-loss 0.7060, risk factor ***

EUR/GBP: long at 0.7140, target 0.7280, stop-loss moved to 0.7195, risk factor ***

EUR/JPY: long at 135.20, target 138.00, stop-loss moved to 137.20, risk factor ***

EUR/CHF: long at 1.0320, target 1.0510, stop-loss 1.0225, risk factor **

CHF/JPY: long at 131.10, target 133.70, stop-loss moved to 132.10, risk factor **

Pending Orders:

EUR/CAD: buy at 1.3620, if filled - target 1.3870, stop-loss 1.3560, risk factor **

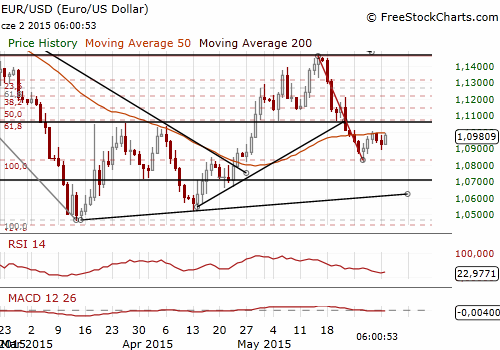

EUR/USD: Inflation Data Bring Good News For Our Long Position

(long for 1.1140)

- Eurostat said consumer prices in the Eurozone rose 0.3% yoy last month after a flat reading in April, beating market expectations of a 0.2% yoy increase. Excluding the volatile energy prices, which were 5% lower yoy in May, consumer prices rose 1.0% yoy. Excluding energy and unprocessed food, or what the European Central Bank calls core inflation, prices were up 0.9% yoy, accelerating from 0.7% yoy in April.

- Prices at factory gates in April, however, fell 0.1% mom for a 2.2% yoy decline, weaker than market expectations of a 0.1% mom rise and a 2.0% yoy fall.

- Prime Minister Alexis Tsipras said Greece has sent creditors a comprehensive and realistic package of reforms for consideration and is calling on Europe's leaders to accept it so a long-awaited deal can be struck. Sources close to the talks said the latest proposal did not contain major new concessions on issues holding up a deal, such as pension and labour issues.

- Boston Fed President Eric Rosengren (non-voter, dove) said the Federal Reserve is in no position to start raising interest rates with little evidence the U.S. economy is rebounding after a very weak first quarter. He is, together with FRB Chicago's Evans and FRB Minneapolis's Kocherlakota, among the most dovish of FOMC participants, though currently only Evans has a vote on the Committee.

- The EUR/USD reached today’s high at 1.1040 after Eurozone inflation numbers. We stay long for 1.1140. The next important resistance level is 1.1062 (low May 20). A close above this level will open the way to our target.

- We are also closer to our targets on EUR-crosses positions: EUR/GBP and EUR/JPY, so using trailing stop-loss could be a good idea in these cases.

Significant technical analysis' levels:

Resistance: 1.1062 (low May 20), 1.1067 (38.2% fibo 1.1468-1.0819), 1.1084 (100-dma)

Support: 1.0915 (session low Jun 2), 1.0887 (low Jun 1), 1.0867 (low May 28)

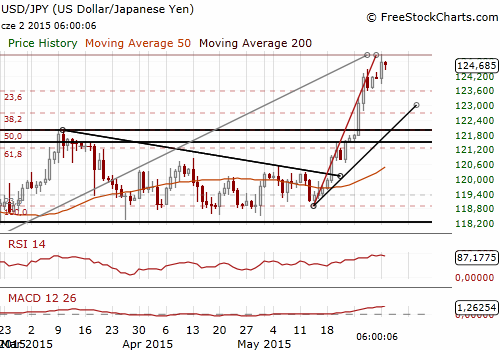

USD/JPY: Mission 125 Accomplished. Time For A Correction?

(short for 122.20)

- The USD/JPY broke above the psychological level of 125.00 today, for the first time since late 2002.

- Bank of Japan Governor Haruhiko Kuroda said it was important for currency rates to reflect economic fundamentals, and reiterated that central bank policy is aimed at fostering price stability and not to weaken the yen. Finance Minister Taro Aso was equally said only that he would watch forex moves carefully.

- Japanese Economics Minister Akira Amari said on Tuesday he is cautious about declaring an end to deflation because policymakers need to be sure the economy is strong enough to prevent a return to deflation. Amari also said capital expenditure is picking up, but there are still some concerns about consumer spending.

- Our USD/JPY short survived today’s jump, but is still under threat. The stop-loss level is situated just above today’s new multi-year high. We should also draw another strong support line on the way to the target – a 28.2% fibo of 118.89-125.07 rise.

- A corrective move is likely now. A mission to reach 125 target is accomplished and new fresh factors are needed for further gains. In our opinion many player may hesitate whether to buy again at elevated levels. That is why, we stay short despite recent bullish bias.

Significant technical analysis' levels:

Resistance: 125.07 (high Jun 2), 125.55 (high Dec 6, 2002), 125.73 (high Dec 5, 2002)

Support: 124.42 (session low Jun 2), 123.86 (low Jun 1), 123.61 (38.2% fibo 118.89-125.07)

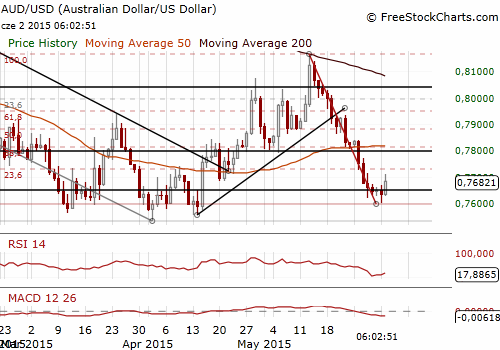

AUD/USD: No Easing Bias In RBA Statement

(long for 0.7900)

- Australia's central bank left interest rates steady, a month after cutting them to all-time lows. The decision was in line with our expectations.

- The Reserve Bank of Australia did not include an explicit bias to ease again, though it did pledge to weigh policy with an eye to coming economic news. The statement suggests that the RBA is in “wait and see” mode. We do not expect further monetary easing this year. We are looking for rate hikes in 2016.

- The RBA said: “The Australian dollar has declined noticeably against a rising US dollar over the past year, though less so against a basket of currencies. Further depreciation seems both likely and necessary, particularly given the significant declines in key commodity prices.”

- The AUD/USD jumped today after the RBA refrained from providing an easing bias that some in the market were looking for. The RBA statement supported our AUD/USD long position.

Significant technical analysis' levels:

Resistance: 0.7761 (high May 28), 0.7768 (high May 27), 0.7839 (high May 26)

Support: 0.7605 (session low Jun 2), 0.7598 (low Jun 1), 0.7572 (low Apr 15)

Source: Growth Aces Forex Trading Strategies