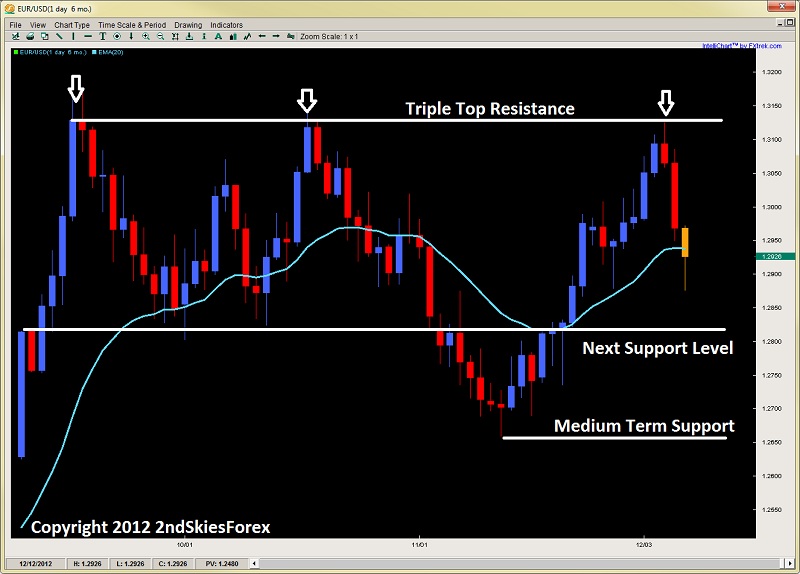

Selling off for the last three days, the euro gave back the prior 5 day’s worth of gains via impulsive price action selling. This was likely a combination of strong profit taking from the prior 450 pip bull run, along with sellers waiting at the 1.3129 triple top resistance area. Short-term, the sellers are still in control, so downside levels to watch for possible price action signals are 1.2800 and 1.2659. EUR/USD 1" title="EUR/USD 1" width="650" height="447">

EUR/USD 1" title="EUR/USD 1" width="650" height="447">

NZD/USD

Showing a fair amount of strength and resilience, the kiwi has climbed 4 of the last 5 days, and has also hit a key triple top level at .8350. Intraday the pair rejected off the level on Thursday (mildly) which was followed by an inside bar to close the week. This could very well be a trend continuation signal before a breakout, so trades should be alert here. Sellers can use this level with tight stops above, but buyers may get a breakout pullback setup should it clear the air above .8350, so it plays on both sides here. Any selling and rejection at this level should push the pair back down to .8250-ish. NZD/USD" title="NZD/USD" width="650" height="447">

NZD/USD" title="NZD/USD" width="650" height="447">

Silver

The last three days for Silver last week were quite interesting as the pair formed an inside bar (which followed a doji), along with another inside bar, so an ii pattern. Intraday price action traders clearly have their battle lines drawn with intraday support a hair above $32.50 while bulls have their short-term resistance at $33.25. Also along the resistance level stated is the daily 20ema which could also be hampering the upside short-term.

This short-term range is likely to clear this week, so watch for a break on either side for clues. Downside support levels are $32, $31.50 and $30.65 while upside resistance comes in at $34.30 and $35. It should be noted if the Fed is likely to signal more QE this Wednesday, then we could see accumulation ahead of the announcement in the precious metal.

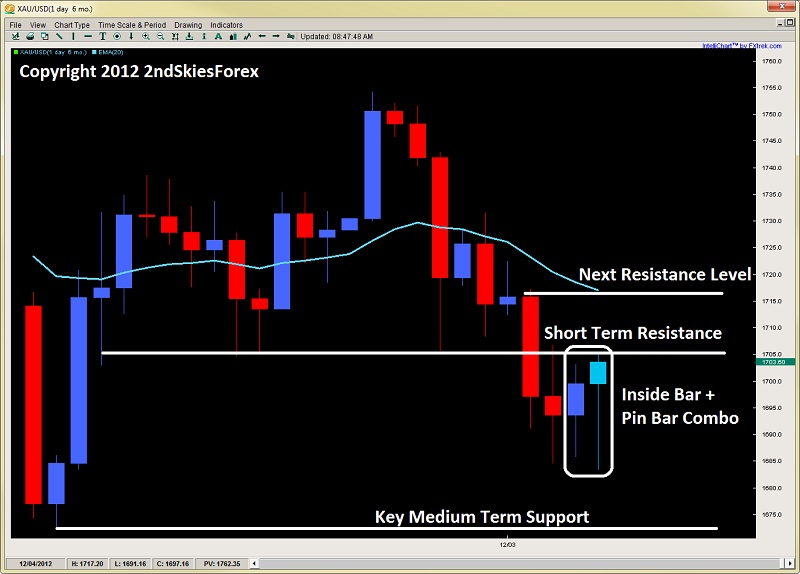

Gold

Holding its own worse than Silver, Gold had sold off 6 of 8 days prior to finding support at the $1685 level. This level has now held three times intraday, forming an inside bar on Thursday and following it up with a pin bar setup on Friday, suggesting intraday buyers coming in at this level. The precious metal has short-term resistance just above at $1705, but should it clear this, $1715 and the daily 20ema are up next. Should $1685 fail, then a key support at $1673 is up next.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/USD: Impulsive Price Action Selling

Published 12/10/2012, 02:58 AM

Updated 05/14/2017, 06:45 AM

EUR/USD: Impulsive Price Action Selling

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.