GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.1245, target 1.1495, stop-loss 1.1145, risk factor **

GBP/USD: long at 1.5500, target 1.5750, stop-loss moved to 1.5730, risk factor **

USD/JPY: short at 123.50, target 120.65, stop-loss 124.75, risk factor *

USD/CAD: short at 1.2300, target 1.2100, stop-loss 1.2400, risk factor **

AUD/USD: long at 0.7740, target 0.7990, stop-loss 0.7660, risk factor **

NZD/USD: long at 0.7000, target 0.7250, stop-loss 0.6910, risk factor ***

EUR/CHF: long at 1.0440, target 1.0680, stop-loss 1.0380, risk factor *

AUD/JPY: long at 95.00, target 97.50, stop-loss 94.00, risk factor ***

Pending Orders

EUR/GBP: buy at 0.7150, target 0.7400, stop-loss 0.7080, risk factor ***

EUR/JPY: buy at 138.50, target 141.30, stop-loss 137.50, risk factor ***

EUR/CAD: buy at 1.3830, target 1.4100, stop-loss 1.3750, risk factor **

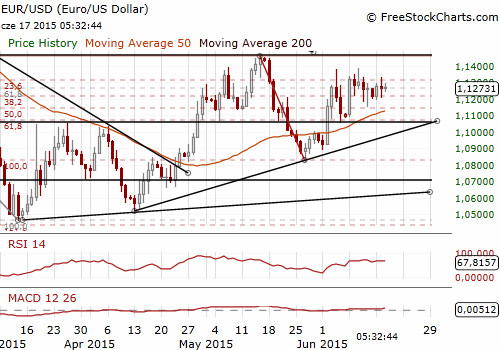

EUR/USD: Greek Soap Opera In The Shadow Of FOMC

(long for 1.1495)

- Athens showed no sign of backing off in its tense negotiations with creditors as Prime Minister Alexis Tsipras accused them of trying to “humiliate” Greeks with more cuts. His comments suggested he has no intention of making a last-minute turn and accepting austerity cuts needed to unlock frozen aid and avoid a debt default within two weeks.

- However, it is very hard to assess how the situation really looks like. In our opinion Greece and its creditors still may reach a compromise at the last minute. Greek government first want to create an atmosphere of bankruptcy threat in its own country. In such a situation if Greek politicians finally capitulate and agree to the conditions imposed by creditors, the government will be still credible for its electorate. On the other hand, the creditors also do not want Greece to leave the Eurozone. In our view we are getting closer to an agreement, although both sides do not want to admit it.

- Ifo institute has revised up its expectations for growth in Germany due to strong private consumption supported by record-low unemployment. The institute expects German economy to expand by 1.9% this year from a previous forecast of 1.5% in December. Ifo expects growth of 1.8% in 2016.

- Eurostat confirmed earlier estimates of HICP inflation in the Eurozone at 0.3% yoy in May. Core inflation amounted to 0.9% yoy.

- The Fed statement is due at 18:00 GMT, followed half an hour later by Chair Janet Yellen's news conference. There will be particular attention on the Fed's median forecast for the funds rate over 2015 which could be trimmed from the previous 0.625%. We expect also lowering Fed GDP growth forecasts.

- The EUR/USD was volatile yesterday on Greece jitters, but we expect the EUR/USD to be stronger today as the market is focusing mainly on the FOMC statement now. Lower Fed interest rate and GDP forecasts should support our EUR/USD long.

Significant technical analysis' levels:

Resistance: 1.1329 (high Jun 16), 1.1335 (high Jun 11), 1.1387 (high Jun 10)

Support: 1.1189 (low Jun 15), 1.1151 (low Jun 12), 1.1083 (low Jun 8)

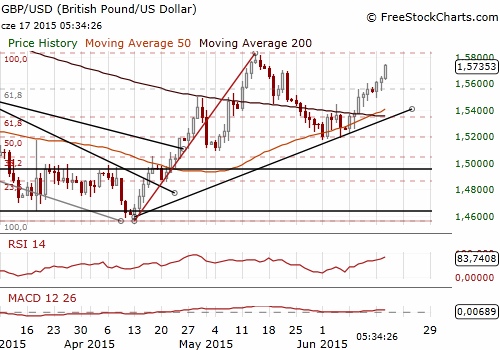

GBP/USD: Long In Good Shape

(long for 1.5750)

- The Office for National Statistics said Britain's unemployment rate held stable at 5.5%, holding at its lowest level since 2008, in line with our expectations. The number of people in employment rose by 114k in the three months to April.

- Total average weekly earnings in the three months to April, including bonuses, rose by 2.7% yoy, speeding up from 2.3% yoy growth in the three months to March. Average weekly earnings, excluding bonuses, went up 2.7% yoy vs. 2.3% in the three months to March and median forecast for 2.5% growth. The reading was even better than our prediction of 2.6% yoy.

- In April alone pay, including bonuses, rose by 2.6% yoy, compared with a revised increase of 4.4% yoy in March, a five-year high for that measure. Excluding bonuses, pay rose by 2.9% yoy in the month of April.

- Wednesday's minutes of the BoE Monetary Policy Committee's meeting ending June 3 showed all nine members voted to hold interest rates at 0.5%, although as in previous months, two members described their decision as “finely balanced”. MPC members noted that headwinds to global growth had started to ease, meaning that some countries would likely start to normalise monetary policy. Last week MPC member Ian McCafferty (hawkish) said the time for raising interest rates was getting closer, and economic data over the next few months would help determine exactly when that will be.

- The GBP rose to a one-month high against the USD, after data showed wages in Britain growing at faster than expected. Our long GBP/USD is close to its target of 1.5750.

Significant technical analysis' levels:

Resistance: 1.5745 (high May 18), 1.5809 (high May 15), 1.5815 (high May 14)

Support: 1.5542 (low Jun 16), 1.5488 (low Jun 15), 1.5468 (low Jun 12)

Source: Growth Aces Forex Trading Strategies