GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.0935, target 1.1140, stop-loss 1.0860, risk factor **

GBP/USD: long at 1.5305, target 1.5600, stop-loss 1.5190, risk factor **

USD/JPY: short at 124.15, target 122.20, stop-loss 125.10, risk factor **

USD/CAD: short at 1.2490, target 1.2250, stop-loss 1.2590, risk factor **

AUD/USD: long at 0.7655, target 0.7900, stop-loss 0.7555, risk factor **

NZD/USD: long at 0.7160, target 0.7350, stop-loss 0.7060, risk factor ***

EUR/GBP: long at 0.7140, target 0.7280, stop-loss 0.7090, risk factor ***

EUR/JPY: long at 135.20, target 138.00, stop-loss 134.40, risk factor ***

EUR/CHF: long at 1.0320, target 1.0510, stop-loss 1.0225, risk factor **

CHF/JPY: long at 131.10, target 133.70, stop-loss 130.40, risk factor **

Pending Orders:

EUR/CAD: buy at 1.3570, if filled - target 1.3800, stop-loss 1.3480, risk factor **

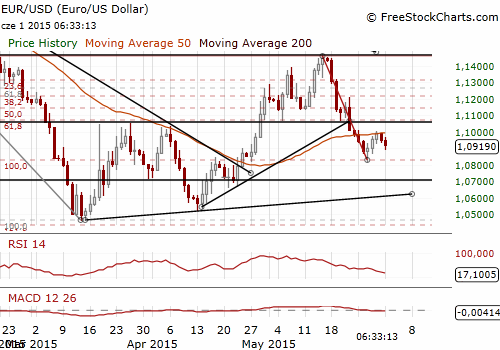

EUR/USD: Greece Deal Still Possible This Week

(long for 1.1140)

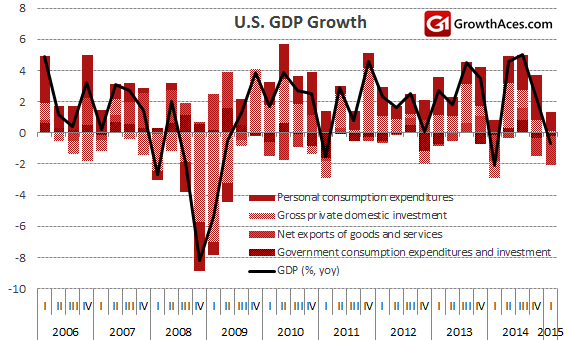

- The US government slashed its GDP estimate to show GDP shrinking at a 0.7% annual rate instead of the 0.2% growth pace it estimated last month. A larger trade deficit and a smaller accumulation of inventories by businesses than previously thought accounted for much of the downward revision. There was also a modest downward revision to consumer spending.

- Trade was hit both by the strong USD and the ports labor dispute, which weighed on exports through the quarter and then unleashed a flood of imports in March after it was resolved. A trade deficit that subtracted 1.90 percentage points from GDP, the largest drag in 31 years, instead of the 1.25 percentage points reported last month.

- Greece and its European creditors agreed on the need to reach a cash-for-reforms deal quickly as Athens missed a self-imposed Sunday deadline for reaching an agreement to unlock aid. The pressure has intensified in recent days, as Athens faces a payment to the International Monetary Fund on June 5, as well as the expiration of its bailout programme on June 30.

- Greek Prime Minister Alexis Tsipras said the Greek government had been ready to make compromises, for instance on privatizations, despite its ideological opposition to them. Labour and pension reforms are believed to be among the big sticking points with Athens.

- Germany's EU Commissioner Guenter Oettinger said on Monday it might still be possible for Greece and its creditors to reach a deal this week. Oettinger, however, downplayed expectations of any breakthrough at a meeting between German Chancellor Angela Merkel, French President Francois Hollande and EU President Jean-Claude Juncker in Berlin on Monday. Oettinger said the talks had moved forward when it came to reforms such as value-added tax, but said differences on central topics such as the labour market and the pension system were still too big.

- The final seasonally adjusted Eurozone manufacturing PMI posted 52.2, matching March’s ten-month high but coming in just below the earlier flash estimate of 52.3. New business and new export orders both rose at the fastest rates in just over a year. The improved level of demand encouraged firms to take on additional staff, leading employment to rise for the ninth month running. Cost pressures remained on the upside in May, as input prices rose for the third month running and to the greatest extent since April 2012.

- The PMI data point to a quarterly rate of industrial growth of approximately 0.5%. This should help drive GDP higher in the second quarter, perhaps matching the 0.4% rise seen in the first three months of the year.

- The EUR tumbled today after Greece missed a self-imposed Sunday deadline for reaching an agreement with its lenders to unlock aid, keeping alive fears of a debt default and potential exit from the Eurozone. Investors have largely shrugged off data showing the US economy contracted in the first quarter. We do not change our EUR/USD long position. There are some important resistance layers between 1.0990/1.1014. Breaking above these levels would open the way for stronger gains.

Significant technical analysis' levels:

Resistance: 1.0990 (session high Jun 1), 1.1002 (10-dma), 1.1006 (high May 29)

Support: 1.0867 (low May 28), 1.0819 (low May 27), 1.0785 (low Apr 24)

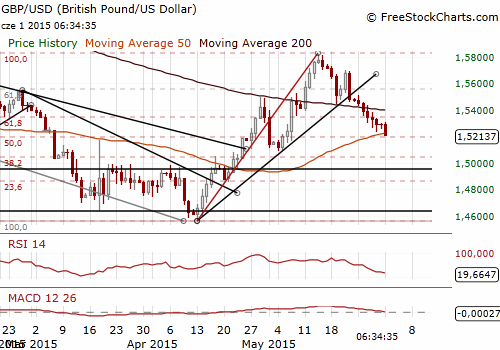

GBP/USD Hits 3-Week Low On Weaker PMI Data

(long at 1.5305)

- British manufacturing PMI rose to 52.0 in May from a downwardly revised 51.8 in April, but that was lower than the market consensus of 52.5. May saw a further increase in incoming new business, with the rate of growth in new orders picking up slightly from April’s seven-month low.

- The data show that the trend in new business from overseas remained lacklustre compared to conditions in the domestic market. This was highlighted by the level of new export business holding stable in May, following a modest decrease during the prior month. The exchange rate and soft global market conditions were again cited by companies as factors contributing to the decrease in new work from abroad.

- Average selling prices in the manufacturing sector rose for the first time in five months during May, mainly due to solid increases at both consumer and investment goods producers. Factory gate prices were broadly unchanged in the intermediate goods sector.

- The GBP/USD fell to its lowest since last month's UK general election, after British manufacturing activity for May missed forecasts. Our long position is under threat. The stop-loss is near 50% fibo of 1.4567-1.5815 rise.

Significant technical analysis' levels:

Resistance: 1.5305 (session high Jun 1), 1.5343 (high May 29), 1.5400 (psychological level)

Support: 1.5191 (50% fibo of 1.4567-1.5815), 1.5167 (100-dma), 1.5150 (low May 6)

Source: Growth Aces Forex Trading Strategies