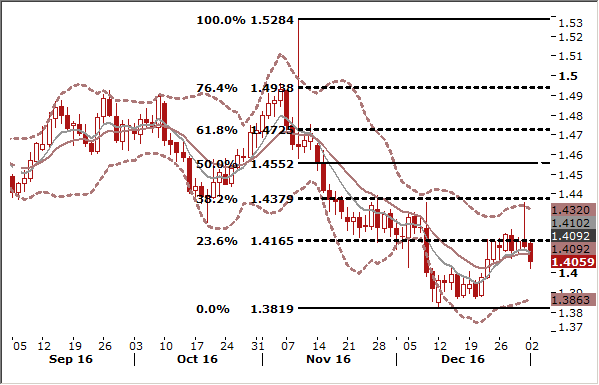

EUR/USD: Friday’s jump triggered sell order at 1.0590

- The EUR/USD climbed to 1.0651 on Friday, but retreated immediately near 1.0500 . We used this jump to get short at 1.0590, in line with our trading idea. The shift came in the period at the start of the Asian day when markets were at their thinnest and the bulk of liquidity available tends to come from the automated computer programmes run by banks and other major houses.

- Further gains for the dollar are one of the big consensus plays for investors going into 2017. The market has taken the view recently that Donald Trump’s promised policies, such as sizeable fiscal stimulus will be a boon for the dollar.

- Fundamentally, our problem with this line of reasoning is as follows - the US economy is currently operating at near full capacity, which implies that substantial fiscal stimulus (lacking the ingredients to improve productivity) is likely to compress US real rates further via higher inflation. In fact, over the past 40 years or so, material fiscal expansions (more than 1.5% of GDP on an annual basis) when the economy’s output gap was similar to what it is now (between 0% and -2%) have been broadly associated with lower real rates and meaningful USD depreciation over the subsequent year.

- However, it is an undisputable truth that markets have become very excited in bidding the USD higher. The price momentum has grown so swiftly and strongly that being bearish the USD feels like standing in front of a runaway train. Technically, the trade-weighted index is now hovering around multiyear highs and a convincing break above these levels would only add fuel to the fire.

- We lowered the stop-loss on our short EUR/USD to the entry level (1.0590). The EUR/USD may be under pressure in the short term. But there is a risk of recovery in the medium term, as we expect a rapid rise in Eurozone inflation and this may inspire discussion on ECB tapering.

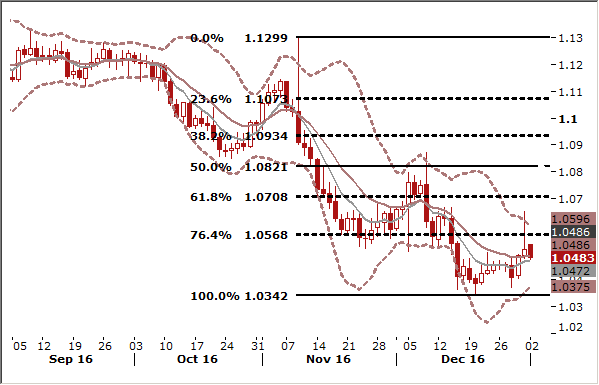

EUR/CAD: Long-term short opened at 1.4300

- The Canadian dollar strengthened against a weaker greenback on Friday in thin pre-holiday market trading. The EUR/CAD jumped temporary above 1.4300, which triggered our long-term short position. Our long-term target for this pair is 1.3600.

- We think that commodity currencies seem to be better placed to outperform peers (appreciating strongly in a lower USD scenario or experiencing limited downside in a stronger USD environment).

- We expect the CAD to be the main beneficiary of the rise in oil prices. The CAD’s outperformance of its commodity FX peers since the OPEC agreement to cut production in the first half of December suggests that the market is gradually aligning itself with our constructive view of the currency. Canadian employment dynamics have improved significantly since oil production returned in the second half of 2016. In due time, this should be reflected in higher inflation, which is not far from target anyway. Following that, markets are likely to start bringing forward the timing of rate hikes. Our CAD outlook for 2017 is bullish.