GROWTHACES.COM Forex Trading Strategies

Taken Positions

GBP/USD: short at 1.5680, target 1.5530, stop-loss 1.5755, risk factor ***

EUR/CHF: long at 1.0780, target 1.1170, stop-loss 1.0640, risk factor *

AUD/NZD: long at 1.1170, target 1.1440, stop-loss 1.1050, risk factor **

EUR/USD: Fed Minutes In The Spotlight

- Investors are waiting for US inflation data (12:30 GMT). Our US CPI forecast is in line with market consensus, which is 0.2% yoy for CPI and 1.8% yoy for core inflation. Traders are also eyeing minutes from the Federal Reserve (14:00 GMT) that could signal whether the central bank is on track to raise interest rates next month.

Significant technical analysis' levels:

Resistance: 1.1091 (55-dma), 1.1094 (high Aug 18), 1.1125 (high Aug 17)

Support: 1.1017 (low Aug 18), 1.1010 (21-dma), 1.0988 (61.8% of 1.0847-1.1215)

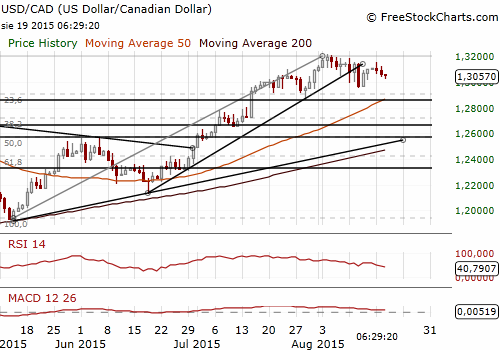

USD/CAD: Short-Term Outlook Still Bullish

(buy at 1.3015)

- The loonie appreciated against its US counterpart on rising oil prices yesterday. The price of oil, a major Canadian export, stayed near six-and-a-half-year lows but settled up 1.8% above USD 42 a barrel.

- The Fed minutes will be the most important event today for the USD/CAD. CAD traders are also awaiting Canadian inflation and retail sales data due on Friday. We expect Canadian CPI inflation to rise in July to 1.4% yoy from 1.0% yoy in June and core inflation to go up to 2.4% yoy from 2.3% yoy previously. Our Canadian CPI forecast is in line with expectations. We have slightly higher-than-market-consensus forecast of retail sales.

- In our opinion the short-term USD/CAD outlook remains bullish. However, the CAD has quite strong potential to appreciate later this year because of relatively high inflation measures. This potential may be increased by a recovery in oil prices, that are strongly correlated with the loonie.

- We keep our buy order at 1.3015,which is only slightly below today’s low at 1.3024. If the order is filled the target will be 1.3180, just below double high on August 10 and August 7. There are two important technical support levels ahead of us: 23.6% fibo of 1.1920-1.3213 rise at 1.2908 and 23.6% fibo of 1.2127-1.3213 rise at 1.2957. This second level is additionally strengthened by 1.2952 low on August 2. We would place our stop-loss below this barrier, at 1.2925.

Significant technical analysis' levels:

Resistance: 1.3152 (high Aug 17), 1.3158 (high Aug 12), 1.3182 (high Aug 10)

Support: 1.3024 (session low Aug 19), 1.3017 (low Aug 14), 1.2952 (low Aug 12)

Source: Growth Aces Forex Trading Strategies