EUR/USD continues to struggle, as the pair tries to stay above the 1.32 line in Friday trading. The euro has shed about two cents since Wednesday, when the US Federal Reserve announced that it plans to taper the current QE program sometime in 2013. There was plenty of activity on Thursday, as both the Eurozone and US released key events, with mixed results. Friday’s sole fundamental release came from the Eurozone, as the Current Account surpassed expectations.

The currency markets have been buzzing since Federal chair Bernard Bernanke signaled that QE would likely be scaled down in 2013, and could be terminated in 2014, if growth and employment numbers continue to improve. The Fed said it expects the U.S. economy to grow between 2.3% and 2.6% this year, and unemployment should fall to between 6.5% and 6.8% by the end of 2014. It should be remembered that the Federal Reserve is not making any changes at present to QE, which involves bond purchases of $85 billion each month by the Fed. Bernanke’s comments boosted the dollar against the major currencies, as winding up QE is dollar-positive. The euro has dropped sharply this week in response to the Fed’s comments about QE.

The markets were busy on Thursday, with plenty of data supplied by the Eurozone and the US. In Europe, PMI releases were mostly positive, which points to increased economic activity in the Eurozone. However, there was a glaring weak spot as German Manufacturing PMI fell short of the estimate. This PMI has been below the 50 level since February, indicating contraction in the German manufacturing industry. The other German release also disappointed, as PPI declined by 0.3%, missing the estimate of 0.0%. In the US, Unemployment Claims disappointed, but there was better news from Existing Housing Sales and the Philly Fed Manufacturing Index, both of which beat expectations.

Earlier this week, ECB President Mario Draghi that he is open to “non-standard” monetary tools, and would consider their implementation if needed. Draghi recently said that the ECB could consider a negative deposit rate, and the euro lost ground as a result. Other non-standard measures include long-term lending operations and modifying collateral requirements. Draghi has managed to steer the Eurozone through the worst of the debt crisis, but the zone remains stuck in its longest recession since its creation in 1999. If the ECB does take action and introduces negative rates or other non-standard measures, we could see a sharp reaction from EUR/USD.

The Eurozone economy continues to be hampered by low inflation and high unemployment. Although Eurozone inflation did increase in May to 1.4%, this remains well below the ECB’s target of 2%. The ECB recently lowered interest rates to 0.50% in an attempt to raise inflation and increase economic activity. The labor market situation continues to look grim. Unemployment in the Eurozone has risen to 12%, and is much higher among younger Europeans and in southern countries such as Spain and Greece. The persistent unemployment crisis has led policymakers to declare that the Eurozone unity faces more danger from a social breakdown than from any market forces. With a severe recession affecting many member countries, both small and large, politicians and policymakers will have to find a way to reduce the severe growth and unemployment problems facing the Eurozone if it is to survive. EUR/USD" width="400" height="300">

EUR/USD" width="400" height="300">

EUR/USD June 21 at 8:40 GMT

EUR/USD 1.3224 H: 1.3254 L: 1.3199

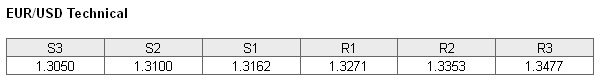

EUR/USD is trading slightly above the 1.32 line on Friday. The pair is facing resistance at 1.3271. Given the volatility we are seeing, this line cannot be considered safe. This is followed by a strong line at 1.3353. On the downside, 1.3162 continues to provide support. The next support level is at the round number of 1.3000.

- Current range: 1.3162 to 1.3271

- Below: 1.3162, 1.3100, 1.3050 and 1.3000

- Above: 1.3271, 1.3353, 1.3477, 1.3586, 1.3690 and 1.3793

The EUR/USD ratio has shifted directions from Thursday, and is pointing to movement towards short positions in Friday trading. Currently, the pair is not showing much movement, as it struggles to find its footing following sharp losses. Short positions continue to enjoy a substantial majority of the open positions, as many long positions have been covered this week as the euro took a dive.

The euro has had a busy week, and most of it has been negative, as the broadly stronger dollar has posted sharp gains. Friday has only one release, so we could see the pair settle down close to the 1.32 line and call it a week.

EUR/USD Fundamentals

- 8:00 Eurozone Current Account. Estimate 15.1B. Actual 19.5B.

- All Day ECOFIN Meetings.