After showing some volatility, EUR/USD has kicked off Monday trading on a quiet note. The pair has continued where it left off on Friday, trading in the mid-1.29 range. The week ended on a high positive note, as US and German numbers beat their estimates. In Germany, Consumer Climate posted a multi-year high, and the Ifo Business Climate easily beat the forecast. In the US, Core Durable Goods Orders bounced back after a decline and recorded a respectable gain. On Monday, we can expect thin volume, as the US markets are closed for Memorial Day, and there are no releases out of the Eurozone.

There is a lot of truth to the motto “as goes Germany, so does Europe” when it comes to economic developments. After some lukewarm PMI data out of Germany last week, there was better news on Friday. German Consumer Climate had its best showing since 2007, and IFO Business Climate rose as well. German GDP showed improvement in Q4, posting a modest 0.1% gain. We’ll get a better picture of the direction of the Eurozone’s largest economy, as Germany releases CPI, Unemployment Change and Retail Sales. Eurozone releases continue to struggle, which is weighing on the euro.

Almost overshadowed by Bernanke’s testimony to a Congressional committee last week was the release of the minutes from the FOMC’s last policy meeting. The minutes indicate that the US recovery will have to gain more traction before the Fed winds down QE. Policy members were split, as some suggested scaling back QE in June (at the next policy meeting), while others wanted to increase QE, given the weak inflation readings we are seeing. Meantime, the Fed is maintaining the current round of QE, which entails asset purchases of $85 billion each month.

The markets are accustomed to ups and downs in US numbers, which has typified US releases in 2013. Last week saw mixed housing numbers, as Existing Home Sales missed the estimate, but New Home Sales looked very sharp. Unemployment Claims bounce back with a strong release, and the week ended with a rise in Core Durable Goods Orders. What is the bottom line? The Fed must be wondering the same thing, and has maintained course with the current round of QE. The markets will need more convincing that the US recovery is gaining steam, and we’ll get a snapshot of the mood of the US Consumer on Tuesday, when the US releases CB Consumer Confidence.

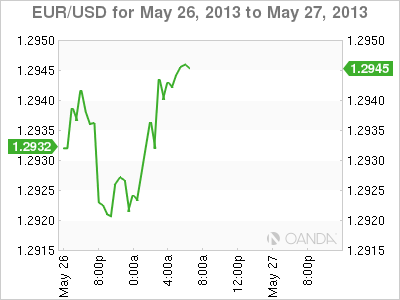

EUR/USD May 27 at 11:00 GMT

EUR/USD 1.2947 H: 1.2949 L: 1.2915 EUR/USD Technical" title="EUR/USD Technical" width="601" height="82">

EUR/USD Technical" title="EUR/USD Technical" width="601" height="82">

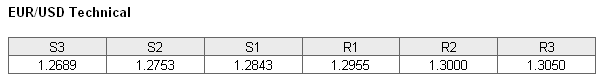

EUR/USD is quiet in thin trading on a US holiday. The pair is receiving support at the 1.2843 line on the downside. This line has strengthened as the pair trades at higher levels. The next support level is at 1.2753. On the upside, the pair is testing resistance at 1.2955. This line could see activity if the euro shows some upward movement. There is a stronger resistance at the round number of 1.3000.

- Current range: 1.2955 to 1.3000

Further levels in both directions:

- Below: 1.2843, 1.2753, 1.2689, 1.2589 and 1.2500

- Above: 1.2955, 1.3000, 1.3050, and 1.31

EUR/USD ratio has shown some movement towards short positions. We are not seeing this reflected in the pair, which is drifting in the mid 1.29 range in quiet trading. The ratio is very close to an even split between short and long positions, indicating a split in trader sentiment as what to expect from EUR/USD.

After a volatile week, the pair has started the week very quietly. With the markets is in the US closed for a holiday, we can expect a quiet day from the pair.

EUR/USD Fundamentals

- There are no releases out of the Eurozone or the US on Monday.