The euro has pushed above US$1.39 for the first time since March. The last time it was up at these heady levels was at the end of 2011. Traders looking for a pullback based on stimulus from the ECB could be in for a shock. The euro looks set to remain high.

A high euro is not an ideal situation for the european Central Bank. In fact, President Mario Draghi has said that a high euro could be the catalyst for more stimulus because it reduces inflation. With eurozone inflation sitting stubbornly low at 0.7% - according to the latest eurostat estimate, Draghi might be tempted to talk some more about stimulus when the ECB meets later on today. Any more serious talk will push the euro lower, but unless we see action, it will not be for long.

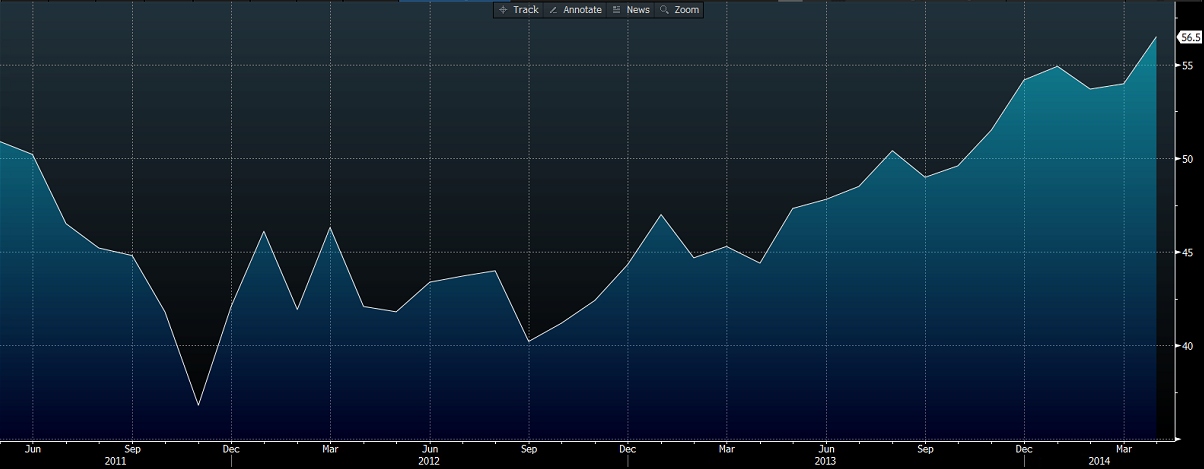

This week we saw some positive results coming out of some of the hardest hit euro member states. Spain in particular released some very encouraging results with the Unemployment rate dropping by 111,600 compared to a drop of 16,600 a month before. The Services PMI was up to 56.5 from 54.0 a month ago. This index bottomed out at 36.8 in December 2011 so things are starting to show a solid turnaround. Last week, Spain’s manufacturing sector delivered a PMI of 52.7, down fractionally from 52.8 a month earlier. Slightly disappointing, but above 50 indicates expansion, so it could be worse. Preliminary GDP met expectations of 0.4%, quarter on quarter growth are up from 0.2% from 3 months ago.

Spain Services PMI

Italy, another european member state to feel the worst of the euro crisis, reported its own Services PMI of 51.1, up from 49.5 a month ago. Italian manufacturing PMI beat market expectations at 54.0, up from 52.4, and unemployment looks to have peaked last month at 13.0%, coming down to 12.7% this month.

Germany, the powerhouse of the eurozone, looks to be slowing in its rate of growth, with services PMI dipping to 54.7 from 55.0 and manufacturing following suit, with 54.1 from 54.2 a month ago. These figures are nothing to stress over, however, as unemployment continues to fall and consumer confidence remains even.

On the whole, the outlook for the euro is certainly not as gloomy as it was a couple of months ago. If these PMI figures continue to show expansion, this will no doubt filter through to the rest of the economy and surely boost inflation towards the ECB’s 2.0% target. This might be a while off, but as long as the situation does not deteriorate, we should see the ECB hold off from stimulus and hence see a strong euro.