The U.S. dollar fell against the majority of its Forex trading peers despite speculation that the recent string of positive economic reports could convince the Federal Reserve to trim the monthly bond purchases further. It slumped against the Swiss Franc on announcements by the Swiss government suggesting that the banks will limit mortgage loans, and against the euro subsequent to the release of Manufacturing Output out of the E.U. The greenback traded to the downside on reports revealing that the Chicago Federal National Activity Index climbed a mere 0.16 in December, rather than the predicted 0.90. Other releases confirmed that the number of individuals who applied for Unemployment Benefits surged by 1,000 to 326,00 in the week that ended on January 18. Gold prices climbed as the U.S. dollar went down subsequent to the release of stellar economic reports from the euro region. Gold Futures for February delivery traded at $1,246.90 a troy ounce during the european market hours.

In the euro region, Germany reported a big expansion in Manufacturing activity, while the Composite Output Index for the entire zone hit a 31-month high. The updates on economic data bolstered risk appetite in the foreign currency exchange. The British Pound surged to a 2½ year high versus the greenback on speculation that the Bank of England may increase the interest rate earlier than anticipated as the economy continues to show signs of improvement. The Sterling slipped versus the euro after data out of the E.U. confirmed that Factory Production expanded at a quicker pace than predicted.

The yen climbed versus the U.S. dollar as the Asian Equities market posted losses subsequent to the release of lackluster metrics out of China. Risk appetite ebbed slightly after China announced that the HSBC Manufacturing Purchasing Manager’s Index dropped to a six-month low, suggesting that the world’s second biggest economy has lost momentum.

Lastly, the Australian dollar was impacted by a drop in Manufacturing Activity in China, and by news that the Nikkei reported a decline of 0.79 percent. The Aussie weakened against all of its most traded Forex counterparts as China is the nation’s main trading partner. The drop caused it to erase prior advances versus the greenback. The Aussie’s gains came about on Wednesday following news that inflation accelerated. According to the official announcement, the gauge on prices surged 2.6 percent in the last quarter of 2013. New Zealand’s dollar jumped versus the Aussie for the first time in almost one week after Prime Minister John Key stated that the economy may expand at a very quick pace in 2014.

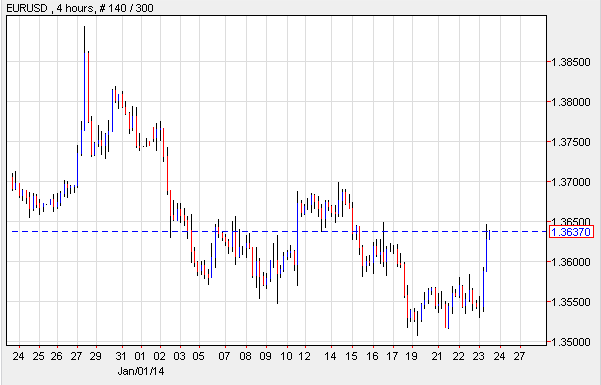

EUR/USD: Economic Reports Boost euro

The EUR/USD rallied and hit a one week-high as better than anticipated data out of the euro monetary bloc fueled risk appetite in the markets. For starters, the E.U.’s Purchasing Manager’s Index posted gains from 51.0 to 51.9 for January, denoting a four-month high. Markit also announced that the region’s Composite Output Index surged to a 31-month high, and read at 53.2 this month, after coming in at 52.1 in the last month of 2013. Lastly, Germany, which represents the E.U.’s biggest economy, met analysts’ expectations by announcing that Manufacturing Activity rose at the quickest rate since 2011. The PMI Climbed from 54.3 to 56.3. And Services PMI went up to 53.6, which was just a tad lower than the forecast. But not all the news was positive as Spain announced that its Rate of Unemployment climbed to 26.03 in the fourth quarter of 2013.

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

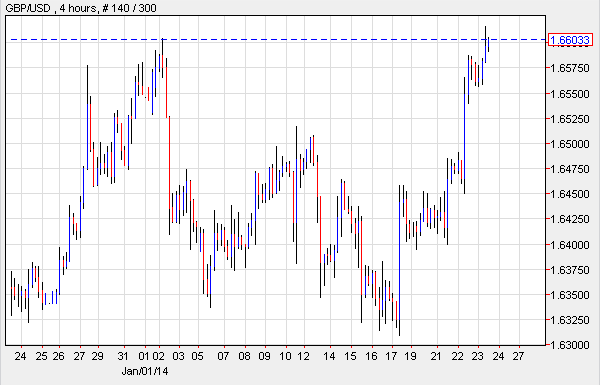

GBP/USD: Pound Fueled By BOE Speculation

The GBP/USD rose and reached a 2½ year high as investors predict that the recent line-up of positive economic releases may prompt the Bank of England to opt for increasing the benchmark interest rate sooner than planned. However, it is the consensus among a number of economists that the central bank may not raise the rates as soon as unemployment drops to 7 percent, as it will need to assess the economy as a whole. The central bank’s policy makers have suggested that production is still a matter of concern and that indicators are still making sluggish recovery. However, the bank anticipated that inflation would be contained. On the data front, the Confederation of British Industry said that Retail Sales slowed down in January and dipped from 34.0 to 14.0. The less than stellar reports failed to affect the GBP/USD, which instead climbed to a 29-month high.

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

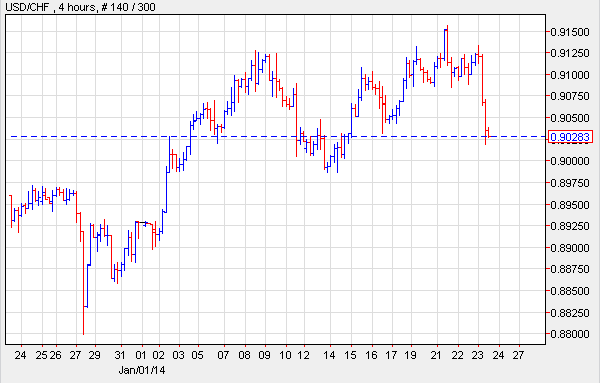

USD/CHF: New Limits On Mortgages

The USD/CHF slumped as the Swiss government upped the amount of money the financial institutions must retain in order to safeguard against defaults on home loans. The Franc gained versus the greenback as the government issued a small list of limitations which will go into effect at the end of June. Officials explained that the surge in home, prices together with the hike in mortgage loans have contributed to a major imbalance.

USD/CHF 4 Hour Chart" title="USD/CHF 4 Hour Chart" width="474" height="242">

USD/CHF 4 Hour Chart" title="USD/CHF 4 Hour Chart" width="474" height="242">

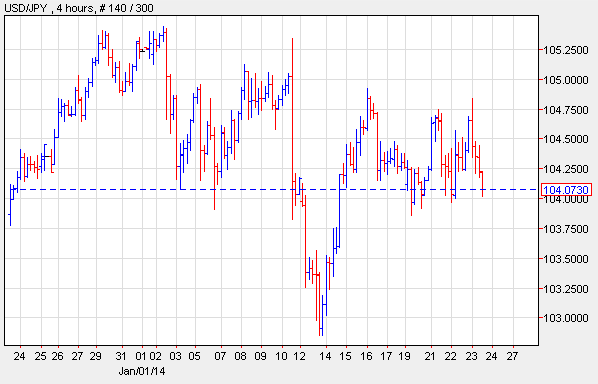

USD/JPY: Chinese Data Impacts Nikkei

The USD/JPY advanced as the Nikkei reported losses due to the release of disappointing metrics from China. The Bank of Japan concluded its two-day policy meeting, during which time policy makers decided to leave stimulus unchanged, as they believe the economy will continue improving at a steady pace. The central bank indicated that consumption has gone up, but analysts suggest this is due to the fact that sales taxes will be increased in April. The bank also announced that business and public investments rose. A few months ago, analysts predicted that the BOJ would increase monetary easing, however, many have since reduced speculation on such a hike.

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="474" height="242">

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="474" height="242">

Daily Outlook: Today’s economic calendar shows that the U.K. will report on BBA Mortgage Approvals. The euro region will issue data on Spanish PPI and Italian Retail Sales.