The U.S. dollar traded mixed, though demand for the greenback remained high as market traders anticipate that the Federal Reserve could make further cuts to monthly bond purchases during its next meeting. Traders remain cautious as bank officials expressed concerns over inflation. U.S. Core CPI posted a slight advance of 0.1 percent in December, while the index which measures Producer Prices posted a minor gain of 0.4 percent. Gold Prices went down to a one-week low on increased speculation that the Fed may taper stimulus further. Gold Futures for delivery in February traded at $1,239.80 a troy ounce on the Comex.

The euro got off to a rocky start, plunging versus the British Pound to a 12-month low while reaching an eight-week low against the greenback. However, the euro rebounded versus its U.S. peer later during the American trading session on speculation over further Fed tapering. In the euro region, deflationary concerns remain a major concern for the central bank. A slowdown in inflation may indicate that the european Central Bank could opt for slashing the interest rates. The euro could see much volatility in the coming days as world leaders and central bankers will meet in Davos, Switzerland for the World Economic Forum. The British Pound rallied versus the euro and the U.S. dollar as an announcement by the Office for National Statistics indicated that Unemployment in the U.K. fell to 7.1 percent. The Sterling was also boosted by good news in Public Sector Finances and positive minutes issued by the Bank of England. The minutes showed that bank officials are confident in the fact that the U.K.’s economic recovery remains “robust” and will likely continue on the same course as it picked up momentum in recent months.

The yen climbed versus the U.S. dollar upon the release of the Bank of Japan’s report, but dropped against the greenback soon thereafter. The Bank of Japan decided to keep stimulus unchanged as the economy has shown recent improvements, despite sluggish inflation data issued recently.

Lastly, in the South Pacific, the Australian dollar rose by the most in five days on metrics which confirmed that inflation quickened, bolstering the possibility that the Reserve Bank may refrain from reducing the interest rate. The New Zealand dollar continued its advance versus the greenback, but the hike came to a halt as investors still believe the Federal Reserve could announce further cuts in stimulus in the near future.

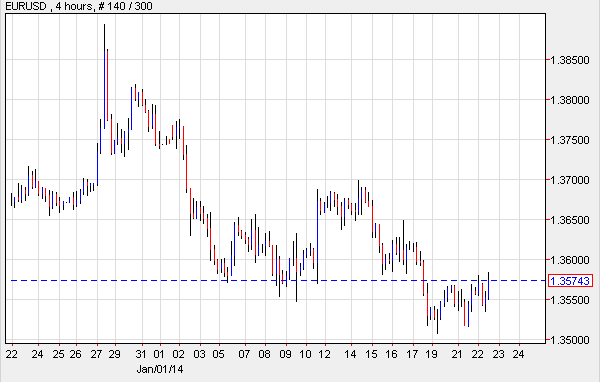

EUR/USD: ECB Remains Concerned

The EUR/USD erased some of its losses after previously plunging to an eight-week low. The shared currency could see an increase in volatility as the World Economic Forum begins. Analysts predict that any comments, especially by central bankers, during the summit, could impact the major currencies. Meanwhile, the european Central Bank has expressed worries about inflation in the euro region, as Monday’s metrics out of Germany showed a mere advance in producer prices of 0.1 percent. With such lackluster figures, officials are growing weary that deflation could become a real problem.

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

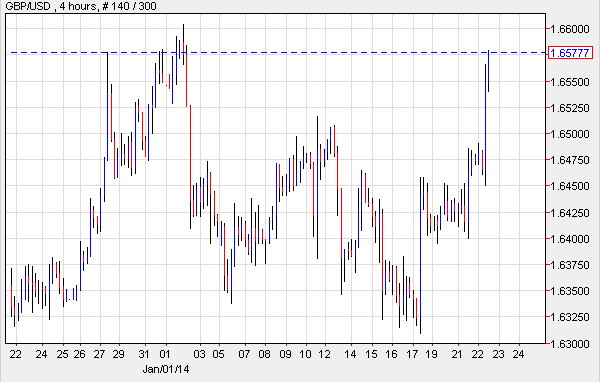

GBP/USD: Sterling Boosted By Three Reports

The GBP/USD was bolstered by several factors: Firstly, the Office for National Statistics announced that inflation dropped to 7.1 percent in November, after posting at 7.4 percent in the previous month. Employers created 280,000 jobs, and there were 167,000 fewer unemployed individuals. The number of people who filed for Jobless Benefits fell by 24,000 in the last month of 2013, and the Claimant Count rate dipped to 3.7 percent. In other releases, the U.K. reported that Public Sector Net Borrowing fell 2.1 billion in December to 12.1 billion Pounds. In total, the debt was 75.7 percent of Gross Domestic Product, which was lower than the 100 percent threshold. And lastly, the Bank of England’s minutes denoted optimism among policy makers, and confidence over the fact that the Jobless Rate appears to be dropping steadily. The bank estimates that it will soon reach the 7 percent target rate, at which point it will consider whether to raise the benchmark interest rate.

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

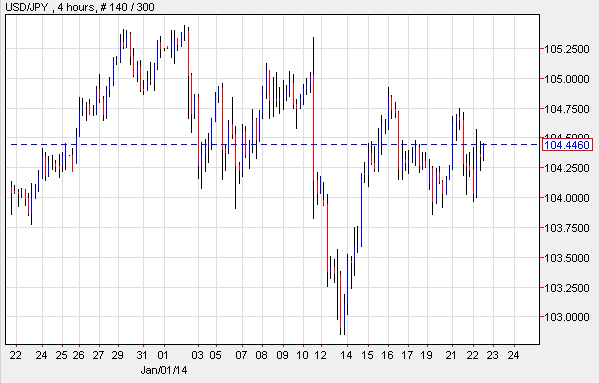

USD/JPY: BOJ Keeps With Status Quo

It came as no surprise that the Bank of Japan decided to leave stimulus unchanged as some economists believe the decision to increase the monetary base by 60 to 70 trillion yen is an already bold move. Officials intimated that the economy is growing at the right pace though they had some concerns about inflation. The bank still hopes to reach the 2 percent inflation target by 2015, and suggested that it would do whatever is necessary. With this said, it raised speculation that the BOJ may increase quantitative easing in the latter part of the second quarter of the year. The yen declined versus the U.S. dollar.

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="474" height="242">

USD/JPY 4 Hour Chart" title="USD/JPY 4 Hour Chart" width="474" height="242">

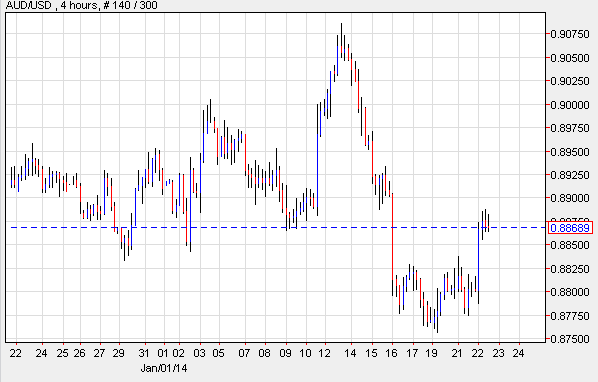

AUD/USD: Inflation Rises

The AUD/USD surged as data out of the land from down under surprised the markets. According to official metrics, the trimmed mean gauge which measures Core Consumer Prices went up 0.9 percent in the fourth quarter of 2013. Now, economists predict that there is a mere 23 percent possibility the Reserve Bank will lower the already record-low key cash rate. The release indicated that the majority of the price hikes were related to the cost of food, tobacco and recreational activities.

AUD/USD 4 Hour Chart" title="AUD/USD 4 Hour Chart" width="474" height="242">

AUD/USD 4 Hour Chart" title="AUD/USD 4 Hour Chart" width="474" height="242">

Daily Outlook: Today’s economic calendar shows that the euro region will report on the Current Account, Services and Manufacturing PMI. The U.K. will issue the CBI Distributive Trades Survey. The U.S. will publish Initial and Continuing Jobless Claims as well as Existing Home Sales.