To finish out last week, the Euro was forced away from the resistance level at 1.34 which saw it ease its way back towards the previous resistance level of 1.33. Earlier last week it was able to push through the 1.33 resistance level and continue on to touch 1.34 and reach a seven week high before easing back late last week. Prior to last week, for a couple of weeks the Euro established and traded within a narrow range between two key levels of 1.32 and 1.33 as it continued to place pressure on the latter. Over the last couple of weeks as the resistance level at 1.33 has stood firm, the Euro has found solid support right around 1.3250 as well. The 1.33 level is now likely to play a role in providing some support. A couple of weeks ago it surged higher to reach a new one month high just shy of 1.3350 however it continued to meet stiff resistance at 1.33 during this period. In the week prior to the recent consolidation period between 1.32 and 1.33, the Euro enjoyed a healthy and steady rally towards the resistance level at 1.32 and finally made its way through culminating in its recent push higher.

About a month ago the Euro was content to maintain the level above 1.31 and settle there, as it received solid support from both 1.30 and 1.31. On a couple of occasions it made an attempt to move within reach of the longer term resistance level at 1.32 and finally it finds itself trading on the other side of this level and being well established there. It has been some time since the Euro has experienced a 24 hour period with as much range as the period almost a month ago when it surged higher from from below 1.28 up to above 1.32. Prior to that jump, the Euro had been in a very solid medium term down trend after succumbing to the resistance at 1.29 and moving down below the key long term level of 1.28. This resulted in it trading at a multi-year low near 1.2750. After reaching a four month high above 1.34 about seven weeks ago, the EUR/USD was in the midst of a very solid medium term down trend which has seen it fall sharply.

It was only a month or so ago that the 1.30 level was standing up and proving itself to be a brick wall of support, and even though it failed a couple of weeks ago leading to the new lows, it has since been called upon again to offer support over the last couple of weeks. Throughout May and most of June the Euro surged higher to a four month high above 1.34. Before that in the first half of May, the Euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the Euro received solid support around 1.28 and this level was called upon to provide additional support. Throughout this year the Euro has moved very strongly in both directions. Throughout February and March the Euro fell sharply from around 1.37 down to its lowest level since the middle of November around 1.2750. Sentiment has completely changed with the Euro over the last few weeks and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards 1.34 before falling very sharply to below 1.29 and setting a 6 week low.

The German economy is likely to have expanded significantly between April and June, helped by higher private consumption and investment in construction, but growth will be more modest in the rest of the year, the Economy Ministry said. “The German economy grew briskly in the spring,” the ministry said on Friday in its monthly report. “After the weather dampened growth in the first quarter, there was a growth spurt in the second quarter due to catch-up effects.” The modest underlying rate of growth in the economy should accelerate slightly in the rest of year, held back by the tough European and international environment, the ministry said. The Bundesbank said in June that the German economy would slow down after a surge in the second quarter and expected just 0.3 percent growth for the year as a whole. Since then, the data picture has brightened somewhat, with industrial production and orders increasing much more briskly than expected in June. Preliminary data on second quarter gross domestic product (GDP) in Europe’s largest economy is due on August 14 – five weeks before parliamentary elections.

EUR/USD August 11 at 22:55 GMT 1.3333 H: 1.3341 L: 1.3320

During the early hours of the Asian trading session on Monday, the Euro is easing back to and finding support just above the key level of 1.33. Since the middle of June, the Euro has generally fallen sharply from new highs above 1.34, and has been looking to return back to the significant lows around 1.2800, however in the last month or so it has recovered well and moved back to above 1.34 again. Current range: trading right around 1.3330.

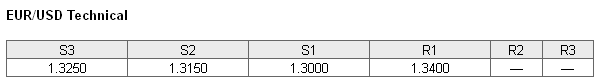

Further levels in both directions:

• Below: 1.3250, 1.3150 and 1.3000.

• Above: 1.3400.

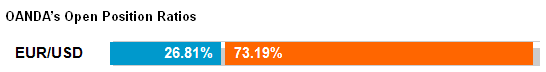

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has fallen sharply to below 30% for the first time in some time, as the Euro has surged higher through to 1.34. The trader sentiment remains strongly in favour of short positions.

Economic Releases

- 23:50 (Sun) JP GDP (Prelim.) (Q2)

- 04:30 JP Capacity Utilisation (Jun)

- 04:30 JP Industrial Production (Final) (Jun)

- 18:00 US Budget (Jul)